New York investor-owned utilities last week said they support cost-of-service-based electric rates with time-bound incentives to provide cost relief for EV charging station owners, which they deem preferable to solutions based on rate design. (18-E-0138; 22-E-0236).

The rate-design-based solutions proposed by several stakeholders “are too broad-brushed and inflexible, do not reflect cost causation, and are inferior to targeted, transparent, flexible, and timebound non-rate design based incentive solutions,” the utilities said in comments filed with the New York Public Service Commission.

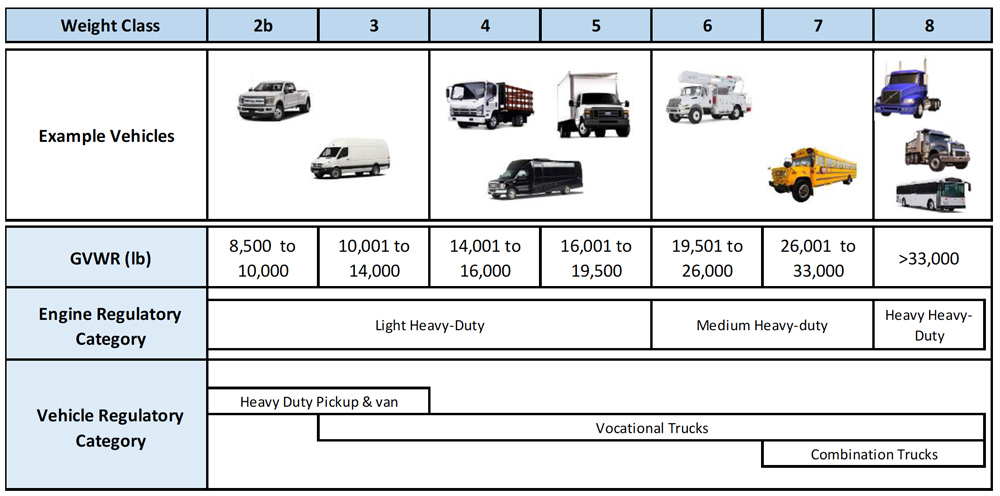

The proceedings concern EV supply equipment and infrastructure, and establishment of a commercial tariff or other solutions to facilitate faster charging for light-, medium-, heavy-duty and fleet electric vehicles (EVs). (See New York Utilities Report Slow Start to EV Fast Charging.)

The IOUs responding included Con Edison (NYSE: ED) and its subsidiary Orange and Rockland; Central Hudson Gas and Electric; National Grid (NYSE: NGG) for its Niagara Mohawk Power subsidiary; Avangrid (NYSE: AGR) subsidiaries New York State Electric and Gas (NYSEG) and Rochester Gas and Electric (RG&E); and PSEG Long Island operating for the Long Island Power Authority.

Cost Concerns

Advanced Energy Economy and the Alliance for Clean Energy New York asked the commission to “consider how to fairly spread the costs across all customers rather than commercial customers alone,” which the utilities said reflects the EV program being one of several public policies supporting clean energy initiatives.

Other stakeholders said that demand charges send important price signals but reducing or eliminating those charges in tariffs may be the only cost-relief option, an approach the utilities deemed “suboptimal compared to solutions that would provide cost relief and maintain appropriate price signals.”

For example, the Alliance for Transportation Electrification noted that “demand charges are a fair and efficient means of recovering the costs utilities incur … but can raise issues when included in rates paid by charging station operations.”

PowerFlex said that rates should align with grid needs so EV adoption does not become a cost burden to electric customers. It said that while demand charges encourage grid-beneficial behavior, they should not be so high so as to discourage EV charging station installation.

ChargePoint recommended reducing demand charges and increasing volumetric charges for at least 10 years, while Tesla supported shifting DCFC charging customers to rates with reduced or no demand charges. The Metropolitan Transportation Authority wanted utility rates to be set such that commercial EV fleet owners do not incur higher costs than when operating diesel and compressed natural gas vehicles on a cost per mile basis.

The utilities counter that targeted incentive-based operating cost relief can support EV fast charger installation while retaining the beneficial price signals in demand charges.

“Rate-design-based solutions also result in shifting more costs from EV charging station operators to other customers compared to incentive-based solutions. The bill impact of incentive-based cost relief programs can be smaller than that of rate-design-based solutions and more spread out both over time and across all customer groups, rather than concentrated in that year in a single service class,” the IOUs said.

Fast charger network Electrify America suggested that residential customers who charge their vehicles at home end up paying more than residents of multi-unit dwellings in urban areas who rely on public chargers, and that demand charges are “the largest differentiating factor between effective electricity rates billed by the utility to residential and to commercial EV customer accounts.”

While the disparity between at-home and public charging may be a barrier to more equitable EV adoption, moving away from cost-reflective utility rate design likely would create further inequities among utility customers and create disincentives for efficient investment and innovation, the IOUs said.

“Proposals for rate-design-based solutions are not aligned with appropriate and established rate design principles … and do not reasonably manage cost shifts while promoting access to benefits, i.e., availability of fast charging to all customer groups. Optimal solutions should instead seek to target incentives to reach only the charging stations that need them and thus avoid inadvertent or unexpected cost shifts to other utility customers,” the utilities said.

The New York Power Authority advocated partnerships between ride-sharing companies and public fast charging providers to spread demand costs among more users, increase utilization and help reduce the impact of these costs.

The IOUs said they “support solutions that leverage price signals to encourage the adoption of innovative business models and technologies that enable grid-beneficial behavior.”