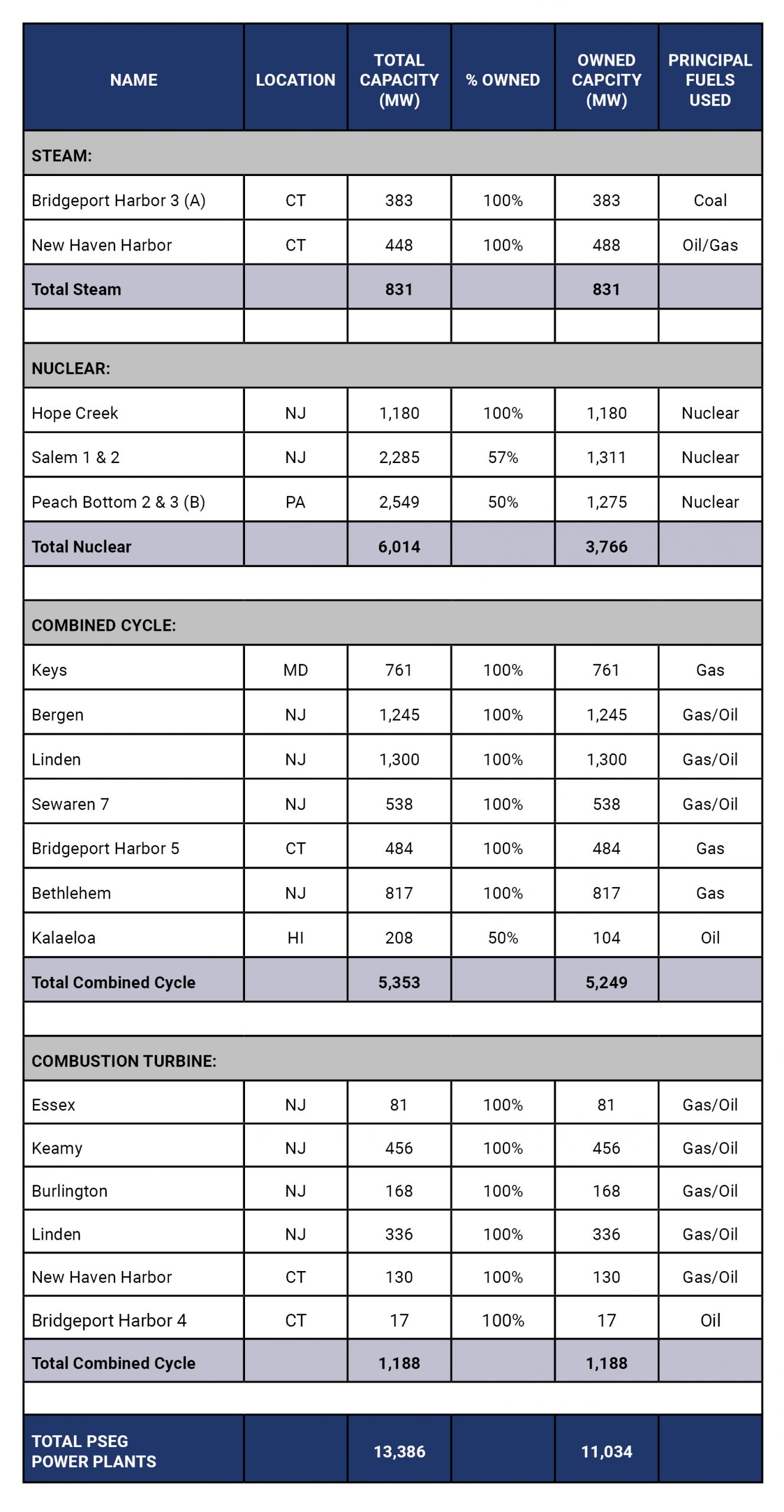

Public Service Enterprise Group (NYSE:PEG) agreed to sell its 6.7-GW fossil fuel fleet in New Jersey, Connecticut, New York and Maryland to ArcLight Capital Partners for $1.92 billion to further its transformation to a primarily regulated electric and gas utility.

