Duke Energy CEO Lynn Good spent most of Thursday’s third-quarter earnings call talking about the progress the utility has made on its climate goals and clean energy transformation, such as cutting emissions more than 40%, accelerating the closure of coal plants and launching a new sustainable financing initiative for “green and social projects.”

Duke will finance a range of clean energy projects — non-hydro renewables, energy efficiency and storage — via bonds, loans or commercial paper, according to a report on the initiative released Tuesday. Nuclear projects will not be eligible, and the utility has pledged to provide transparency with a website that will track the money it allocates to projects and their environmental impacts.

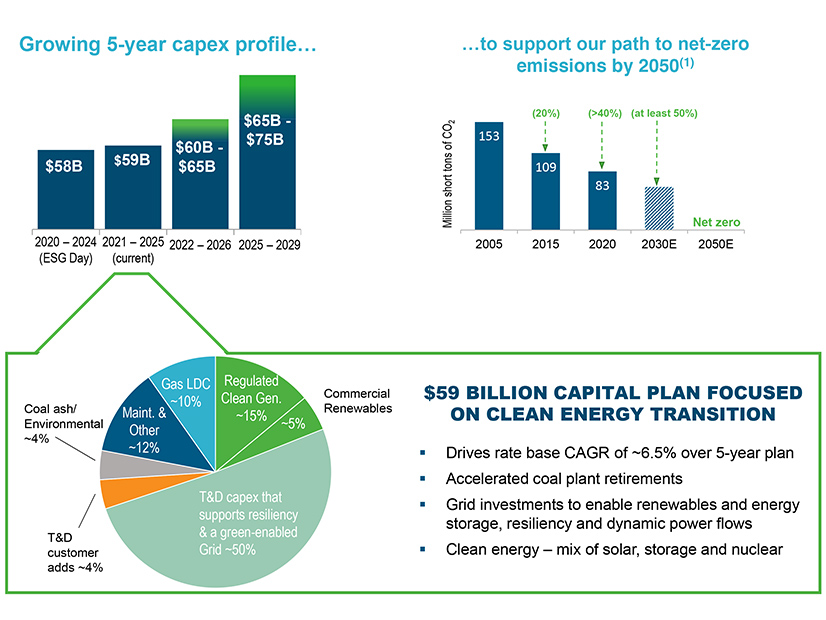

Spokesperson Meredith Archie said Duke has financed $2.3 billion in projects with green bonds since 2018, but the utility has not committed to any specific spending targets for the new initiative. Rather, the initiative will be part of Duke’s capital expenditures, which, Good said, are expected to grow from $59 billion for 2021-2025 to $65 billion to $75 billion by 2029.

“As we look ahead, our pace of change will accelerate as we work toward our carbon reduction goals and the broader clean energy transformation across all of our jurisdictions,” Good said.

According to information in the Q3 slide deck for the call, the utility sees 50% of its capital spending going to transmission and distribution investments in resiliency and a “green-enabled” grid and another 20% to renewable projects.

The passage of House Bill 951 in North Carolina in October has upped the ante for Duke, which had originally committed to cutting its carbon emissions 50% by 2030, on the way to achieving net zero by 2050. A bipartisan compromise, the new law mandates a cut of 70% over 2005 levels by 2030, while keeping the 2050 goal for net-zero. (See NC Compromise Energy Bill Passes Senate, Heads Back to House.)

The law gives the North Carolina Utilities Commission (NCUC) the primary responsibility for developing a carbon reduction plan, to be reviewed every two years, with utility and stakeholder input. But Good clearly sees Duke as having a major role in shaping the plan, which she said will be “approved” by the commission and will draw on “the conversations that have been ongoing over the last several years.

“We anticipate the active involvement of South Carolina in this process as they have been over the decades in developing and retiring assets that serve both states,” Good said.

The law also gave Duke a major win with its authorization of performance-based regulation and multiyear rate plans. Under the law, Duke will have to hit certain performance targets, to be set by the NCUC, but will be able to file a three-year rate plan under which, once approved, the utility will be able raise rates up to 4% in each of the subsequent two years without submitting an annual rate case, as it does now.

CFO Steve Young cited the multiyear rate plan as one of several growth drivers for Duke, and he said 2022 would be a “key year” for the rule making needed to implement HB 951 and the carbon reduction plan.

Young reported third-quarter unadjusted earnings of about $1.37 billion ($1.79/share), up from $1.27 billion ($1.74/share) a year earlier. Adjusted earnings per share were $1.88, a penny over the adjusted earnings of $1.87 per share a year ago.

Another growth driver in the quarter was a bounce-back in electricity demand, especially in the commercial and industrial sectors as the economy recovers from the COVID-19 pandemic and people return to offices, Young said. Residential retail sales took a small 0.2% dip, but overall electricity sales were up 3.4% for the quarter, he said.

Shift Away from Coal

Other green initiatives highlighted by Good included a “low-income collaborative to propose new low-income programs to further help our customers.” Archie said the initiative would bring in consumer advocates and other stakeholders to look at rate design, energy efficiency programs and other measures to cut bills for low-income customers.

Good also talked about Duke’s accelerated coal retirements, as laid out in the utility’s revised integrated resource plans for Duke Energy Carolinas and Duke Energy Progress, submitted to the South Carolina Public Service Commission in August. The commission earlier this year rejected Duke’s original plan, which kept more than 3,000 MW of coal-fired generation online through 2038; the revised plan would retire all coal by 2035.

In North Carolina, the utility has retirements planned for three units totaling 677 MW at its Allen Steam Station, one already offline and the other two by the end of the year, Archie said. Another 280-MW of coal fired-generation in Indiana has also come offline this year, she said.

Good expects the revised plans for South Carolina to be approved by the end of the year; the utility’s IRPs are still pending before the NCUC. She also noted that Duke Indiana will be submitting its IRP by a Nov. 30 filing deadline. While she said the IRP “will continue to advance efforts to shift away from coal,” she did not provide further details. Information on the utility’s website sets 2048 as the retirement date for Duke’s final coal plant in Indiana.

Responding to an analyst question, Good also aligned Duke’s clean energy transition with the clean energy provisions in the bipartisan infrastructure plan and the budget reconciliation bill still in negotiation in Congress.

The utility is seeing “conversation” around the clean energy transition across its service territories in the Carolinas, Indiana and Florida, she said. “You see increasing opportunities for renewable investment, for storage investment, energy efficiency, demand response investment … some of our states also have a keen interest in getting a base amount of electric vehicle infrastructure in place.”

Although not mentioned during the call, Duke and Honeywell recently announced that the utility will be testing a new, long-duration flow battery technology developed by the tech company to provide flexibility and backup power for renewables.