While the U.S. offshore wind market awaits its first Jones Act-compliant turbine installation vessel, it needs to be watching Europe, where the development pipeline may also face vessel constraints.

As the U.S. heads into a busy decade for OSW, the volume of European projects set for construction during that time “cannot be underestimated for its knock-on effect around the world,” Maxwell Clarke, senior associate at The Renewables Consulting Group (RCG), told NetZero Insider.

And although near-term manufacturing growth in the U.S. for some wind turbine components may look positive, U.S. developers will also have to rely on European component suppliers that are already in high demand.

OSW developers in the U.S. market must turn to European-flagged jack-up vessels if any steel is going to go in the water before Dominion Energy’s (NYSE:D) Jones Act-compliant vessel is completed sometime in 2023.

“There are nine jack-up vessels available at the moment globally capable of installing turbines greater than 10 MW,” said Clarke, who is co-author of the group’s new 2020 Global Offshore Wind Annual Market Report. “And there are only two jack-up vessels currently in the water” capable of installing turbines in the 12-MW-plus category.

But in Europe, RCG forecasts that over 86 GW of projects will enter construction over the next 10 years, and project developers there will want to install turbines with the largest capacities, Clarke added. The needs of European developers will constrain availability for the jack-up vessels that can handle those systems, he said. While more vessels are under construction and planned, demand will continue to be considerable.

For the foreseeable future, U.S. OSW developers must rely on barges that feed components to European vessels. It is not clear how that system will work with mega-projects like the 800-MW Vineyard Wind I.

Where Vineyard Wind has provided benchmarks for permitting and development in the U.S., it will do the same for construction in the early pipeline of large projects, Clarke said.

Dominion’s jack-up vessel will help move the needle in U.S. construction when it’s completed, but Clarke said it is still just one vessel.

“With multiple projects under construction over the space of one year, you’re still going to need two or three other vessels from Europe to help support that,” he said. “I don’t think we can expect all projects to be installed without a feeder barge system or other installation strategy for non-Jones Act vessels before the end of the decade.”

The near-term situation for components does not look much better.

Domestic components manufacturing is not going to come online in the U.S. at scale before projects enter construction in the coming years.

The current U.S. project pipeline, according to the RCG report, shows commissioning starting slowly in 2024 and 2025 and then ramping up significantly in the years following.

There has been some movement for foundations with the news that Germany-based EEW Group will construct a facility in New Jersey. Other suppliers will come forward in that space, Maxwell said, but there are still going to be monopiles that need to be built in Europe for the U.S. Northeast market in this decade.

“European suppliers will need to think about their orders on the books in Europe, where they’re already going to be massively stretched,” he said.

However, use of European supply chains for near-term projects could be positive for the U.S. market. For example, in Taiwan, the waiving of local content requirements for early OSW projects has allowed approximately 560 MW to enter construction since 2017, from a standing start. That approach has allowed the local supply chain to mature in time to support larger-scale projects entering construction from 2022. A similar approach could accelerate the U.S. market.

U.S. Ranking

New announcements for U.S. projects in the first quarter helped advance the market in the global portfolio ranking over the previous quarter from fifth to fourth place, according to the report, which is based on RCG’s GRIP 2.0 online database. With a total portfolio of 42 GW — counting installed, secured and in-development projects, the U.S. ranks behind the United Kingdom (49 GW), China (63.5 GW) and Vietnam (65.8 GW).

Globally, developers have announced projects totaling about 200 GW of new capacity since the beginning of 2020, according to the report, which said the active project portfolio for OSW now stands at 500 GW.

The U.S. West Coast is set to contribute to a burgeoning floating OSW market with the news the Bureau of Ocean Energy Management (BOEM) is planning a lease auction off the coast of California next year.

California’s OSW market will benefit from growth in the global floating wind market, which the report said is embracing more innovative technology concepts at a large scale.

“Ongoing development and formalized leasing of projects, as well as the construction of the 88-MW Hywind Tampen site in 2021 [in the North Sea], will support the global floating supply chain to enable rapid cost reductions as seen in fixed foundation OSW throughout the 2010s,” the report said.

Federal Actions

Successful commissioning of the pipeline of U.S. projects in the second half of this decade is predicated on the Biden administration’s plan to accelerate project permitting.

The administration made good on that promise last week with the news that it will begin the environmental review of Empire Wind’s projects off the coasts of New York and New Jersey.

BOEM issued a notice of intent to prepare an environmental impact statement for the 816-MW Empire Wind 1 and the 1,260-MW Empire Wind 2 projects. The New York State Energy Research and Development Authority awarded the projects under 2019 and 2021 solicitations, respectively. Together, the projects would have up to 174 wind turbines, two offshore substations, three submarine export cables and landfalls, and two onshore substations to connect to the New York power grid.

The Empire Wind lease area is 12 nautical miles south of Long Island, N.Y., and 17 nautical miles east of Long Branch, N.J.

BOEM will hold virtual public meetings for the projects on June 30, July 8 and July 13.

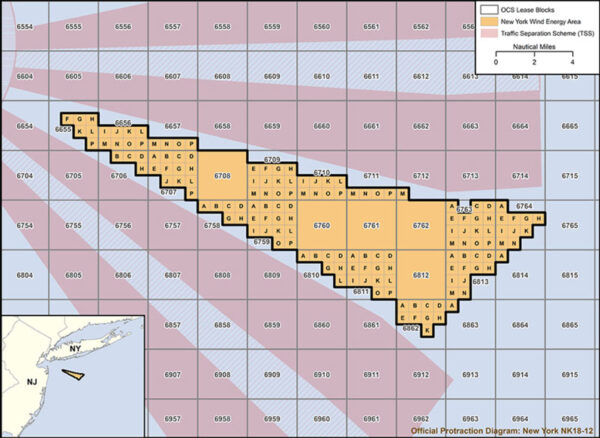

The Biden administration is also moving forward with its first lease sale for the New York Bight between Long Island and the New Jersey coast for a potential 7 GW of energy.

As proposed, the auction would offer eight leases totaling 627,000 acres.

BOEM is seeking input on the following lease stipulations:

- Developers must make a reasonable effort to enter into a project labor agreement covering the construction of any project proposed for the lease area.

- Developers must include a stakeholder and ocean user engagement summary as part of a lessee’s progress reporting requirements.

- Developers must develop mechanisms to provide benefits to underserved communities and investments in a domestic supply chain.

BOEM will consider public comments on the NOI before releasing a final sale notice, which would include the time and date of the sale.