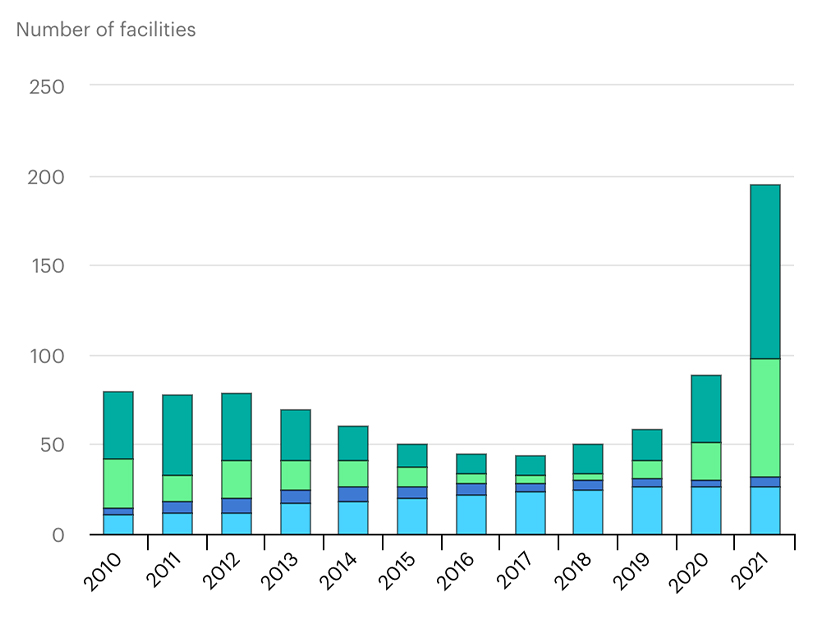

Energy Secretary Jennifer Granholm came to the Global CCS Institute Forum in D.C. on Thursday to tell a roomful of executives, engineers, financiers and other advocates that the Biden administration is all in on carbon capture and storage (CCS) as a critical technology in the fight against climate change.

Energy Secretary Jennifer Granholm | © RTO Insider LLC

Energy Secretary Jennifer Granholm | © RTO Insider LLC“The climate science on this is unequivocal,” Granholm said. “Yes, we need to accelerate clean generation, and yes, we need to decarbonize because the goal of getting to 1.5 degrees Centigrade to meet the Paris Agreement, it just can’t happen without carbon removal. It can’t happen without carbon capture.”

While acknowledging public skepticism about the expense and feasibility of CCS, Granholm argued that “carbon-management technologies offer us tools, and these tools can be helpful or hurtful depending on how carefully or responsibly you can use them.”

Granholm’s use of the term “carbon management” reflects the repositioning of CCS that is underway both within traditional fossil fuel companies and CCS startups bringing their technologies to market, as the industry continues to negotiate a path into the clean energy mainstream. The underlying message at the conference was not if CCS will be effective, functional and affordable, but when that level of development will occur and what’s needed to accelerate the process.

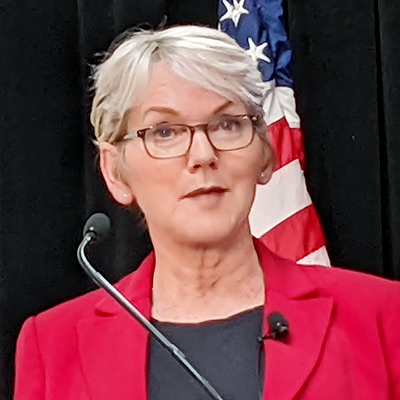

Figures from the International Energy Agency (IEA) show that the existing 27 CCS facilities worldwide have the capacity to take about 40 million tons of CO2 per year out of the air. The industry saw a record growth spurt in 2021 with 97 new projects announced and 66 more in advanced stages of development. But even if all these projects were to come online, the IEA says, they would not provide the 1.7 billion tons of CCS capacity that will be needed by 2030 as a foundation for a global net-zero economy by 2050.

In her keynote at the forum, Granholm focused on the environmental and economic imperatives for CCS. It will decarbonize the “things we cannot live without and yet whose carbon emissions we cannot live with,” such as steel, cement and chemicals, she said.

It will also be a job creator, Granholm said, providing new opportunities for fossil fuel workers and communities that “have powered this nation for over 100 years … and should empower us into the future.”

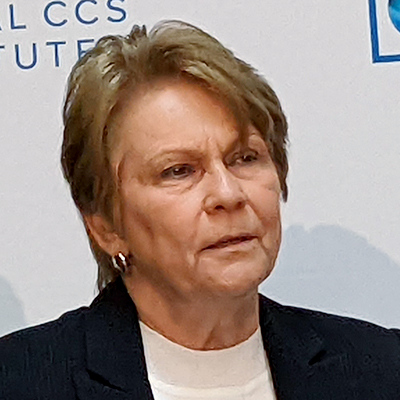

Jarad Daniels, GCSSI CEO | © RTO Insider LLC

Jarad Daniels, GCSSI CEO | © RTO Insider LLCBut scaling CCS will require both government and industry to step up, said Jarad Daniels, CEO of the Global CCS Institute. Federal programs and incentives are vital “during those first-of-a-kind [projects],” he said. “But it’s really industry and the private sector that are going to get this deployed at commercial scale.”

The Biden administration’s support for CCS includes $12.1 billion in funding for demonstration projects and other research and development activities in the Infrastructure Investment and Jobs Act. Expanding tax credits for CCS — specifically, the 45Q tax credit — is also part of the clean energy incentives the administration and the industry still hope to get through Congress before the upcoming midterm elections.

The energy sector as a whole is also beginning to shift, Daniels said, toward “providing diverse energy services, and it should be [technology] agnostic … as long as it moves toward sustainability” and reducing greenhouse gas emissions.

