Carbon capture went mainstream in 2021.

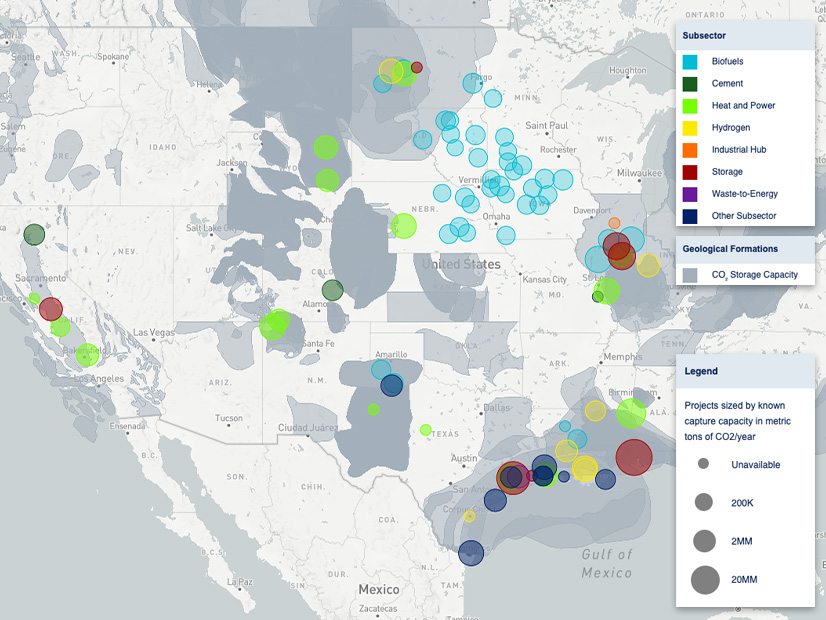

According to the Clean Air Task Force (CATF), 51 carbon capture and storage projects were announced in the U.S., more than the total of all projects announced in the previous three years. The industry got a federal stamp of approval as the Department of Energy’s Office of Fossil Fuels became the Office of Fossil Fuels and Carbon Management.

The Infrastructure Investment and Jobs Act (IIJA) provided yet another boost, with more than $12 billion in funding for a range of carbon capture pilot projects, pipelines and research that could help push those 51 projects toward completion and operation.

“We’re really looking at carbon management technologies as part of a system of decarbonization options and a decarbonization portfolio,” said Lee Beck, CATF’s international director for carbon capture. “It’s really an option that we need to be commercialized as soon as possible to have multiple options or technologies available … to enable communities and regions to really choose technology pathways to net zero that are suitable to their individual social, political, economic and resource circumstances.”

Speaking at a Tuesday press briefing sponsored by the Carbon Capture Coalition, Beck was part of a panel of advocates and corporate executives arguing for carbon capture as essential for decarbonizing certain industrial sectors with high emissions, such as steel and cement manufacturing.

Industry accounts for about 23% of U.S. carbon emissions, and “over half of the emissions in the sector are inherent to physical or chemical processes” involved in manufacturing, said Jessie Stolark, public policy and member relations manager for the nonpartisan coalition.

Carbon capture offers “a unique solution to reducing emissions in the sector in a timeframe consistent with midcentury net-zero targets,” she said.

Echoing Stolark, Virgilio Barrera, director of government and public affairs for cement manufacturer LaFargeHolcim, described the particular decarbonization challenges his company faces.

“You can electrify everything, use alternative fuels and you would still be generating 50% of your emissions,” Barrera said. “That’s because it’s a chemical transformation of taking raw material — in this case, limestone — heating it up and converting it to … cement.

“The key for us to reach net zero is really getting carbon capture, utilization and storage projects online,” he said.

The company has received DOE funding to help develop carbon capture projects at two plants, one each in Colorado and Missouri, he said.

Continued Opposition

The strong project pipeline notwithstanding, the U.S. only has about a dozen commercial-scale CCS projects online at this time, according to the Global CCS Institute, and some environmental groups continue to voice strong opposition to the technology, arguing it doesn’t work and is too expensive.