The announcement, coming only two months after PSEG sold off its solar generation unit, will eliminate virtually all the company’s generation except for its 3.8 GW of nuclear capacity in New Jersey and Pennsylvania.

“A year ago, we announced the strategic review of PSEG’s non-nuclear generating assets in line with our long-term focus on regulated utility growth, improving our business mix and enhancing an already compelling environmental, social and governance profile,” PSEG CEO Ralph Izzo said in a statement. “With today’s agreement, which is the result of a robust sale process, PSEG is on track to realize a more predictable earnings profile. Further, this transaction continues our evolution toward a clean energy, infrastructure-focused company that will enable our increasingly low-carbon economy.”

Escaping the uncertainty of merchant generation business will come with a substantial write-down from the power plants’ $4.5 billion book value. PSEG said it will record a pre-tax impairment charge of $2.15-$2.225 billion, employee severance and retention costs up to $25 million, debt redemption costs — including a make-whole premium — of approximately $280-$340 million, and “potential impacts on employee pension and other post retirement plans, environmental remediation costs and other items.”

Sale proceeds will be primarily used to pay down PSEG Power’s debt, company officials told stock analysts in the second quarter earnings call last month. (See PSEG Seeking to Sell Fossil, Solar Generation.)

The deal does not include Bridgeport Harbor 3, a 383-MW coal-fired combustion turbine in Connecticut, which retired May 31.

Also excluded is PSEG’s 50% share in the 208-MW oil-fired Kalaeloa combined cycle plant in Hawaii. PSEG spokesperson Marijke Shugrue declined to comment on the company’s plans for the plant, which is co-owned by limited partner Harbert Power Fund V, a unit of Harbert Management Corp.

In its Aug. 9 10-Q filing, PSEG disclosed that it had already taken a pre-tax charge of $519 million to recognize that the cash flows and fair value of its fossil units in ISO-NE were less than their carrying value as of June 30. The company’s “impairment assessment” found that its fossil units in PJM and NYISO did not require a write-down as long as they remained classified as “held-for-use.” PSEG reported its combined cycle plants had a 44.3% capacity factor in the first half of 2021, the same as a year earlier.

As a result of the sale, PSEG said it was updating its full-year 2021 non-GAAP operating earnings guidance to $3.50 to $3.65/share, from $3.40 to $3.55/share, “reflecting the cessation of depreciation expense and lower interest expense related to the sale of the PSEG Fossil assets and repayment of PSEG Power’s outstanding debt.”

PSEG shares closed Thursday at $63.85/share, up 40 cents on the day.

The sale to ArcLight, which is subject to review by the Justice Department and FERC, is expected to be completed late in the fourth quarter of 2021 or the first quarter of 2022.

For ArcLight, a Boston-based private equity firm, the deal is just the latest in a series of more than 110 acquisitions and 69 exits since its founding in 2001. The company invests in energy infrastructure assets with “substantial growth potential, significant current income and meaningful downside protection,” including renewable and fossil generation, oil and gas production and midstream operations such as pipelines, storage and gathering and processing.

The company did not respond to a request for comment.

In March, Generation Bridge, a unit of ArcLight Energy Partners Fund VII announced it would purchase 4.85 GW of generation from NRG Energy (NYSE:NRG) for $760 million. The company also has purchased generation from AEP and Exelon as they have also sought to reduce or exit their merchant generation. (See Blackstone, ArcLight to Purchase AEP Merchant Plants for $2.2B and Exelon Selling Last Major Coal Generation in Fleet).

Reuters reported that ArcLight and its limited partners, including pension funds representing Maine teachers and NFL football players, lost several hundred million dollars in their ill-fated investment in the Limetree Bay refinery in the U.S. Virgin Islands, which was shut down by environmental regulators in May.