Small modular reactors appear to be cost-competitive compared to other energy sources in the Pacific Northwest, according to a recent national laboratory study.

In May, the Pacific Northwest National Laboratory and the Massachusetts Institute of Technology unveiled a joint study on the economics of two types of small modular reactors in scenarios in which they’re installed at three locations in Washington state. PNNL is in Richland, Wash.

“The feasibility study indicated that in a future carbon-free electricity sector, deployment of advanced SMRs would be competitive if the projected LCOEs [levelized cost of energy] for these designs can be attained,” the PNNL-MIT study found.

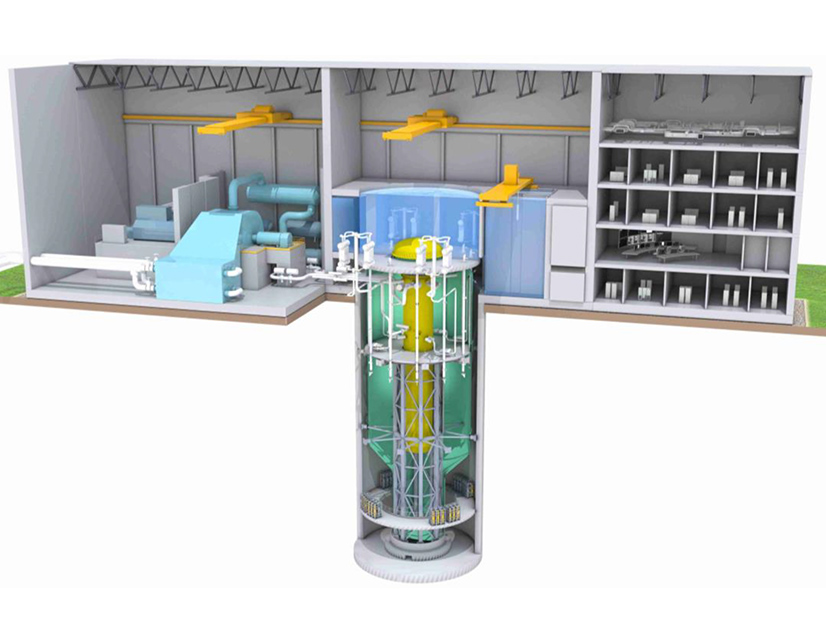

Small modular reactors are prefabricated facilities with parts manufactured in one location then transported to the reactor site for final assembly. A modular segment would consist of a mini reactor of 50 to 300 MW. The design allows for extra modules to be added as needed.

So far, only one design, by Portland, Ore.-based NuScale, has been approved by the U.S. Nuclear Regulatory Commission. (See NRC OKs NuScale’s Small Modular Reactor Design.) Grant County Public Utility District in Washington last month signed an agreement to explore use of NuScale’s reactors in a project. (See Wash. PUD, NuScale Sign MOU to Explore Use of Small Reactors.)

Meanwhile, GE Hitachi of Wilmington, N.C., is working on its own design — the BWRX-300. The primary difference between the two designs is that NuScale’s involves connecting small reactor modules in a series, while GEH’s design is a single 300-MW reactor.

The study looked at two adjacent partially built reactor sites at the Hanford nuclear reservation, both near Richland and next to Energy Northwest’s 1,200-MW Columbia Generating Station reactor. It also examined two adjacent Energy Northwest reactor sites at Satsop, Wash., where construction never seriously began. And the study checked out the Centralia, Wash., site of a TransAlta coal-fired power plant due to shut down in 2025.

The PNNL-MIT study targeted sites with infrastructure that would be compatible with nuclear reactors and have easy access to transmission lines, said Ali Zbib, PNNL’s manager for nuclear power systems. Zbib tackles nuclear economic and technological matters for the laboratory.

The study was prompted by the 2019 Washington Clean Energy Transformation Act, which set a target that all the state’s electricity would come from carbon-free sources by 2045.

“Climate change is an existential threat. This is the time to tackle it because time is running out,” Zbib said. “To do that successfully, we need to use every tool available. … We envision nuclear power to be competitive and to be an integral part of [Washington’s] climate change portfolio.”

The PNNL-MIT study looked at small modular reactors’ technology and potential market in the Northwest in relation to a regional power grid that is increasingly using solar and wind power, Zbib said.

“Nuclear energy is not there to replace the other non-emitting resources. It’s there to complement other non-emitting resources,” Zbib said.

He also noted that small modular reactors are a potential alternative to full-size reactors, such as those running behind schedule and over budget during construction at Georgia’s Vogtle plant, where the first of two new reactors is scheduled to go online in 2022, six years later than expected. Project costs have soared to $26 billion from the original budget of $26 million.

Cost Comparisons

Zbib cautioned that the study has reached a variety of apples-to-oranges comparisons because NuScale’s reactor design is essentially complete, while GEH’s design is in flux. Also, wind and solar power have a range of subsidies differing from area to area to affect the cost estimates of individual projects.

With those caveats, the study estimated that the LCOE for the current NuScale design is $51-$54/MWh, while that for the GEH BWRX-300 design is $44-$51/MWh, although that estimate is less solid.

In comparison, Columbia Generating Station produced power for $35.60/MWh in 2018 and $47.60/MWh in 2019, with fluctuations attributable to refueling outages and other activities. The report notes the plant is projected to have an LCOE between $47/MWh and $52/MWh over 2014-2043.

The study found that, with an LCOE between $35 and $45/MWh, geothermal is the only firm generating resource that can produce emissions-free energy more cheaply than the small reactors. However, geothermal sources are rare in the Northwest, while being more prevalent in the Southwest.

LCOE’s for the Northwest’s non-firm resources include about $40/MWh for hydroelectric, $39 to $55 for Columbia Basin wind (depending on capacity factors) and $30.40 for solar power (with some variation based on subsidies).

The report’s authors also speculate that small reactors might earn a price premium in the market because they would offer power for firm delivery.

The study did not address the reactor design for Bellevue, Wash.-based TerraPower. While the company had considered locating a reactor on Energy Northwest land on the Hanford Nuclear Reservation, it recently announced it has selected a Wyoming site instead. (See Wyoming Welcomes DOE-funded Advanced Nuclear Plant.)