Exelon (NASDAQ:EXC) CEO Chris Crane opened the company’s second quarter earnings call on Wednesday by announcing the impending closure of two Illinois nuclear plants and a new target for cutting operational greenhouse gas emissions.

Proposed federal and state legislation to provide financial support for nuclear plants will not delay or defer the shutdowns of the Byron and Dresden plants, which could result in thousands of job losses for the state economy, Crane said. “We don’t want to close these plants, but we cannot make decisions based off of legislation being passed in the future.”

With shutdowns possibly “only weeks away,” he said, “it will take many years … to add enough intermittent renewable energy to get to where Illinois is [now] in terms of clean energy production. In the meantime, more than 100 million metric tons of additional carbon will be emitted over the next decade.”

The company also said it will cut operational GHG emissions by 50% over 2015 levels by 2030. Crane said the company would use “robust energy efficiency programs,” electrify the company’s light-duty fleet and develop “zero-carbon alternatives” for medium- and heavy-duty vehicles, along with investing in new equipment and processes to cut emissions from its gas plants and operations.

The company will also pilot new, low-carbon grid technologies and advocate for affordable grid decarbonization, he said. In addition, it has joined the Electric Highway Coalition, a group of 14 utilities working to deploy a “seamless network” of electric vehicle fast chargers on major highway systems across the country. The company has set a net-zero target for 2050.

Crane said hopes for a last-minute rescue for the Byron and Dresden nuclear plants have dimmed due to the slow progress on federal and state legislation. The bipartisan infrastructure bill moving through Congress contains $6 billion in funding to prop up existing nuclear plants that have been unable to compete against cheaper natural gas plants and solar and wind energy.

Another possibility is a nuclear production tax credit, said Kathleen Barrón, executive vice president for government, regulatory affairs and public policy, who noted the Democratic reconciliation bill could include a federal Clean Energy Standard that would also benefit nuclear. But, echoing Crane, she said everything is speculative at this point.

A clean energy bill in Illinois also contained help for the state’s nuclear plants but has been stalled due to unrelated labor issues, Crane said.

The CEO said that once the plant shutdown process starts, it is irreversible. “You shut down, you cool down, you disassemble the reactor,” he said. “You offload all of the fuel into the spent fuel pool, and you relinquish the license to the Nuclear Regulatory Commission, and there is no path back from that. There is no regulatory path back.”

