After barreling through both houses of the North Carolina General Assembly in a matter of days, the compromise energy bill H951 could transform the role of resource and transmission planning as the state seeks to reduce its carbon emissions by 70% over 2005 levels by 2030.

In addition to setting that ambitious goal, the bill also calls for the state’s utilities to add 2,660 MW of new solar generation, while developing a portfolio of least-cost resources that “maintain or improve upon the adequacy and reliability of the existing grid.”

In other words, thousands of megawatts of Duke Energy’s (NYSE:DUK) coal-fired generation could soon be retired, while solar, storage and offshore wind are added to a grid that, in some places, has already absorbed all the new renewable energy it can take, Duke executives told the North Carolina Utilities Commission (NCUC) at a technical conference on Oct. 6.

Installing any new solar in those “transmission constrained areas will likely incur expensive network upgrades for interconnection,” said Dewey “Sammy” Roberts, Duke’s general manager of transmission planning and operations strategy. “We’re essentially running out of places where grid capability is available that lends itself favorably to locating incremental resources such as solar and storage.”

Costs for system upgrades for the 32 projects currently in Duke’s interconnection queue are estimated at $267 million, he said.

H951 passed the House in a 90-20 vote Thursday after clearing the Senate the day before and is expected to be signed by Gov. Roy Cooper. (See NC Compromise Energy Bill Passes Senate, Heads Back to House.)

Last week’s half-day NCUC session was the third installment of the commission’s examination of Duke’s 2020 integrated resource plan (IRP) and the methodologies it used for determining coal plant retirements, replacement resources and grid planning. While Duke emphasized the need for new “firm,” dispatchable power, preferably sited at retiring coal plants, advocates and other state officials questioned the approach, calling for more holistic, transparent and proactive system planning. (See NCUC Debates Best Path for Duke Coal Retirements.)

Speaking for the Southern Alliance for Clean Energy and the Carolinas Clean Energy Business Association, Jay Caspary of industry consultants Grid Strategies cited a raft of studies that predict the U.S. transmission system will need to grow two- to threefold to decarbonize the grid by President Joe Biden’s goal of 2035.

“We can do this; we just need to kind of think a little bit outside the box,” Caspary said. “What do we expect the resource mix to be? What are the benefits of adding transmission capacity? It’s not just economic benefits. There are probably reliability benefits, security benefits and other benefits that transmission provides just because it is such a flexible resource that provides a lot of optionality for future resource plans.”

Caspary pushed for the use of grid-enhancing technologies (GETs), such as dynamic line ratings, to upgrade existing transmission and distribution lines to make room for some of the 755 GW of solar, wind and storage that the Lawrence Berkeley National Laboratory estimates are sitting in interconnection queues across the country.

Edward Burgess, senior director at consulting firm Strategen, presented the state attorney general’s concerns on the need for more transparency about the $17 billion in transmission investments Duke has told its investors it is planning in the coming years, especially investments related to coal plant retirements. Avoiding those costs “actually wind up delaying the retirement of certain coal plants,” he said, recommending that an independent analysis of Duke’s transmission needs be conducted before its next IRP in 2022.

