WASHINGTON — Supply chain challenges and trade and tax legislation were recurrent themes in discussions at the American Council on Renewable Energy’s Policy Forum on Thursday.

ACORE CEO Greg Wetstone opened the daylong session at the Convene conference center on a note of optimism — citing Sen. Joe Manchin’s (D-W.Va.) willingness to resume negotiations over the energy tax incentives in the Build Back Better (BBB) bill he had rejected in December — before dourly noting that the Russian invasion of Ukraine had spurred “new enthusiasm for near-term fossil fuel development and … momentum for growing the export of liquefied natural gas.”

“Meanwhile, supply constraints, trade policy issues and legislative uncertainty are slowing renewable development,” he continued. “The world has changed in ways that are complicated and not fully understood. But a couple of things are clear: We do know that the folly of our continued reliance on the fossil fuel economy — which leaves us vulnerable to unsavory foreign actors and the gyrations of unpredictable markets — has never been more clear.”

Solar’s Headwinds

Katherine Gensler, vice president of government affairs and marketing for generation developer Arevon, noted that the U.S. has seen three consecutive quarters of price increases for installed solar. “That has not happened before in the United States,” she said.

John Smirnow, general counsel and vice president of market strategy for the Solar Energy Industries Association, said tariffs “are doing great damage” to the solar industry.

“We’ve literally lost tens of thousands of jobs, multiple gigawatts of solar deployment and billions of dollars of economic investment,” he said during a panel on strengthening renewable supply chains through trade and regulatory policy. “Are we still growing as an industry? Sure. Are we going to have our best year ever? Maybe. That’s a question mark.”

Smirnow said the solar industry is “dangerously over reliant” on imports. “Ninety-five percent of solar wafers are manufactured in one country, almost in one region. If solar is going to be the economic engine — the national security economic development engine — that we need here in the United States, we have to grow a solar supply chain here.”

Doing so, he said, will require the federal government to invest in manufacturing, starting with passage of the clean energy provisions of the BBB bill. “Today as a country, we mainly look to the states to drive economic development. Anytime you see a new announcement for new manufacturing investment, it’s always the state governor [or] state economic development officials that are there with the investment,” Smirnow said.

“We can’t compete for private sector investments by relying on states alone, because other countries aren’t relying on their provinces or states alone. And it’s not just China. India, for example, just started a new production-linked incentive. That’s a big reason why First Solar is building a plant there.”

Supply Chain Challenges

Rachel Jones, vice president of energy and resource policy for the National Association of Manufacturers (NAM), said industry needs to change its siloed “pre-pandemic, pre-Ukraine invasion playbook” focused on the “fastest, easiest” way to obtain supplies. Now, she said, manufacturers must understand not only their direct suppliers but the entire supply chain above them.

“I had a company that was looking to build a facility, and they couldn’t get the structural aluminum that they needed,” she recalled. “It became a several-day endeavor of unpacking backwards until we identified the global shortage of magnesium [as the problem]. Ultimately, the global shortage of magnesium was about 20 links up the chain and totally out of control of the person that was trying to build a facility. … It was eye opening.”

The need for critical minerals, she said, “means all of us in this room need to learn about mining” and processing.

