Members Endorse Changes from Winter Storm’s Emergency List

ERCOT’s Technical Advisory Committee last week endorsed several protocol revision requests and associated changes related to the use of emergency response service and load-resource participation in non-spinning reserves, a result of members’ work on the committee’s emergency conditions list following the February winter storm.

The committee approved the three ERS-related measures on a single ballot during Wednesday’s meeting, with only Morgan Stanley casting an opposing vote. The independent power marketer was among several from its segment that voted against the measures as they wound their way through the stakeholder process.

The key nodal protocol revision request (NPRR1090) clarifies that ERCOT has the flexibility to declare when exhausted ERS service types will be renewed for some or all of the ERS time periods and extends the deployment limit of weather-sensitive resources.

The measure revises several ERS processes, including modifying and clarifying language related to the beginning and end of contract periods for ERS renewals; removing the limit on the maximum number of deployments per contract period; and revising the cumulative deployment obligation time requirement for weather-sensitive resources.

Staff said NPRR1087 will ensure any critical load in ERS programs can continue to support critical operations if they are deployed by requiring an attestation that the resource is not located behind an electric service identifier (ESI ID) for a critical load. The NPRR also requires a qualified scheduling entity representing an ERS resource to ensure and attest that it is not located behind an ESI ID for a critical load or itself is not the critical load.

The final ERS measure (NPRR1082) changes the testing criteria for ERS load with obligations less than 100 kW co-located with an ERCOT generator.

The TAC also separately approved NPRR1093, which allows ERCOT to explore temporary workarounds for non-controllable load resources to participate in non-spinning reserves and provide additional capacity for the grid operator in the coming winter and summer seasons. The non-controllable resources will be deployed after offline units participating in non-spin.

The change request reinstates protocol requirements that were in place during the nodal market’s first five years and were then subsequently changed to enable controllable load resources to be economically dispatched and to participate in non-spin. It also incorporates market design changes that have been made for the operating reserve demand curve (ORDC) and reliability deployment price adder (RDPA) process when deploying ancillary services from non-controllable load resources.

The measure passed by a 22-6 margin with two abstentions. All four cooperatives and two independent generators opposed the NPRR over concerns that a “resulting flood” of participation in the non-spin market “will artificially suppress” the service’s value. Non-spin can clear as low as 1 cent/MWh, they said, with “bleed-over” effects into the day-ahead and real-time markets.

An earlier proposal to table the change request for a month failed 8-17, with five abstentions. Staff said any delays would close the window for making the additional non-spin available to their operators before next summer.

The measure carries a price tag between $450,000 and $650,000 and will take about a year to complete.

“This is a complex addition to the ancillary service-clearing engine,” explained Kenan Ögelman, ERCOT’s vice president of commercial operation. “That’s why it’s both expensive and time-consuming. But with so many items going on, it’s a matter of reserving resources so they can work on this too.”

The vote on NPRR1082 also included two other binding document revision requests (OBDRRs) and a change to the nodal operating guide (NOGRR):

Load Project Threshold Approved

The TAC approved ERCOT’s request to increase the boundary threshold used in load forecasting from 5% to 7.5% for all eight weather zones. Staff said increasing the threshold will provide the transmission service providers (TSPs) more flexibility in handling the fast-growing areas on their systems, but they also noted the Public Utility Commission directed ERCOT to pursue the increase during its Sept. 23 open meeting.

The need has become more acute with large consumers, such as data centers, proposing new facilities with accelerated development timelines in addition to the state’s explosive population growth. According to 2020’s U.S. Census Bureau data, Texas’ 29.4 million residents account for 8.9% of the country’s population, but 32.4% of the total growth between 2019 and 2020.

The Far West zone’s boundary threshold already stands at 7.5%, having been raised in 2018 because of the additional transmission necessary to address oil and gas development in the Permian Basin.

ERCOT compares its load forecast, a top-down system-level approach, with the TSPs’ ground-up projections, aggregated by weather zones. If staff’s projections are higher in a particular zone, ERCOT uses its forecast and distributes load to each substation according to the TSPs’ allocations.

In zones where the TSP forecast is higher than ERCOT’s but below the grid operator’s boundary threshold, the TSP’s projections are used. If the TSP forecast exceeds ERCOT’s boundary threshold, it is reduced to match the ERCOT forecast plus the threshold.

