Any financial institution in Washington that invests in fossil fuels would be charged an annual “climate resiliency and mitigation” fee under a bill introduced Monday in the state legislature.

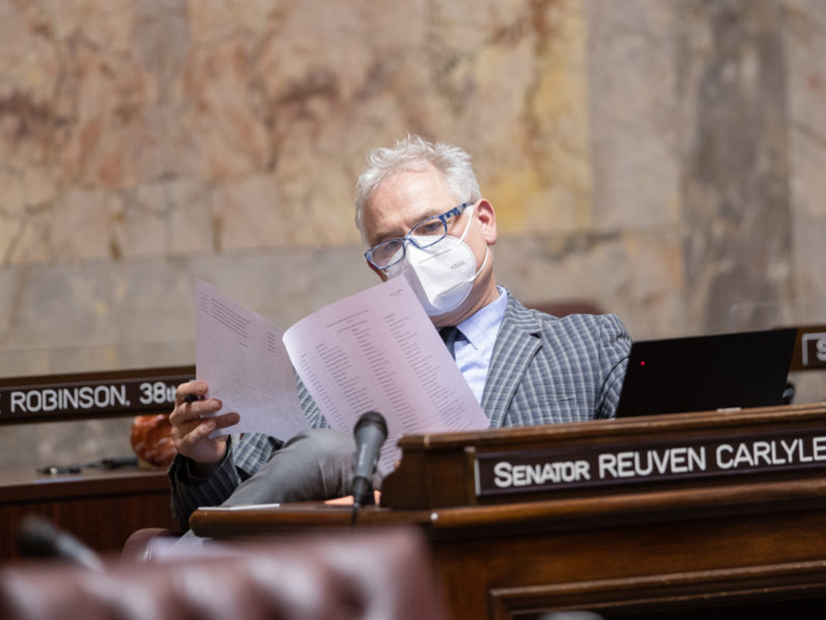

The bill (SB 5967) by Sen. Reuven Carlyle (D) calls for any such financial institution with a presence in Washington and earning a net income of $1 billion to pay a surcharge on its business and occupation tax, the state’s tax on a firm’s gross income.

The legislation has been referred to the state Senate’s Ways and Means Committee.

Under the bill, a financial institution would pay a 0.5% surcharge to the state if more than 4% of its investments are in fossil fuel-related businesses. The surcharge would decline to 0.375% for investments ranging from 2.5 to 4% and 0.25% for investments less than 2.5%, according to the bill.

The bill calls for the Washington Department of Commerce to compile a report on each financial institution’s fossil fuel investment percentages by October 2022. That report would be updated annually, beginning in 2024.

“Notwithstanding … global, national, and state-level efforts to address climate change, the world’s largest commercial and investment banks have been largely omitted from these efforts and, to a certain extent, impeded these efforts in recent years through fossil fuel industry financing practices” the bill says. “In fact, banks play a disproportionate and comprehensive role in climate change by financing fossil fuel projects worldwide that are directly and scientifically shown to be the primary cause of climate change. Between 2016 and 2021, data shows that the 60 largest commercial and investment banks through their lending and underwriting practices invested a total of $3.8 trillion into fossil fuels.”

The bill defines financial institutions as any corporation owned by a federal bank holding company, a national bank, a savings association, a federal savings bank, a branch of a foreign depository or a corporation whose voting interests are more than 50% owned by a financial institution.

Washington’s government spent $1.4 billion on climate change measures in the 2019-2021 budget biennium, according to the bill.

Carlyle announced his intention to introduce this bill mid-December 2021, drawing his inspiration from attending the UN Climate Summit in Glasgow, Scotland last fall. (See Wash. Senator Seeks Fee on Fossil Fuel Financers.)

He contended the surcharge would raise $80 million to $100 million annually for climate resilience measures, such as creating public cooling centers, relocating infrastructure at risk from floods and sea level rise, and helping farmers and communities obtain critical water supplies during more frequent and severe droughts.