The times, they may be a-changing in Texas, where the Public Utility Commission is considering expanding DC ties with neighboring grid operators following February’s devasting winter storm.

Texas regulators have long jealously protected the ERCOT grid’s electrons from mingling with those of its neighbors. The result is a grid isolated from the Eastern and Western Interconnections and exempt from FERC jurisdiction.

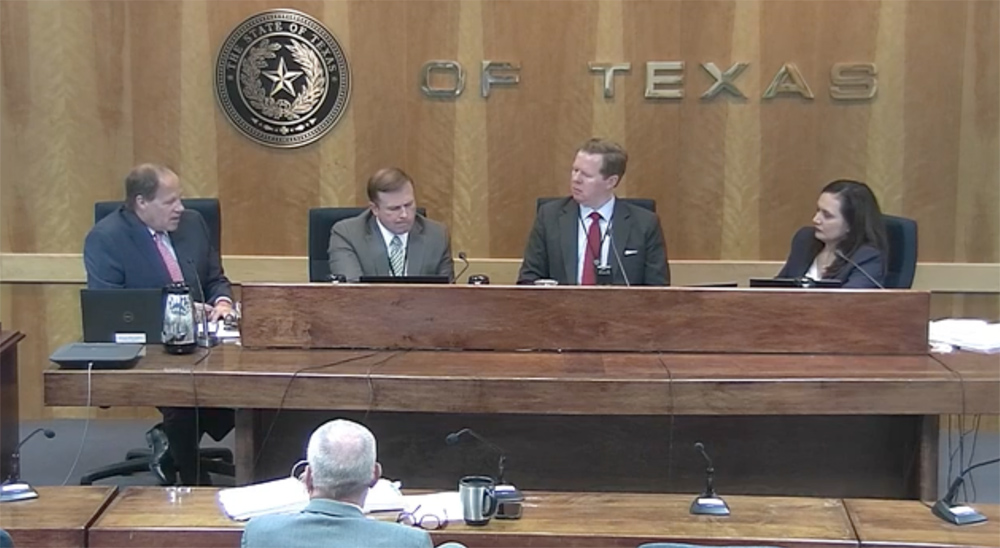

“Obviously, protecting our ERCOT market from FERC jurisdiction has been of upmost importance for the commission, historically,” Commissioner Lori Cobos said during the Thursday open meeting.

The Texas grid has two DC ties with SPP and a third with Mexico, but they are limited to a combined 1.1 GW of capacity and are primarily used for commercial purposes. ERCOT uses the same ties to exchange power with its neighbors during emergency conditions.

But there may be another option: Pattern Energy’s Southern Cross Transmission merchant project, a bi-directional HVDC transmission line that will asynchronously connect ERCOT with systems in the SERC Reliability region. The 400-mile, double-circuit 345-kV line will be capable of carrying 2 GW of power between Texas and SERC, enough to have possibly made a difference during the February storm.

“Winter Storm Uri, opened our eyes to the challenges that come from our isolation,” said Cratylus Advisors principal Mark Bruce, who represents Pattern before ERCOT and the PUC and calls Southern Cross “a gift to the state of Texas.”

“The Southern Cross project will be funded entirely by private capital and those costs will be recovered exclusively from the wholesale power traders who use the facility,” Bruce told RTO Insider. “Absolutely no costs of the project will be included in Texas transmission rates.”

The project has FERC approval and a waiver from the commission’s jurisdiction. It also has a certificate of convenience and necessity, granted by the PUC in 2017 to Garland Power & Light, which owns the project’s western endpoint.

The developers are working with ERCOT to respond to 14 PUC directives to determine whether DC ties should be economically dispatched or subject to a congestion-management plan (46304). Half of the directives have been completed, Bruce said. (See “Members Debate Southern Cross’ Bid to be Merchant DC Tie Operator,” ERCOT Technical Advisory Committee Briefs: Feb. 22, 2018.)

Commissioner Jimmy Glotfelty, who was among those behind Clean Line Energy Partners and its plan to ship renewable energy over HVDC lines to urban centers, spoke up for the Southern Cross project.

“I’m a fan of DC ties,” he said. “If we want to continue to be the best place to do business, we’re going to have to have that type of a system that is technologically advanced and reliable and economic. If DC lines are going to be part of it, and I think they should, let them be part of it.”

“Pattern is pleased that this commission recognizes the value of reliability benefits and the economic benefits that come from this kind of interconnection,” Bruce said. “… We are excited that the commission wants to wrap this up and we are certainly willing to do our part to make it happen.”

Doug Lewin, an Austin-based energy consultant, told RTO Insider he was “intrigued” by the commissioners “seemingly universal feeling … that connecting to the Eastern and Western Interconnects is a good idea.”

He said he agreed with other experts that ERCOT doesn’t have to give up independence from FERC jurisdiction to interconnect with the other grids. He said the commission might grant a waiver “given the magnitude of the problems facing Texas last February and potentially facing us in the future.”

Cobos has been leading an effort to investigate expanding current ties and adding other interconnections that don’t incur FERC jurisdiction. She told her fellow commissioners that ERCOT has also studied a potential tie with MISO. Unsurprisingly to those involved in SPP’s and MISO’s effort to agree on interregional transmission projects, Cobos said the study turned up cost allocation and modeling “differences” between ERCOT and MISO.

Commissioner Will McAdams cited Uri in urging deeper ties with the Texas grid’s neighbors.

“We need a way to build around this in case the one-in-200-year events happens … where we can draw resources in and work through a partnership with those [RTOs],” he said.

“We can’t look at these weather events as static, one time,” Glotfelty said. “They are going to happen again and again.”

The commissioners, who all joined the PUC since April, have begun to flex their regulatory muscle. In a memo, Cobos reminded the commission that they have the authority under the state’s Public Utility Regulatory Act to order ERCOT to build transmission that ensures the safety and reliability of the grid.

They discussed the need for a transmission solution to congestion issues in the Rio Grande Valley. Cobos said a 345-kV line in the Valley is “double-circuit capable,” but only one circuit is being used. She suggested ERCOT study adding another line and building a new 345-kV line running east to west near the border with Mexico.

“We can have ERCOT and the [transmission service providers] study those transmission solutions that are near term, low-hanging fruit, and see if it’s a good idea to move forward with the transmission buildout,” Cobos said. “We can get additional information from ERCOT, and we can order them to build it.”

ERCOT’s interim CEO, Brad Jones, released a roadmap to grid reliability in July that included new transmission capacity to address the Valley’s limitations. The grid operator’s Regional Planning Group could take up the issue during its next meeting on Sept. 15. (See ERCOT Issues ‘Roadmap to Grid Reliability’.)

Cobos included in her memo an eight-point list of actions that could be taken to speed up ERCOT’s planning process.

“If we want to use our authority, we can’t let them get bogged down in [a] multi-stakeholder process at ERCOT,” Glotfelty said. “It takes too long. Everyone has to have their say. It’s a big market. We’ve got to hold their feet to the fire to get these things done.”

PUC Chair Peter Lake asked Cobos to develop a process for completing the potential Rio Grande Valley projects “sooner, rather than later.”

“Let’s see what additional analysis is needed and the commission’s authority to order the construction of these lines,” he added. “We got very clear and robust direction from the legislature to solve these problems.”

Lewin said the PUC’s newly emboldened outlook is “long overdue.” He said recent chairs have been hesitant to use their authority and “did a lot of arguing for their own limitations.”

“This commission is operating in a very different context, with, as Chair Lake says, ‘a bias toward action,’” Lewin said. “Texas needs new transmission, and I’m glad the commission is moving aggressively.”