ERCOT’s 2021 regional transmission plan (RTP) found that demand forecasts for six of the weather zones were limited by the boundary threshold. The TSP-developed forecasts for those zones ranged from 6.8 to 11.2% above ERCOT’s projections in the RTP’s final year (2027), resulting in a demand reduction of about 2.8 GW.

“I don’t think we’re in perfect lock-step all the time, but there’s not necessarily a disconnect between the two processes,” said ERCOT’s John Bernecker, manager of transmission planning assessment. “We’re also seeing significant changes in demand-side behavior. That certainly warrants further discussion in investigating why we’re seeing some of these things we see, as well as evaluating how we approach appropriate load-forecast studies.”

“Raising this [threshold] to 7.5% is just hand-waving,” Morgan Stanley’s Clayton Greer said, calling for a subcommittee assignment. “We need to get to the root-cause analysis of what’s happening here.”

Members Endorse $101M Tx Project

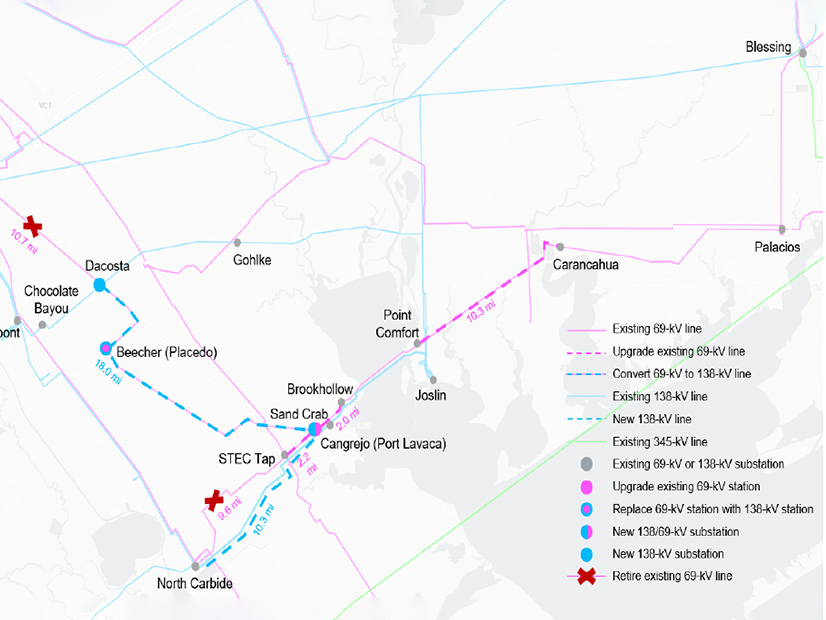

Members endorsed staff’s recommendation for a $101.5 million transmission project that addresses reliability and aging infrastructure needs in the Port Lavaca area on the Gulf Coast by placing it on the combination ballot.

Staff reclassified American Electric Power’s (NASDAQ:AEP) original $97.8 million proposal to a Tier 1 project when its review found reliability planning-criteria violations that elevated the project’s costs over a $100 million threshold. Tier 1 projects must be approved by the Board of Directors.

The project involves rebuilding and adding a second 138-kV circuit to 10 miles of an existing line; upgrading 24 miles of 69-kV line to 138 kV or capable; constructing two 138-kV substation and one 138/69-kV substation and installing two 138/69-kV transformers to replace 69-kV facilities; and retiring 20.3 miles of 69-kV line.

About 40 miles of the area’s 69-kV lines date back to 1949 to 1953. AEP expects to complete the project by December 2024.

Slim Combination Ballot Passes

The TAC pulled NOGRR223 off the combination ballot to allow Luminant (NYSE:VST) to vote against it. The measure, which requires phasor measurement recording equipment at existing facilities with an aggregated capacity above 20 MVA at a single site before entering the interconnection queue or change-request process, passed 27-1, with two abstentions.

Luminant said there is no “clear justification” for ERCOT to require phasor measurement unit capability, as most of the burden is on owners with the 20-MVA requirement for new generation resources.

The remainder of the combo ballot included two revisions to the planning guide (PGRR) and a change to the resource registration glossary (RRGRR):

-

- PGRR093: reinserts three requirements into the board-approved graybox language for PGRR082 that were inadvertently removed in its revisions.

- PGRR094: aligns the guide with current practices by grayboxing language requiring project construction start and completion date submittals until system implementation in the resource integration and ongoing operations-integration services system.

- RRGRR030: removes certain transformer data’s hard coding of voltage levels for certain resource registration information, allowing resources connected to other voltage levels to submit their registration data without receiving validation errors.