Securities and Exchange Commission Chair Gary Gensler and officials of two large investment funds on Tuesday defended the SEC’s proposed disclosure rule for climate risks, saying it will bring consistency and transparency.

Gensler said the proposed rule, released following a 3-1 vote in March, is consistent with the commission’s “long tradition of disclosures,” which began with reporting of companies’ financial performance and executive pay. (See SEC Seeks Standard Disclosures for Climate-related Business Risks.)

“The core bargain from the 1930s was, and still remains, that investors get to decide which risks to take,” Gensler said during a webinar by Ceres, a nonprofit that promotes corporate sustainability practices. “Risk by definition often involves events that have not yet occurred — the future. So back in 1964, the SEC started to offer guidance about disclosure of risk factors. The agency later adopted disclosure requirements related to management discussion and analysis in the late 70s. Then, they also added environmental-related disclosures. … The same principle applies again and again: Investors get to decide which risks to take, as long as the public companies provide full and fair disclosure and are truthful in the disclosures.”

Gensler urged investors and filing companies to submit comments on the rule before the May 20 deadline. “We’ve already gotten a lot of feedback: some of it for the proposal, some against. That’s what we need to hear,” he said. “And we need to hear the reasons too. We need to hear all sides of this. We consider all of those comments in determining whether and how to adjust the release as we move forward.”

The SEC’s proposal is based on the international Financial Stability Board’s Task Force on Climate-Related Financial Disclosures (TCFD). It would require disclosure of climate-related risks with a “material impact on its business, results of operations or financial condition.”

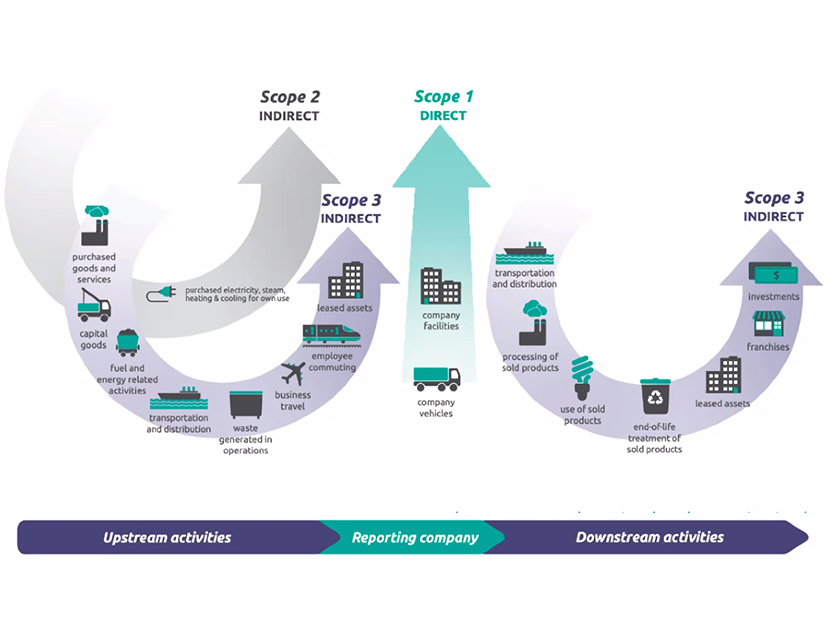

The rule also would require publicly traded companies to disclose their greenhouse gas emissions, including Scope 1 (company vehicles and facilities) and Scope 2 (purchased electricity, steam, heating and cooling for the company’s own use).

Disclosure of Scope 3 emissions (including indirect emissions from purchased goods and services and the transportation and use of a company’s products) would only be required if they are material or if the company has set a GHG emissions-reduction target that includes Scope 3.

Manchin: ‘Not Necessary’

Earlier this month, Sen. Joe Manchin (D-W.Va.) joined with Republicans in criticizing the rule, saying it undermined “the all-of-the-above energy policy that is critical to our country right now.”

“I cannot help but consider the true need for that mandate when the commission itself reports that ‘nearly two-thirds of companies in the Russell 1000 Index, and 90% of the 500 largest companies in that index,’ already publish sustainability reports that include information about climate risks,” Manchin said in an April 4 letter to Gensler. “In that sense, one could argue that the proposed rule aims to solve a problem that does not exist.”

But Ceres President Mindy Lubber said her organization’s analysis of comments filed with the SEC last year found “overwhelming support” from investors and companies for mandatory standards that are consistent with those used globally.

Lubber said the current voluntary reporting “is not good enough.”

“We want information to be accessible, clear, real and consistent. And right now it’s not. It is inconsistent, at times incomparable, and many cases, not strong enough quality — thus the need for the SEC [rule],” she said. “The investors we’re working with feel like they’re flying blind on investment decisions in their portfolios.”

Anne Simpson, global head of sustainability for Franklin Templeton, which manages $1.5 trillion for investors, also supported the rule, saying it was responsive to the needs of investors. “Risk is a good thing. Risk is where we make the returns. But we have to be able to appraise risk,” she said.

She also said companies that excel in their reporting on sustainability typically have lower costs of capital and that the rule will relieve their “survey fatigue.”

“Typically, a big company will be receiving several hundred surveys a year, most of most of which focus on climate risk, among other issues,” she said. “Having these standardized reporting guidelines will actually make a huge difference for companies.”

Joe Amato, chief investment officer for Neuberger Berman, which manages $500 billion in investments, said investors often have to rely on third-party estimates based on sector or industry averages that “fail to consider important company-specific nuances. And this clearly makes for less efficient capital markets.”

Joe Allanson, Salesforce’s executive vice president for finance ESG (environmental, social and governance), said his company five years ago became one of the first to include ESG reporting in its 10-K filings.

“I still vividly recall the internal debates back then, of how much to report, what to say, what legal exposure we might be taking on. It was quite personal to me, since I was one of the signers of the 10-K,” he said. “But the current proposal helps to alleviate much of the anxiety that I had experienced years ago because I find the proposal quite thoughtful and responsive to preparer concerns.”

Concern over ‘Chilling Effect’

Cynthia Curtis, senior vice president of sustainability for real estate services company Jones Lang LaSalle, said her company also sees the need for increased disclosure and transparency, noting that buildings are responsible for almost 40% of the world’s greenhouse gas emissions.

“That said, we all are also a little … ‘anxious’ is too strong a word. But we just don’t want companies to be backing off of commitments. … If you haven’t made a Scope 3 commitment, will this make you hesitate to lean into establishing a Scope 3?

“You know, quantifying the impacts of climate change, of course, is very hard. And putting it in your SEC filing just raises the bar. … So I just think we do need to pump the brakes a little bit and ensure we get the language right for the level of disclosure and the phase-in of the safe harbor, so that it promotes more disclosure and doesn’t result in some of that chilling effect.”