Despite the pandemic, green banks in the U.S. mobilized more investment in 2020 than any previous year, according to the annual report of the American Green Bank Consortium released last week.

The consortium’s 21 green bank members spurred $1.7 billion in investments last year with just $442 million of funds. Since 2011, the banks have incited $7 billion in total investment.

Other metrics for green bank growth showed positive trends too.

Green banks’ self-sustainability ratio, which measures earned revenue to operating expenses, has increased from 0.05 in 2013 to 0.7 in 2020. Together, consortium members deployed about $650 million in loans to green and resilient projects last year, up from $490 million in 2019.

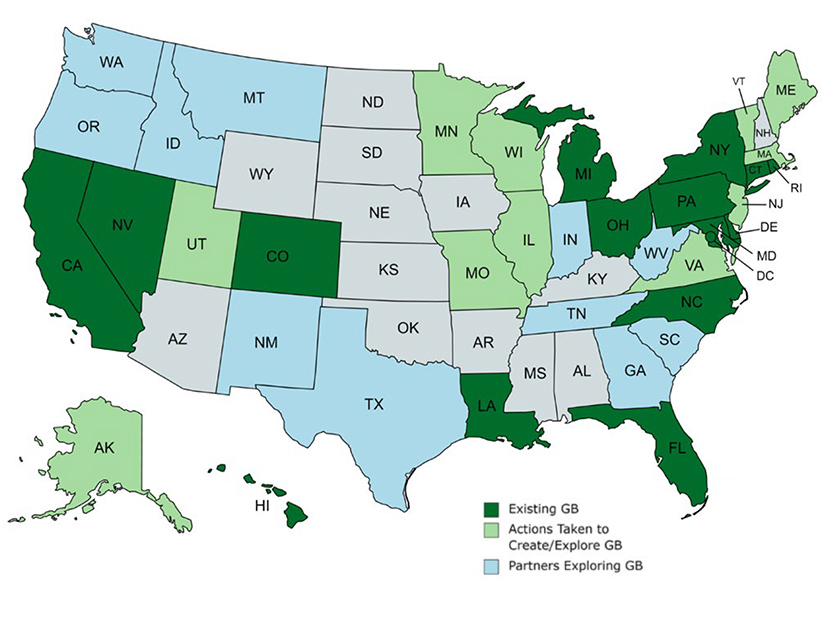

The consortium, which is a project of the Coalition for Green Capital (CGC), added five new members in 2020, and there was activity across 22 states for exploring or taking steps to develop green banks. But researchers have targeted a need for at least $2.5 trillion in investments to reach net-zero carbon emissions in the U.S. by 2050.

Filling the clear financing gap between current green bank capabilities and the needed investment could be done by a national green bank, the report said.

The Biden administration’s jobs plan calls for development of a green bank-like Clean Energy and Sustainability Accelerator seeded with $27 billion to drive private investment in distributed energy, building retrofits and clean transportation. In addition, a $100 billion accelerator is part of the Climate Leadership and Environmental Action for our Nation’s (CLEAN) Future Act.

“As Congress considers infrastructure legislation this summer, green banks in the U.S. are making a clear case for the inclusion of a federal Clean Energy and Sustainability Accelerator that can bring green bank impact to scale across the country,” CGC Executive Director Jeffrey Schub said in a statement. “A national green bank is a major part of the solution our country needs to achieve a just-and-true clean energy transition.”

At $100 billion, according to the report, a clean accelerator could encourage $880 billion in public and private investment over 10 years.

“The ultimate goal of the accelerator is to mainstream green lending so that any lender — particularly those serving low-income communities — can finance clean energy projects at scale with confidence,” the report said.

Like existing green banks, a key focus for current accelerator models is directing investment to disadvantaged communities by de-risking low-income financial products and reducing impacts of pollution and climate change.

Local lenders, the report said, are positioned to drive investment in underserved communities and would need to partner with the accelerator to reach its goals. Models for those partnerships already exist.

Capital For Change, for example, partnered with Connecticut Green Bank and Amalgamated Bank to offer homeowners unsecured lending for energy efficiency projects. The partnership, the report said, created a $27 million line of credit for a nonprofit subsidiary of Capital For Change. The green bank provided $4.5 million of the credit line, which enabled unsecured, low-cost, long-term financing to low- and moderate-income homeowners.

In another example, the green bank Michigan Saves developed a loan-loss reserve that acts as a partial guarantee for green lending products offered by Michigan State University Federal Credit Union.

Green Bank Solutions

Clean energy financing organizations are addressing specific barriers to the clean energy transition, according to research by CGC.

Issues related to upfront project costs have kept clean energy providers from serving low- and moderate-income households and communities of color. Green banks can direct capital purposefully to those communities, the report said. In addition, they can lower the overall cost of financing to help reduce electricity costs for customers.

Currently, loan products do not have the capacity to match the long life spans of clean energy projects. A green bank can offer loans with longer terms that match project life and make projects cash-flow positive from the start, according to the report.

Green banks also have a role to play in overcoming clean energy misperceptions and knowledge gaps through local education. Intense and broad-based marketing efforts, the report said, are critical to overcoming the belief that clean energy is expensive or is complicated to adopt.

2020 Snapshots

Throughout 2020, members of the consortium hit significant milestones and built on their innovative financial models, according to the report.

Official operations of DC Green Bank were launched in April, and the bank made its first investment in support of a company struggling because of the COVID-19 pandemic. When a private lender investing in solar contractor Flywheel Development paused lending, the bank stepped in to maintain a critical construction timeline. The bank partnered with a community development financial institution to provide $1.78 million in financing.

NY Green Bank also was able to be a support mechanism to clean energy and sustainable infrastructure businesses during the pandemic. It became an approved lender under the U.S. Small Business Administration’s Paycheck Protection Program and issued four loans to businesses that reduce greenhouse gas emissions in New York state.

Connecticut Green Bank was recognized for its first Green Liberty Bond issuance. The $17 million securitization supporting the bank’s solar PV and energy efficiency program won The Bond Buyer’s Innovative Deal of the Year Award.

And in California last summer, Gov. Gavin Newsom signed a law that created the Climate Catalyst Fund at the state’s Infrastructure and Economic Development Bank. The fund will finance climate and sustainability projects, with an initial focus on zero-emission vehicles and natural and working lands.

Coming Up

Philadelphia Green Capital Corp. (PGCC) is planning its official launch this summer and will be the green bank affiliate of the Philadelphia Energy Authority. PGCC plans to offer predevelopment and term loans for nonprofits and multifamily buildings; a revolving solar REC fund; and solar loans for low-income homeowners.

Following on its efforts in 2020 to raise investment capital, develop products and source a project pipeline, the Colorado Clean Energy Fund is launching and expanding its lending programs this year. The programs are designed to support clean energy projects for low- and moderate-income residences and small business.

Finance New Orleans, which began its transition to a hybrid green bank last year, is now focusing on growing its new sustainable developer financing program and launching a green mortgage program. The developer financing program helps affordable and innovative housing developers apply for tax abatements, housing bonds, tax credits and green bonds.