The NY Green Bank is starting a $250 million Community Decarbonization Fund this year and increasing its own capitalization by nearly a third to address stakeholder requests for the state-owned bank to improve how it serves disadvantaged communities (DAC), feedback it detailed in a revised annual plan filed May 2 (13-M-0412).

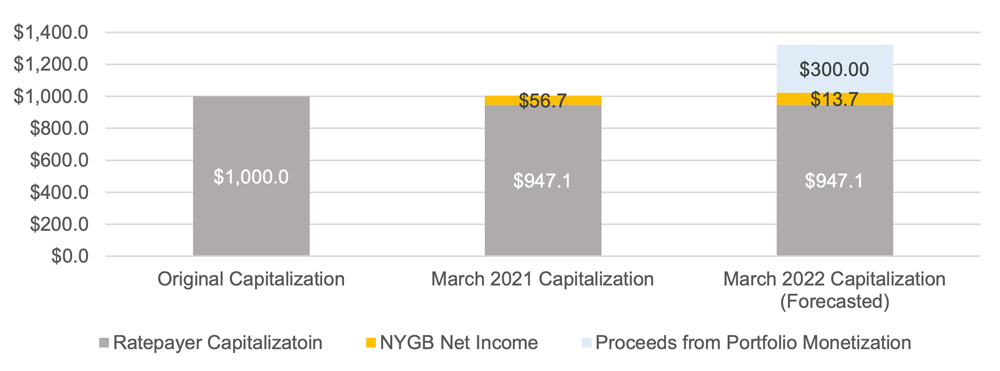

The NY Green Bank in 2021 raised $300 million in private funds to increase its capitalization by nearly a third. | NYGB

The NY Green Bank in 2021 raised $300 million in private funds to increase its capitalization by nearly a third. | NYGB

The bank raised $300 million from private sources to leverage the nearly $1 billion in ratepayer funding that supported its existing commitments, namely to invest $150 million in affordable housing projects by 2025 and $100 million in building electrification and energy efficiency in disadvantaged communities by 2025.

New York’s Climate Leadership and Community Protection Act (CLCPA) requires that 35% to 40% of all state spending related to clean energy go to DACs, which the NY Green Bank calculates from its total investments planned through Dec. 31, 2025, the end of the current Clean Energy Fund term.

NY Green Bank requested from the Public Service Commission an extension from the original filing deadline in March to more fully gather stakeholder comment, which it summarized in this month’s amended annual report without identifying any commenters.

Noted Comment

Some stakeholders complained of “cumbersome and lengthy” project financing processes, while others noted the increased capital needed to meet state environmental goals across building typologies, including affordable multifamily housing, or to comply with New York City’s Local Law 97, under which most buildings over 25,000 square feet will be required to meet new energy efficiency and greenhouse gas emissions limits by 2024.

One environmental justice advocate involved in those discussions with the NY Green Bank, Clarke Gocker, director of policy and strategy for PUSH Buffalo, told NetZero Insider he is “guardedly optimistic” about the bank’s move toward greater focus on serving DACs.

“If the state’s going to meet its climate goals, there really has to be a sea-change and a revolution in how existing funds are mobilized, and there needs to be a dramatic scaling up of investment that comes first from the public sector,” Gocker said.

PUSH Buffalo is a member of NY ReNews and is on the steering committee, and it has “been calling in the past 18 months, in particular after the passage of the CLCPA, for massive investments to implement the climate law really in line with even [New York State Energy Research and Development Authority’s] own projections released last fall, which are on the order of $10 billion a year,” Gocker said.

The state’s Climate Action Council has estimated a minimum of $1 billion in annual grants and incentives will be required through 2050 to green the affordable housing market, which would require a quadrupling of current funding. The council’s Climate Justice Working Group is helping define DACs, with draft criteria encompassing 35% of the population and households in the state, and it is holding public hearings on the topic through June 30.

Specific census tracts and low-income individuals are included in the draft definition as DACs that bear negative public health burdens or as individuals earning less than 60% of the state median income or participate in assistance programs, regardless of where they live.

NY Green Bank also is committed through 2025 to provide $100 million in financing to help clean transportation businesses locate or expand in New York and up to $100 million toward port infrastructure projects.

Reasonable Terms

“A theme repeated by developers, lenders and community-based organizations related to a lack of capital available to support building decarbonization or ambitious energy efficiency,” the amended plan said. “Owners and operators of regulated multi-family affordable housing properties commented that their properties had no excess cashflow or balance sheet resources to cover the cost of energy-related building upgrades.”

In 2021, NY Green Bank launched two financing channels, which included a request for proposal (RFP) for financing high-performance affordable housing, and another on “mandatorily redeemable preferred equity for disadvantaged community lenders.”

Stakeholders urged the bank to consider replacing the broad pathway for building decarbonization with focused RFPs addressing predevelopment loans, incentive bridge loans and permanent debt, and to publish indicative terms to align with “off-the-shelf” products offered by other real estate project lenders. Specialty lenders, they said, do not necessarily need preferred equity infusion to facilitate the expansion of their lending activities.

Environmental justice advocates pointed out that community-owned solar projects offer greater energy bill savings than those available to subscribers of privately-owned ones, but that lending institutions lack interest in such small, complex projects, the bank said.

One perspective among environmental justice advocates was that NY Green Bank currently charges higher interest rates than the private sector lenders to low-income New Yorkers, Eddie Bautista, executive director of the New York City Environmental Justice Alliance and a member of the state’s Climate Justice Working Group, told NetZero Insider.

The state in 2013 chartered NY Green Bank, which operates as a division of NYSERDA, to work with the private sector to increase investments in the state’s clean energy markets.