Developers of the proposed PennEast Pipeline said Monday they are canceling the natural gas project, conceding defeat in a seven-year battle despite a U.S. Supreme Court ruling supporting their ability to seize properties in New Jersey via eminent domain.

“Although PennEast received a certificate of public convenience and necessity (CPCN) from FERC to construct the proposed pipeline and obtained some required permits, PennEast has not received certain permits, including a water quality certification and other wetlands permits under Section 401 of the Clean Water Act for the New Jersey portion of the Project,” the company said in a statement. “Therefore, the PennEast partners, following extensive evaluation and discussion, recently determined further development of the project no longer is supported. Accordingly, PennEast has ceased all further development of the project.”

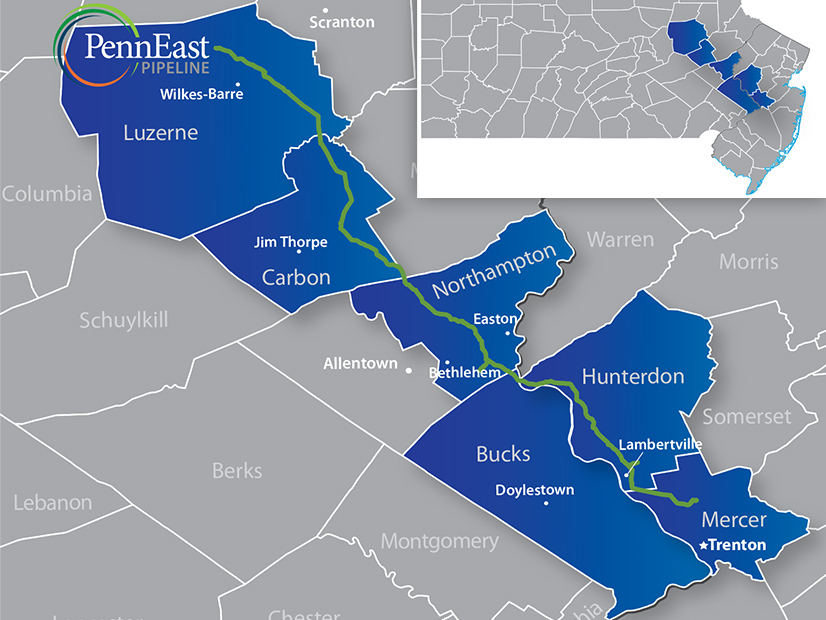

The $1.2 billion 120-mile pipeline would have delivered shale gas from Luzerne County in Northeastern Pennsylvania to Transco’s pipeline interconnection in Mercer County, N.J.

Monday’s announcement was foreshadowed when four of the five partners — New Jersey Resources Corp. (NYSE:NJR), South Jersey Industries (NYSE:SJI), Southern Co. (NYSE:SO), and a subsidiary of UGI Corp. (NYSE:UGI) — told investors recently they were writing off about $354 million from their books, representing nearly their entire investment in the project. Enbridge Inc. also was a partner (NYSE:ENB).

Last week, the New Jersey attorney general announced in a federal court filing that PennEast had dropped its bid to condemn 42 parcels in which the state claims a property interest, most of them privately owned land on which the state Jersey has granted conservation easements.

In June, the Supreme Court ruled 5-4 that the Natural Gas Act allows private energy companies to seize “necessary” land for a project if they have obtained a CPCN from FERC. New Jersey officials responded to the order with a vow to continue their fight against the project.

“I welcome today’s decision by PennEast to cease development on the PennEast Pipeline and am committed to protecting our state’s natural resources and building a clean energy future that works for all New Jerseyans,” Gov. Phil Murphy said in a tweet.

Abigail M. Jones, vice president of legal and policy at PennFuture, said the pipeline would have damaged streams, wetlands and forest habitat while increasing greenhouse gas emissions.

“New Jersey had denied critical environmental permits for the pipeline, which resulted in PennEast proposing to bifurcate its process and build the Pennsylvania-portion in phases to allow for construction to move forward,” she said in a statement. “PennEast’s announcement that they will cease development of the pipeline is great news, especially for the many landowners in Pennsylvania whose properties were threatened by eminent domain and clearcutting for a pipeline to nowhere.”

The Consumer Energy Alliance (CEA), a group backed by oil and gas producers and mining interests, said the cancellation was “a sign that even with a Supreme Court victory under its belt, critical infrastructure in the U.S. faces needless and politically-motivated opposition.”

“Unfortunately, a regulatory process designed to get things built safely and in the public interest has fallen prey to anti-business interests and compliant elected leaders,” said CEA Mid-Atlantic Director Mike Butler.

The Energy Information Administration reported last week that the U.S. benchmark natural gas spot price at the Henry Hub in Louisiana has been at a premium to Northeast natural gas hubs since the third quarter of 2020, “as total Appalachian supply exceeded demand growth and storage levels were above average.

“Although storage levels fell in 2021, other factors, such as record high Gulf Coast LNG exports, winter freeze-offs in Texas and neighboring producing areas, and Appalachian pipeline outages kept the Henry Hub price premium over Northeast hubs higher than 2018-2020 annual averages in 2021,” EIA said.