Traditional oil and gas companies can and should take a leadership role to accelerate the transition “to move away from just the energy sector being based on hydrocarbons to being based on this broader suite of technologies that all have lower carbon footprints,” Daniels said. “They have the infrastructure; they have the balance sheet to allow all of us to work together at scale.”

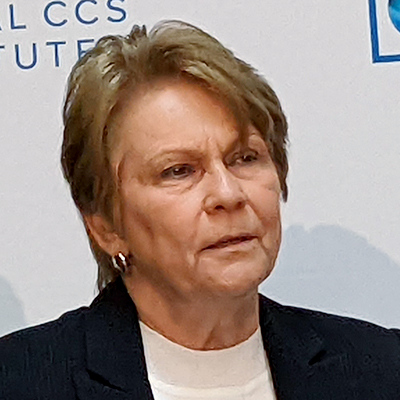

Occidental Petroleum (NYSE:OXY) CEO Vicki Hollub reminded CCS skeptics that “technology can be improved over time, as we’ve seen in the case for solar and wind. … You can’t make it better until you build the first one and improve it over time,” she said.

With market disruptions from the war in Ukraine, Hollub sees a more pressing question for the industry: how to accelerate the energy transition to meet the 2050 goals of the Paris Agreement, “but also ensure that we’re not putting any countries or regions at risk from a security standpoint and that we’re not leaving … developing countries behind.”

The Last Barrel of Oil

For Hollub the answer is Occidental’s commitment to enhanced oil recovery (EOR): injecting CO2 into existing wells to increase their output, while decreasing the fuel’s carbon footprint.

Traditional extraction methods leave 50 to 60% of oil in the ground, Hollub said. But once injected, CO2 expands into porous rock where oil is trapped, pushing it out and then filling the empty space, which sequesters it “forever,” she said.

Oxy CEO Vicki Hollub | © RTO Insider LLC

Oxy CEO Vicki Hollub | © RTO Insider LLC“It takes more CO2 injected into a reservoir than what the incremental oil that that CO2 generates will emit with use,” Hollub said. “So, you can actually generate net-negative or net-neutral carbon oil from an enhanced oil recovery project.”

Occidental currently has three EOR projects online in the Permian Basin in Texas and is also looking to expand into direct air capture to have enough CO2 for widespread adoption of enhanced recovery. Hollub sees a global market for the technology, especially in developing countries that “have all these resources to develop, so they can achieve the same quality of life we have here in the United States,” she said. “We need to allow them to be able to develop, but in a carbon-neutral way.”

Hollub also anticipates a huge corporate market for EOR. “There are more than 5,000 corporations in the world that have committed to be net zero by 2050,” she said. “And what that means is there are not enough natural ways to sequester CO2, so, we’re going to need carbon capture and sequestration.”

The goal, she said, is to reduce the carbon footprint of future oil development and production. “The last barrel of oil produced in the world should come from a CO2 enhanced oil recovery reservoir,” she said.

Valuing Carbon

Getting to that last barrel is a matter of both technology and finance, said Jonathan Pershing, environment program director at the William and Flora Hewlett Foundation. Prices must come down, scale must go up, and “somehow, you’ve got to value the carbon,” he said in an afternoon keynote.

Jonathan Pershing, William and Flora Hewlett Foundation | © RTO Insider LLC

Jonathan Pershing, William and Flora Hewlett Foundation | © RTO Insider LLC“We have to figure out how to bridge the gap between the economic return [on CCS], which is a pretty small share of the total, and the price, which is a much larger number,” Pershing said. At present, he sees prices of $50/ton for industrial CCS and $200/ton for direct air capture as good targets.

Current 45Q tax credits are either below or just equal to those benchmarks — with no direct-pay option — with credits for EOR projects receiving credits starting at $10/metric ton, increasing over time to $35/MT, while the credit for carbon sequestered in salt caverns or other underground formations ranges from $20 to $50.

The incentives proposed in the original Build Back Better Act would have increased tax credits for carbon stored in geological formations to $85/MT, and the credits for direct air capture projects would have jumped to $130 to $180. (See No Net Zero Without Carbon Capture.)

An earlier panel on project finance zeroed in on direct-pay incentives as a key solution to bridging the gap. “Tax credits don’t incentivize because basically no corporations pay taxes … and if they do, they have excess tax credits,” said Jeff Brown, managing director of the Energy Futures Financing Forum. Furthermore, tax credits are not cash, so they cannot be used to pay off debt, he said. (See 3 Keys to Fixing the Cash-flow Dilemma in CO2 Capture.)

Entropy CEO Mike Belenkie | © RTO Insider LLC

Entropy CEO Mike Belenkie | © RTO Insider LLCBut Mike Belenkie, CEO of Canadian startup Entropy Inc., sees a more fundamental problem. However generous, government subsidies and private philanthropy generally result in pilot projects, but climate change is a massive problem requiring more ambitious goals.

“It doesn’t get solved by showing you can do it,” he said. “It gets solved by actually putting a market together, understanding the cost of doing it and doing it.”

Belenkie was one of three startup executives speaking on a panel on the CCS technologies and business models now moving the industry forward. Entropy’s strategy, he said, is to “come up with a full business [model that] can be emulated over and over again around the world and develop a lot of market.”

Putting carbon in the ground “with the lowest possible cost is always going to be the best solution,” Belenkie said. “Avoid pipelines; we do not need a network of pipelines around North America or around the world to store carbon.”

With an investment of $300 million from Brookfield Renewable, the company is about to bring its first commercial-scale project online in Alberta, sequestering 47,000 metric tons of CO2 per year at a cost of $50/ton.