Monthly Energy Prices up 123% Y-o-Y

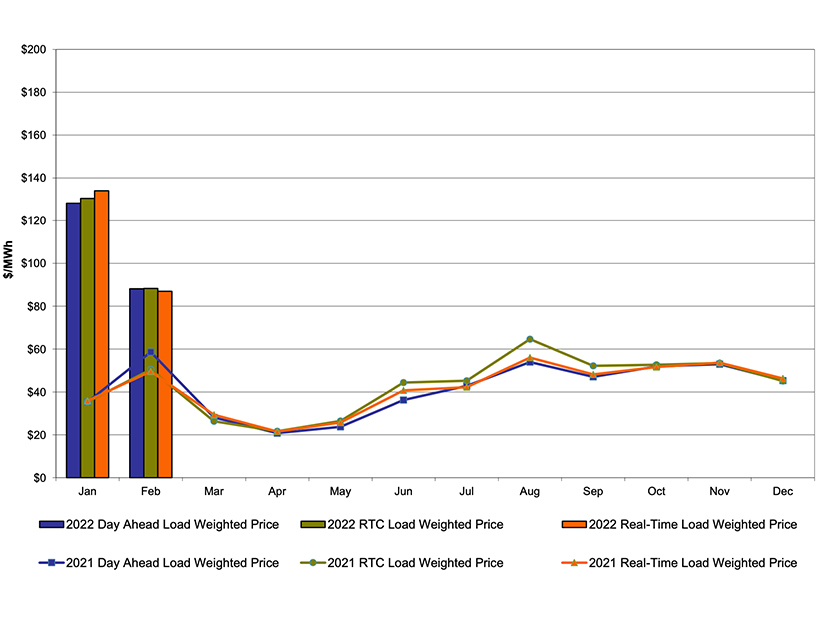

NYISO locational-based marginal prices averaged $94.06/MWh in February, down from $134.79/MWh the previous month and higher than the $63.70/MWh average in February 2021, Rana Mukerji, senior vice president for market structures, said in delivering the monthly operations report to the Business Issues Committee on Wednesday.

Day-ahead and real-time load-weighted LBMPs came in lower compared to January.

Year-to-date monthly energy prices averaged $118.36/MWh, a 123% increase from $52.99/MWh a year ago, which Mukerji attributed to higher natural gas prices.

February’s average sendout was 429 GWh/day, down from 451 GWh/day in January and 434 GWh/day a year earlier.

Transco Z6 hub natural gas prices averaged $6.17/MMBtu for the month, down from $11.15/MMBtu in January and up 18.3% year-over-year.

Distillate prices were up 64.5% year-over-year. Jet Kerosene Gulf Coast averaged $19.79/MMBtu, up from $17.96/MMBtu in January. Ultra Low Sulfur No. 2 Diesel NY Harbor averaged $20.46/MMBtu, up from $18.53/MMBtu in January.

February uplift decreased to -$1.73/MWh from -$1.50/MWh in January, and total uplift costs, including the ISO’s cost of operations, came in higher than those in January.

The ISO’s local reliability share dropped to 4 cents/MWh/MWh in February from 9 cents/MWh the previous month, while the statewide share dropped to -$1.77/MWh from -$1.59/MWh.

The Thunderstorm Alert cost in New York City was $2.98 because of some unusual thunderstorm activity in the month.

Real-time BPCG Eligibility Changes

The BIC recommended that the Management Committee approve tariff revisions that would change the provisions for real-time bid production cost guarantee (BPCG) payments.

BPCGs are paid as an incentive for resources directed to run by the ISO. In order to close a loophole whereby units may receive inappropriate real-time BPCG payments under certain circumstances, the new tariff language would add an exception to the eligibility criteria for units placed out-of-merit (OOM) for reliability, said Mark Buffaline, senior settlements analyst at the ISO.

As an example, the ISO hypothesized a unit scheduled for energy in the day-ahead market (DAM) at 100 MW bidding self-committed fixed/flex in the real-time market with a self-schedule at 200 MW. That unit operating in real time at 200 MW aggravates any transmission constraint and would be placed OOM for reliability with a 140-MW upper operating limit (UOL).

“The unit receives RT BPCG for 40 MW, and by self-scheduling at 200 MW in real time, they have indicated that they want to be a price-taker for all output up to 200 MW,” Buffaline said.

Units that bid self-committed fixed/flex at megawatt levels above the DAM energy schedule are generally ineligible for real-time BPCG, but by placing them out-of-merit for reliability, this makes them eligible for real-time BPCG, which supersedes the self-commitment ineligibility rule, he said.

“That is the discrepancy between the rules that we’re plugging here,” said Chris Brown, lead settlements analyst at NYISO. “So those costs representing that self-committed bid are no longer going to be eligible for a make-whole payment under this scenario with units out-of-merit for reliability.”