In July, more than 500 environmental organizations published an open letter calling on lawmakers in the U.S. and Canada “to recognize that carbon capture and storage is not a climate solution. It is a dangerous distraction driven by the same big polluters who created the climate emergency.”

But environmental groups in the coalition, such as The Nature Conservancy (TNC), maintain carbon capture technologies are needed to keep climate change under 2 degrees by 2050. New technologies to reduce industrial emissions “are either in the very early stages of research or not broadly deployed in the marketplace,” said Jason Albritton, director of climate and energy policy at TNC.

“If we’re going to reach the ambitious goal of net zero by 2050, we really have to be working now to set the stage on how to address these hard-to-eliminate emissions, the emissions we often call ‘the last-mile decarbonization’ because they are so important, but we don’t yet have the solutions broadly deployed,” he said.

A recent analysis from the General Accounting Office offered further criticism of carbon capture. The GAO found that since 2009, the Department of Energy had invested $1.1 billion in 11 carbon capture projects, only two of which are still operating. Of the others, one ended operation in 2020 and eight were never built. The GAO recommended better oversight and monitoring by the DOE and Congress.

Stolark and others have countered that the difference between then and now is the 45Q tax credit, which provides per-ton credits for CCS. In 2018, Congress expanded the credit, setting it at $50 per ton for carbon sequestered in underground geologic formations. To qualify, projects must begin construction by Jan. 1, 2024, and meet certain capture thresholds. For example, industrial facilities must capture at least 100,000 metric tons per year.

That expansion triggered the growing project pipeline, but the further revisions to 45Q in the stalled Build Back Better Act are needed, Stolark said. The coalition is supporting changes that would increase the credits and slash capture thresholds. For example, carbon stored in geological formations would qualify for credits of $85/MT, and the credits for direct air capture projects would range from $130 to $180/MT and come with a direct-pay option.

In addition, if passed, BBB would decrease capture thresholds to 18,750 MT annually for power plants, 12,500 MT for industrial facilities and 1,000 MT for direct air capture.

These “enhancements” to 45Q “are necessary to close the cost gaps for deployment of carbon capture technologies across sectors including steel, cement and refining,” Stolark said.

Not One-size-fits-all

The global food processing company ADM (NYSE:ADM) is one of CCS’s success stories, said Colin Graves, the company’s vice president for innovation.

The company has been sequestering carbon 1.5 miles underground in Decatur, Ill., for 10 years, Graves said. “To date, we’ve sequestered over 3.5 million tons of CO2, which is the equivalent of removing 750,000 cars from the road for a full year,” he said.

Along with other energy efficiency and renewable energy initiatives, CCS has allowed ADM to reach carbon neutrality for its U.S. flour milling operations, and the company is looking to decarbonize more of its industrial processes, Graves said.

“This is an excellent example of the potential of this technology and the cascading effects that it can have for many different industries and products,” he said.

But part of the challenge going forward is that carbon capture is not a one-size-fits-all technology, said Beck of the CATF, responding to reporters’ questions. “It really comes down to the plant level, to the application level; if you’re producing hydrogen, if you’re decarbonizing a refinery, if you’re decarbonizing a cement or steel plant,” she said.

For emissions produced by ammonia, ethanol or natural gas processing, CCS technologies may include compression and dehydration or the use of membranes or physical solvents, said a report in Chemical and Engineering News. Chemical solvents may be used for carbon emissions from coal or natural gas-fired power plants.

That means the cost per ton of different technologies may also vary widely. A Rhodium Group study found that the $50/MT 45Q tax credit pencils out for CCS technologies used for ammonia and ethanol processing, but the BBB’s $85/MT level is needed for cement, steel or refineries.

Another big question is how much underground sequestration does the U.S. have? Stolark said that the DOE has a carbon storage atlas, originally compiled in 2012, showing the country has the capacity to store at least 2,400 billion MT of carbon dioxide.