17% Reserve Margin

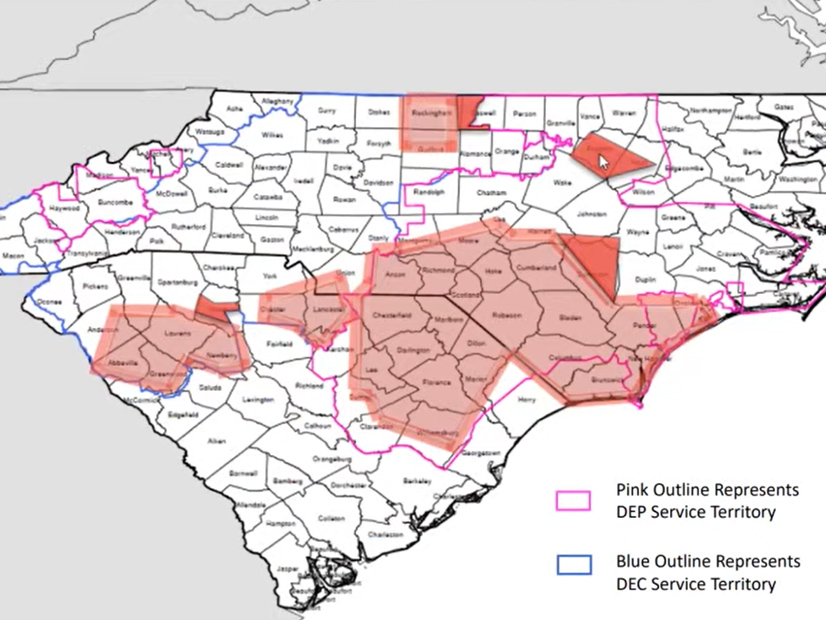

Duke’s North Carolina utilities have submitted IRPs anticipating that a 70% cut in emissions could require more than 16 GW of solar on the grid by 2035, along with 4.4 GW of storage. Duke has two utilities in the state, Duke Energy Carolinas (DEC) and Duke Energy Progress (DEP).

Interconnecting that much new renewable energy will increase the complexity of system planning, Roberts said.

“Storage will need to be studied both discharging energy into the system and absorbing energy from the system,” he said. “A more granular approach [will be needed] to further optimize the integrated resource and grid system. For future IRPs, we’ll likely need to continue to look at alternate pathways of resources for achieving clean energy targets, and that will just add to the modeling complexity with grid resource interaction.”

The utility pointed to its work with the North Carolina Transmission Planning Collaborative, which includes Duke, the state’s municipal utilities and electric co-ops. The group recently completed a study on offshore wind and is working on a single, collaborative transmission plan for DEC and DEP.

At the same time, Duke seemed to take a more conservative and insular approach to transmission planning to avoid too heavy a reliance on “non-firm” — that is renewable — power imports from outside its system. Duke’s IRP envisions replacing coal-fired generation with up to 9,600 MW of natural gas, possibly sited at or near the retiring coal plants to take advantage of existing interconnections and keep costs down, Roberts said.

Based on North Carolina’s winter-peaking system, Duke’s transmission analysis called for a resource adequacy reserve margin of 17%, a figure that includes imports of 2,000 MW of power procured from day-ahead or real-time power markets, said Nick Wintermantel, principal utility and energy consultant at Astrapé Energy. Given that “substantial” level of imports, any further increase in import capacity would need to be firm power, he said.

A further challenge for Duke is that the Southeast is “typically capacity constrained, not transmission constrained, meaning if we increase transmission, we’re likely still not going to be able to get more non-firm imports,” Wintermantel said. “Essentially, it’s cold and gets also cold in TVA, Southern [Company] and the Carolinas; so, it’s typically more capacity constrained.”

Nor should Duke rely on imports from neighboring systems such as the Tennessee Valley Authority or PJM’s regional grid, he said. With Duke having “no control with TVA or PJM [over] their planning processes, it is highly uncertain what [importable power] will be there on that cold morning,” he said.

Getting the Cheapest, Best Resources

While acknowledging Duke’s point on minimizing reliance on imported power, Burgess countered that the February power outages in Texas were partly due to the state’s limited connections to other power systems. “Having greater import and export capability can really be thought of as an insurance policy under this kind of extreme stress,” he said. “Looking at the import and export capability can help to potentially unlock more firm contracts, relying on cheaper resources in other regions than having to build our own.”

Roberts said, “To enable future renewable interconnections may require new regulatory structures as opposed to … upgrading in response to a filed interconnection request, with a customer signing an interconnection agreement.”

Caspary pointed to FERC’s July advanced notice of proposed rulemaking (ANOPR) on transmission planning. (See FERC Goes Back to the Drawing Board on Tx Planning, Cost Allocation.)

The final rule could have “a drastic effect on how we do generation interconnection studies, how we do planning studies, how we define benefit-to-cost analysis, how we try to get more interregional projects completed in advance of the need of the resource mix so that we can actually enable the cheapest and best resources to get into the markets and facilitate the retirement of some of these old, dirtier units that seem to be a challenge for a lot of reasons.”