Technological advances and regulatory changes could unlock as much as 60 GW of geothermal capacity in the U.S. by 2050, according to a recent report by the National Renewable Energy Laboratory (NREL).

The 2021 U.S. Geothermal Power Production and District Heating Market Report said that improvements in regulation and technology are fundamental to facilitating the growth of geothermal resources, both for electricity generation and district heating, said NREL Senior Geothermal Drilling Engineer Jody Robbins, lead author of the report.

Expanded geothermal for heating and cooling could also contribute to the Biden administration’s decarbonization goals to cut emissions in half by 2030 and achieve a carbon-free electric sector by 2035.

Speaking during a webinar hosted by the U.S. Department of Energy’s Geothermal Technologies Office (GTO) last week, Robbins said the addition of nine power purchase agreements in four states and recent renewable energy policy trends indicate that the geothermal sector could resume growth. Included in the PPAs are plans for the first two geothermal power plants to be built in California in a decade.

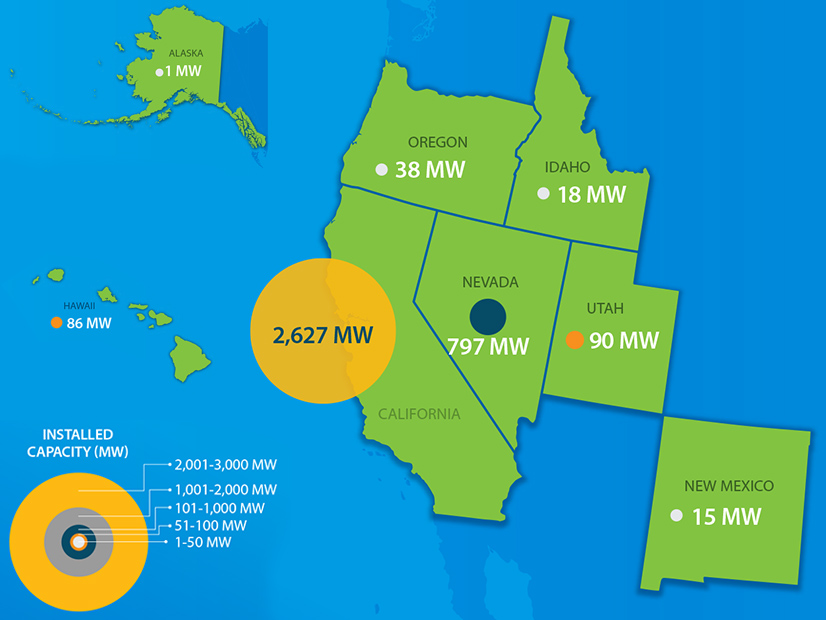

Since 2015, the geothermal power production market has experienced limited net capacity growth. Current nameplate capacity is 3.67 GW from 93 power plants, which is marginally higher than 3.62 GW from 97 plants in 2015. However, almost all capacity additions from 2000 through 2020 have been binary plants that use lower-temperature resources that produce practically no emissions.

GDH Development

There are presently 23 geothermal district heating (GDH) systems with capacity totaling 75 MW of energy in the country, ranging from the oldest installation in 1892 (Boise, Idaho) and the most recently finished in 2017 (Alturas, Calif.).

One major factor impacting GDH development is the market price of competing heat sources. A boost in GDH development in the 1980s appears to have coincided with an uptick in oil and gas prices during that time, Robbins said. However, gas price increases from 2004-2009 and oil from 2011-2014 did not correlate similarly in GDH installations. There is also a lack of federal or state incentive programs that would offset upfront GDH installation costs, in addition to an absence of local and regional stakeholder awareness and support. States once provided financial assistance to support the development of GDH systems, though most have “terminated” such programs in recent years, Robbins said, with the notable exception of California.

The levelized cost of heat (LCOH) value for GDH systems is $54/MWh on average in the U.S., slightly lower than the average European LCOH value of $69/MWh, but higher than the 2019 average U.S. residential natural gas LCOH. The estimated LCOH for existing U.S. GDH systems ranges from $15 to $105/MWh, consistent with European systems.

State and Federal Policy

In terms of policy, the U.S. has experienced two periods of robust federal support for geothermal exploration and development, both of which resulted in increased deployment.

The first period occurred in the late 1970s and early 1980s through the Public Utility Regulatory Policies Act. The second wave of support was part of the American Recovery and Reinvestment Act of 2009, which included a grant program and production tax credit extension. Also, the allowance of geothermal operators to elect the investment tax credit at a rate of 30% in 2019 and the Energy Act of 2020, which eased access to federal lands for renewable developers and accelerated the permitting process. The act additionally authorized an annual budget of $170 million for GTO’s research and development activities.

State-level geothermal legislation and policy development is active in California, Hawaii, Nevada, New Mexico, and Washington, focusing on contributions to aggressive decarbonization goals and streamlining administrative processes and permitting authorities for developing resources. Renewable portfolio standards “have probably been the most influential state policies,” Robbins said, as they can support geothermal development by requiring a certain amount of electricity sold by utilities to come from renewable energy sources.

Twenty-eight states have established geothermal power as an eligible RPS technology. California is seeing an increase in demand for geothermal electricity to the point that it has the highest economic value of renewable resources operating in the state.