American Electric Power (NASDAQ:AEP) last week said it is continuing to transform its energy system for the future and de-risking and simplifying itself.

The company told financial analysts during its first-quarter earnings conference call Thursday that it expects to close the sale of its Kentucky operations by July and that it is preparing to market its 1.6-GW portfolio of unregulated contracted renewables during the second half of the year. The latter’s sale proceeds will be directed toward additional investment in AEP’s regulated businesses.

“We already have shifted $1.5 billion in capital to transmission, bringing our planned five-year capital spend to $14.4 billion in transmission and $10.4 billion in distribution,” AEP CEO Nick Akins told analysts.

The Columbus, Ohio-based company announced last October that it planned to sell its Kentucky utility and transmission companies to Liberty Utilities, a subsidiary of Algonquin Power & Utilities (NYSE:AQN), for $2.85 billion. (See AEP to Sell Kentucky Operations to Algonquin.)

AEP said during its earnings call in February that it will sell some or all of its unregulated contracted wind and solar energy resources and redirect capital previously allocated to that business to its transmission assets. (See AEP to Sell Unregulated Renewables Portfolio.)

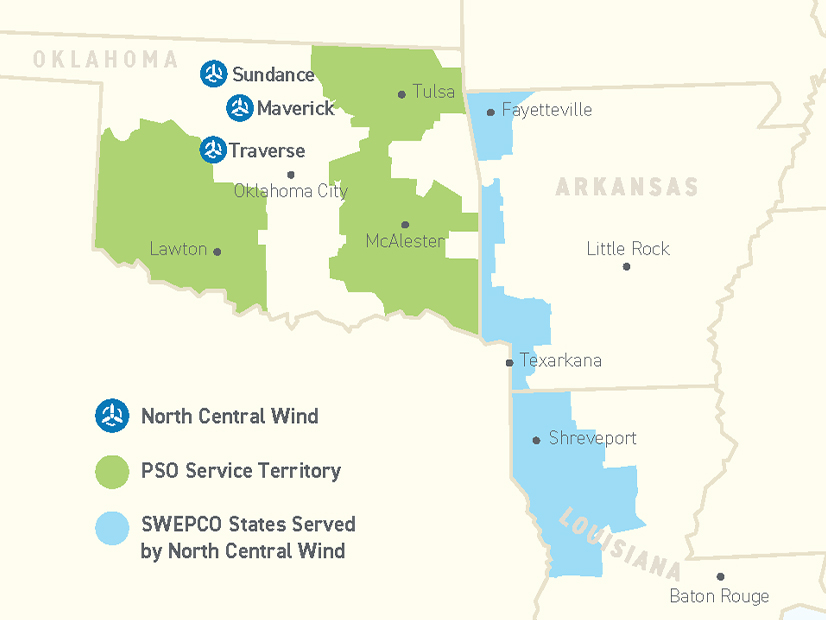

Akins said the company is making “substantial progress” in transitioning its generating capacity to 50% renewables this decade. It recently commercialized the last of three wind farms making up the almost 1.5-GW North Central Energy Facilities in Oklahoma.

AEP reported earnings of $715 million ($1.41/share), up from 2021’s first-quarter performance of $575 million ($1.16/share). Its share price closed at $99.53 the day before the earnings call. It finished the week down 42 cents at $99.11.

Xcel Earnings up 4.7%

Xcel Energy (NASDAQ:XEL) also announced first-quarter earnings Thursday. The Minneapolis-based company reported income of $380 million ($0.70/share), compared to $362 million ($0.67/share) in the same period in 2021.

CEO Bob Frenzel told analysts Xcel had reached “constructive regulatory outcomes” on several key matters, including its Upper Midwest Resource Plan, the Colorado Power Pathway transmission project and a rate case in Colorado.

The Upper Midwest Resource Plan would add 5.8 GW of wind and solar energy to Xcel’s system, extend the life of its Monticello nuclear plant in Minnesota to 2040, and retire its regional coal fleet by 2030. The $1.7 billion Colorado transmission project would enable 5.5 GW of new renewables, Franzel said.

Xcel’s Comanche Peak 3 coal-fired plant in Colorado is out of service following a “transmission event” and is not expected to be back in service until June because of supply-chain constraints. The outage is expected to cost the company about $25 million.

The 750-MW unit was scheduled to run until 2070, but Xcel has offered to shutter the plant by 2031. Comanche 3 went online in 2010, but it has been beset by breakdowns and outages. (See Co-op Accuses Xcel of Coal Plant Mismanagement, Deception.)

Xcel’s share price closed the week at $73.26, a 29-cent increase following Wednesday’s close.