Strong Quarter

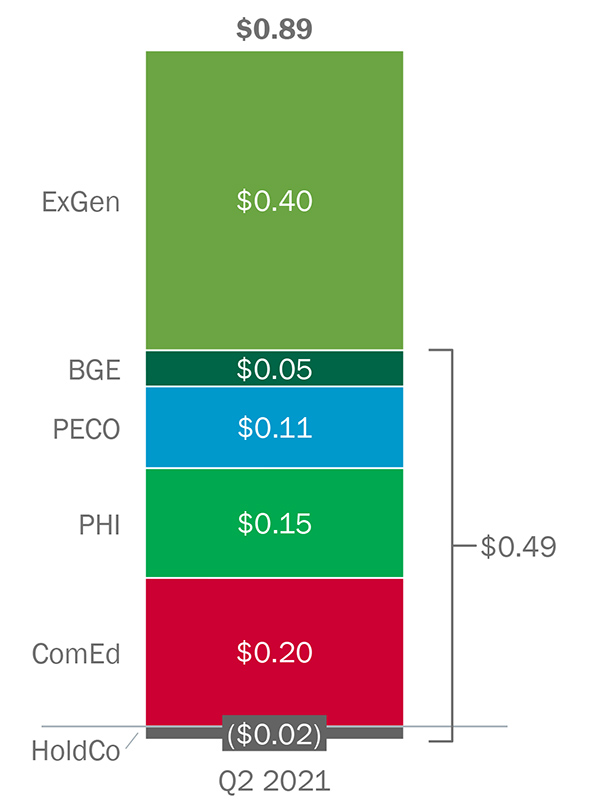

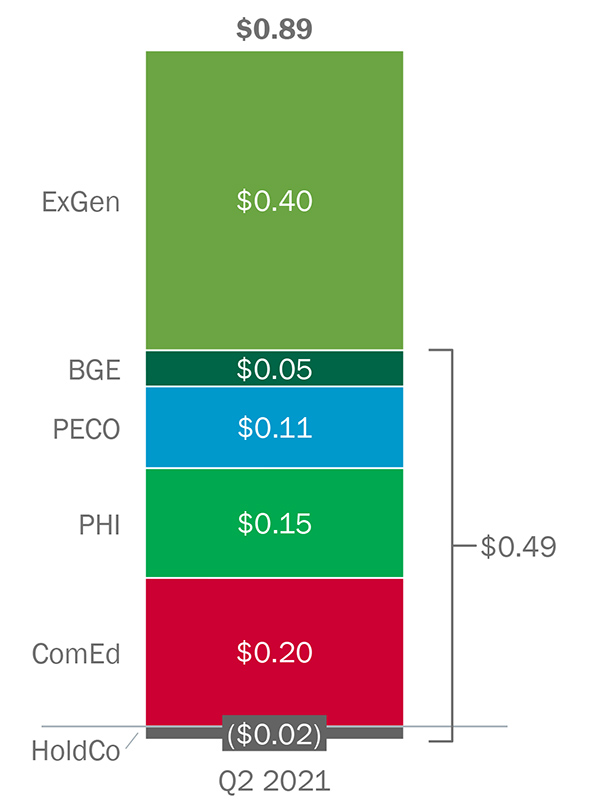

The financial results for the quarter were mixed. Chief Financial Officer Joseph Nigro reported non-GAAP adjusted earnings of $0.89/share, versus $0.55/share for the same quarter in 2020. GAAP earnings were $0.41/share, a drop from $0.53/share reported in the second quarter of 2020.

Total operating revenue for the quarter was $7.9 billion, with a net income of $401 million, according to a Form 8-K Exelon filed with the Securities and Exchange Commission on Wednesday. Nigro also said the company is still on target to meet its full 2021 earnings predictions of $2.60 to $3/share.

The higher adjusted earnings were “driven in part by the absence of storm costs at Exelon utilities and the recovery of costs associated with ongoing investments to improve reliability and service for customers,” Nigro said, noting that the company was successful this quarter in partially recouping its first quarter losses from the winter storms in Texas.

The generation side of the business also had a strong quarter, he said, “due to unrealized and realized gains on Constellation’s technology venture investments, fewer planned nuclear outage days and realized gains in our nuclear decommissioning trust funds.” Exelon subsidiary Constellation NewEnergy Inc. is a retail power supplier of natural gas and clean energy.

Analyst Q&A

Stephen Byrd of Morgan Stanley asked for more detail on the company’s response to its losses in Texas and the ongoing discussions in the state about the changes needed to prevent future catastrophic outages.

“The plants in Texas were never designed for the weather that we saw and especially the duration of the weather that we saw,” Crane said. “So, if we go to something much lower in temperature as a design basis, we have to look at what adequately would preserve the piping. Is it insulation? Is it other types of barriers, and what’s the most economic way to get there.”

“We’ve built the model that has certain assumptions on temperature, wind speed, prolonged longevity of the weather event, that will calculate the engineering changes we need to make to the plant,” said Chief Operating Officer Bryan Hanson. “Once the weatherization standards are published and accepted in ERCOT, we can then tune that model to come up with our final outcomes and establish the price points for those plants.”

Julien Dumoulin-Smith of Bank of America asked about potential growth opportunities in the commercial and industrial sector as more and more companies set clean energy targets.

Constellation CEO James McHugh said the company already is creating products in response to customer demand, with offtakers in the mining industry, data centers and the hydrogen business.

“They’re interested in carbon free-energy, renewable energy, and we’ve had some success in selling emission-free energy credits and other renewable type products to some of our largest C&I customers,” said McHugh. “They’re also interested in sustainability information and data around energy usage and how to be more efficient. So, there’s this burgeoning suite of different products and services that we’re working through with our team and with our customers.”

Other highlights from the call:

- The company’s plan to split its regulated utilities and generation business, announced in February, is on track to be completed by the first quarter of 2022, Crane said.

- On the regulatory front, Exelon’s Pepco utility won approval for new multiyear rate plans in both Washington, D.C., and Maryland, with revenue increases of $108.6 million and $52 million, respectively. Atlantic City Electric also received approval for a $41 million rate case in New Jersey.

- Crane called attention to the company’s diversity and workforce development programs, “spanning from middle schools [and] high schools through colleges, as well as programs for work-ready, underemployed adults.” Exelon’s STEM Leadership Academy program for high school girls has started awarding full-ride two- and four-year college scholarships, which also include guaranteed internships.