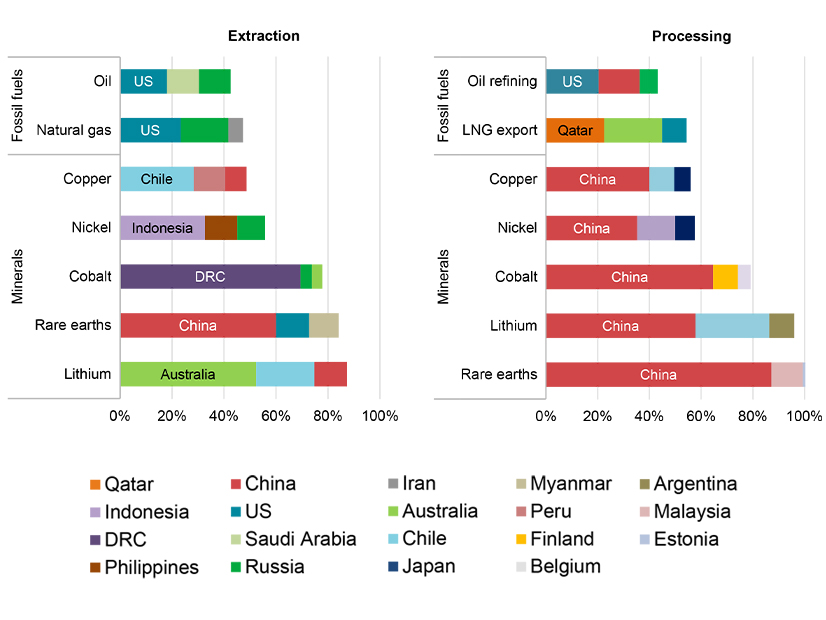

“It’s great if you can mine something in the United States. But if there’s one country that controls all of the processes for that, you have to then be reliant on them.” China, for example, controls almost 90% of rare-earth processing and almost 60% of lithium processing, according to the International Energy Agency.

Offshore Wind: Opportunities and Risks

Grant van Wyngaarden, Ørsted’s head of offshore North America procurement, said the “brand new” supply chain the offshore wind industry is building in the U.S. presents economic development opportunities and “a lot of risks.”

Ørsted is building 12 vessels in U.S. shipyards but will need to use foreign heavy-lift installation vessels initially.

One example of opportunity: A plant in South Carolina that will be supplying some of Ørsted’s projects with high-voltage submarine cable will also produce cable for export to an offshore wind farm in the U.K.

Among the risks: international competition for supplies. “Other countries — Netherlands, Belgium, Australia and the U.K. — all announced increased [OSW] targets just this month alone, and that increases additional pressure on a constrained supply chain,” he said.

Although North American OSW developers are primarily sourcing components from Europe, which has been building offshore turbines for decades, van Wyngaarden said the economics will favor U.S. sources in the long term. Transportation costs are “such a significant portion of the total cost that if we can avoid that cost through domestic production, we’re at a sustainable competitive advantage,” he said.

Security Concerns

The panel also turned to supply chain-related security concerns.

Jonathan Wakely, a partner with law firm Covington & Burling, said the U.S. government is particularly concerned with ensuring no risks are introduced by manufacturers of supervisory control and data acquisition (SCADA) and other industrial control systems.

It also is taking a close look at foreign investment in U.S. renewable projects. “Many of these solar farms [and] wind farms can be located in areas of the country that are close to things that the government cares about [such as military] training and testing that’s being done in the air,” he said. “Transactions have been prohibited because of those concerns.”

At a recent NAM board meeting, Jones said, “The biggest … surprise to me, was to fully appreciate the scale of the cyber warfare that’s going on right now, in particular ransomware.

“If you have ransomware that attacks … your [operating technology] system, that takes two or three times as long to rebuild as an [information technology] ransomware type attack. And so far, almost none of these have been reported,” she said. “Companies obviously don’t want a lot of this [made public]. But I would say … a lot of the supply chain disruptions that we are seeing actually have their roots in cyber warfare by ransomware or other types of things.”

Trade Legislation

Congress is considering legislation that could address some of the panelists’ concerns.

Democratic leaders said earlier this month they will convene a conference committee to iron out differences between the United States Innovation and Competition Act (USICA) (S. 1260), approved by the Senate last June, and the America Creating Opportunities for Manufacturing, Pre-Eminence in Technology and Economic Strength (COMPETES) Act (H.R. 4521), which cleared the House of Representatives on Feb. 4.

Both would provide funding to support supply chain security and U.S. semiconductor manufacturing, research and development.

SEIA’s Smirnow said the semiconductor funding would be “hugely valuable,” but his group is concerned by “anti-circumvention” provisions in the COMPETES Act that would “reduce due process rights.”

Wakely said “every business that does business overseas with foreign partners should look at the outbound investment provision” in the House bill. “This would, for the first time, regulate a broad range of transactions between U.S. businesses and foreign businesses, including investments overseas. It’s never been done before; no other country does it. The language is extraordinarily broad.”

Jones said NAM supports the USICA provisions on chips and critical minerals. “The way that we’re thinking about this is we’ve got an opportunity right now, all of us in this room, to get the best parts of the House bill [and] the best parts of the Senate bill; we get those all together in the conference.”