Consolidated Edison (NYSE:ED) on Thursday reported 2021 third-quarter net income of $538 million ($1.52/share), up 9.1% compared with $493 million ($1.47/share) in the same period a year ago, citing strong performance in its Clean Energy Businesses unit.

For the first nine months of 2021, net income for common stock was $1.122 billion ($3.23/share), an increase of 6% compared with $1.058 million ($3.17/share) over 2020.

“Our energy systems delivered world-class reliability this summer. In response to several storm events and heat waves, our team efficiently restored affected customers and are managing the costs of these efforts,” CEO Timothy Cawley said in a statement.

Protecting customers from climate change makes the company’s integrated planning and clean energy investments more critical than ever, he said.

“We continue to lead the transition to a clean energy future, evidenced during the quarter by our solicitation for large energy storage projects, which will allow our customers to maximize the benefits of renewable energy,” Cawley said.

The company reported its Clean Energy Businesses having 3,004 MW of utility-scale renewable energy production projects in service (2,988 MW) or in construction (16 MW), and 72 MW of such projects behind the meter in service (62 MW) or in construction (10 MW). The business unit generated 1,932 kWh of electricity from solar projects for the three months ending Sept. 30, up nearly 16% compared to 1,667 kWh for the same period in 2020.

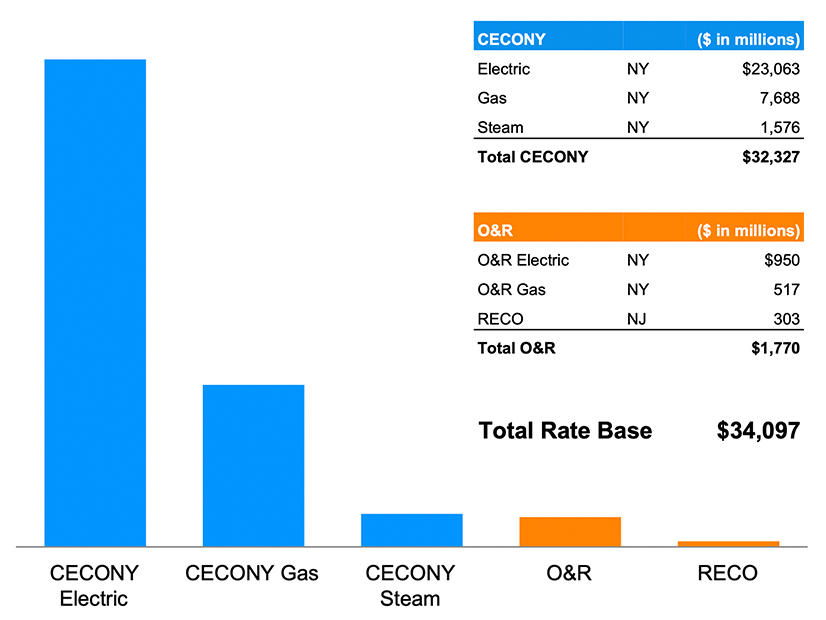

Rate plans for investor-owned utilities in New York allow them to defer costs resulting from a change in legislation, regulation and related actions that have taken effect during the term of the plans once the costs exceed a specified threshold. The total reserve increases to the allowance for uncollectible accounts from Jan. 1, 2020, through Sept. 30 — reflecting the impact of the COVID-19 pandemic for Consolidated Edison Company of New York (CECONY) electric and gas operations and Orange and Rockland Utilities (O&R) electric and gas operations — were $235 million and $7 million, respectively.