Widespread adoption of heat pump water heaters in California has been stymied by a preference for tankless water heaters among homeowners, who may feel that a heat pump appliance is a “step backward,” a new report says.

The California Public Utilities Commission last week announced release of the report, which is a market study of electric heat pump appliances in the state.

“It feels like a step backward when you have a HPWH [heat pump water heater], because you have this giant tank that takes up space and then it’s losing heat,” said a builder who was interviewed as part of the study. “That’s going to be a hard move for consumers.”

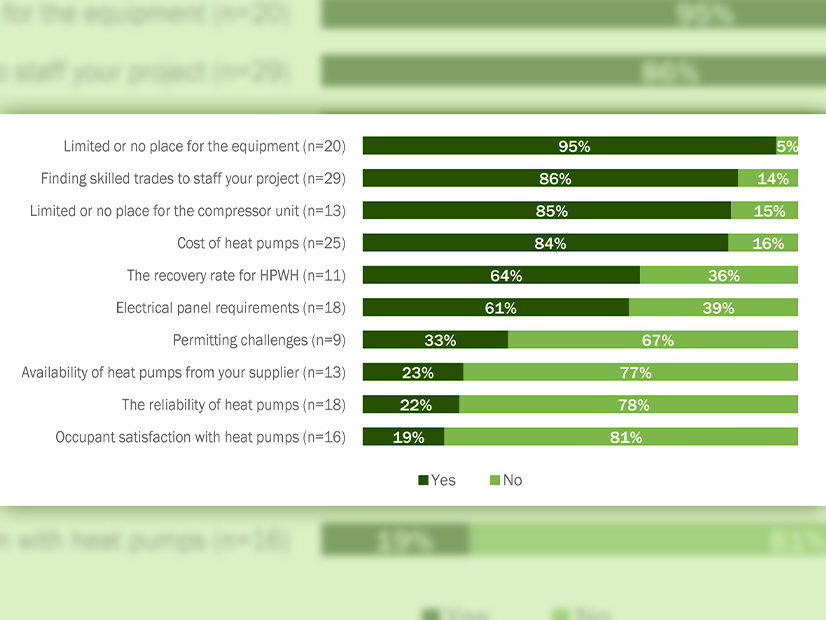

In addition to taking up more space than a tankless unit, heat pump water heaters can be noisy and cost more upfront than alternatives. And contractors might not be familiar with HPWHs and prefer “business as usual, which has largely been gas tankless water heaters,” the report said.

The report recommended more homeowner education on the benefits of HPWHs, which include a chance to relieve stress on the grid if the appliance is tied in with a demand response program.

Meeting Climate Goals

The focus on heat pump appliances comes as California moves toward building electrification as one way to meet climate goals.

About 12% of California’s greenhouse gas emissions are direct emissions from residential and commercial buildings. And much of that is from space and water heating, CPUC said.

“Heat pump systems provide hot water, heating and cooling using energy from the electric grid, which is increasingly renewable,” the CPUC said in a release.

The goal of the new study was to provide insights that may guide strategies to accelerate adoption of heat pump appliances. The CPUC worked with consultant Opinion Dynamics on the study.

The study examines five electric heat pump technologies: air source heating and cooling heat pumps, heat pump water heaters, ground source heating and cooling heat pumps, heat pump clothes dryers, and heat pump pool heaters.

The report included analysis of past research on heat pump technologies and interviews with a range of stakeholders. The study looked at construction of market-rate and affordable housing, and single-family and multi-family buildings.

Heat Pump Surge Expected

Most of the construction trade representatives interviewed for the study said they expect heat pump installation in new homes to increase substantially over the next five years. That’s due, in part, to the growing number of cities that have banned natural gas in new construction or adopted reach codes encouraging the use of heat pump appliances. A reach code is a city building code that goes beyond minimum state standards.

The trend may be amplified when California’s 2022 Energy Code takes effect on Jan. 1, 2023. (See Calif. Energy Commission Adopts 2022 Building Code.) The code includes a provision requiring developers to install either an electric heat pump water or space heater in new single-family homes. For new multi-family housing, heat pump space heating will be the new standard.

The current market share for electric heat pumps for water and space heating in new homes in California is less than 6%, according to the California Energy Commission.

Another factor increasing demand for heat pump technology is the growing number of homeowners who don’t have air conditioning but now want it. Heat pumps can provide heating and cooling in a single piece of equipment and are “an attractive value proposition,” the report said.

“It’s hard to explain to them the value of heat pumps unless they really, really want the cooling,” said one single-family home architect who was interviewed during the study.

Opportunity Ahead

The report also notes an opportunity for heat pump space heating. Almost half of California homeowners whose main heating source is a natural gas or electric space heating appliance have units that are more than 14 years old, and therefore may need replacing within the next 10 years.

Study consultants also researched heat pump programs in states that are having some success in promoting the technology, including New York, Vermont, Washington, Oregon, Maine and an unidentified Southwestern state.

Staff with those programs said a key to success was developing a strong contractor network, starting initially with a few high-volume companies.

They also advised running marketing campaigns to explain to consumers the benefits of heat pumps and how to use them for the most savings.

Another recommendation was to offer a range of incentives to contractors, such as technical training, continuing education credits or free heat pump units so they can try out the technology in their own homes.