A massive expansion of hydrogen-ready pipelines built to move Appalachian shale gas to liquefaction plants on the Gulf Coast for export is the key to U.S. and European energy security and addressing global climate change, according to the head of the largest U.S. gas producer.

EQT CEO Toby Rice | CSIS

EQT CEO Toby Rice | CSIS

Toby Rice — a veteran shale gas entrepreneur, CEO of Pittsburgh-based EQT (NYSE:EQT) since 2019 and an early advocate of “blue” hydrogen, produced using methane — says the pipeline expansion would also “set the table” for accelerated hydrogen production that the Biden administration has called for.

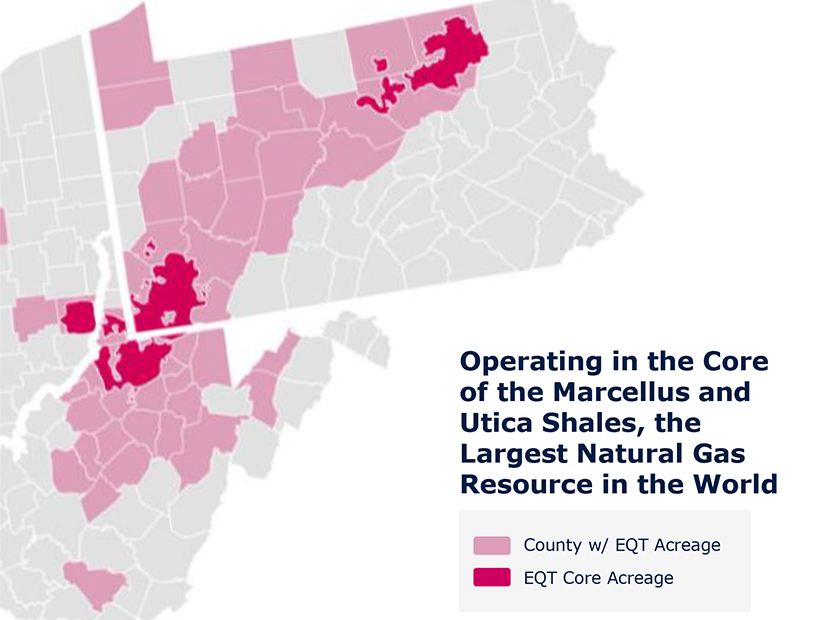

In remarks last past week during a lengthy, multi-topic seminar produced by the D.C.-based Center for Strategic and International Studies, Rice said lack of pipeline capacity is limiting shale expansion, particularly in the Marcellus and Utica Shale plays of northern West Virginia, southwest Pennsylvania and southeast Ohio.

He said the world “is running out of time” to address climate change by waiting for the full-blown development of affordable green hydrogen made by electrolysis using solar or wind power because electrolysis is not yet economically viable.

“Access to cheap, clean, reliable energy underpins modern society, everything we do, the pillars of modern life; things like fertilizer, things like concrete, things like steel, these all require energy,” he said.

EQT is one of several unconventional gas producers in the Appalachian region that drill horizontal wells and then fracture oil-and-gas-rich shale.

Nationally, record gas and oil production from shale wells catapulted U.S. production to record levels by 2020, driving down national wholesale gas prices to $2 per 1,000 cubic feet and oil to $40/barrel. Many producers left or were forced to shut down. The industry is now beginning to recover.

Using slides from EQT’s “Unleashing U.S. LNG,” a 56-page presentation the company unveiled in March at CERAWeek 2022, Rice told his CSIS audience that more pipelines would enable producers, particularly in the Marcellus and Utica Shale plays, to greatly expand current production, resulting in enough gas for liquefaction and export while producing feedstock to make blue hydrogen in the U.S.

EQT is working with state governments and heavy industry in the northern Appalachian region preparing to apply for a $2 billion federal grant to create a hydrogen hub, in this case from natural gas with the resulting carbon dioxide sequestered underground. The hydrogen would then be used by nearby industries to decarbonize the production of steel, gasoline and fertilizer that currently rely on natural gas.

“The government’s talking about doing hydrogen hubs everywhere. Here’s how unleashing U.S. LNG can … make that a 1+1=3,” Rice said, introducing his argument to the CSIS audience.

“U.S. LNG is the energy transition for a zero-carbon economy in the United States. Unleashing U.S. LNG would give us the opportunity to rebuild a significant amount of pipeline infrastructure, and the industry is going to pay for that.

“When we build this infrastructure, let’s not think about moving natural gas; let’s build this infrastructure so that it’s hydrogen-ready. That would be incredibly impactful in setting a foundation for the hydrogen economy. Natural gas is going to be a zero-carbon fuel in the future, because we can transform it to blue hydrogen or blue ammonia.”

Rice also argued that LNG would enable Europeans to reject Russian gas. It could also potentially displace coal in India and China, where new coal power plants are still being built. Rice said natural gas power plants have already reduced overall carbon emissions in the U.S.

“The question is, why are people still using coal? The answer is they just don’t have access to natural gas. As resources, if natural gas is a big decarbonizing solution, who’s going to be able to supply that natural gas for the world?

“We believe that we have the resources to grow production over 50 Bcfd for LNG exports, a fourfold increase in what we’re already doing today in LNG exports,” Rice added.

Feasibility of Pipeline Expansion

Joseph Majkut, director of the CSIS energy security and climate change program, interviewed Rice and questioned the feasibility of quickly building the new pipelines he envisions.

“Pipelines encounter multiple challenges, right? You have people worried about stranded assets … [who] don’t want to invest any more in fossil fuels. You also have people whose land is seized because of eminent domain claims, who are not particularly concerned with climate issues but have very local concerns. What’s the basket of reforms that allows us to realize some of this potential without running roughshod over justifiable concerns?” Majkut asked.

Rice agreed that building pipelines or other energy-related projects is extremely difficult, but “we’ve proven that we’re able to build things correctly here in the oil and gas industry,” he asserted. “And nothing we do should be done in a way that we shouldn’t be able to take care of the stakeholders that are involved. We’ve also got … to realize that we need to build stuff in this country. And that’s going to be a big part of the policy [for] environmental justice.”

Fugitive Methane Emissions

Natural gas consists mostly of methane, and leakage from gas wells and pipelines is a major concern of environmentalists because methane is considered a much more potent greenhouse gas than CO2. Rice said EQT is on the way to reducing methane emissions to net zero.

Ben Cahill, a senior fellow at CSIS, asked Rice “to share some details” about how the company is doing that. “The prospect of sending clean U.S. LNG to the rest of the world sounds great. How do we provide certified gas, so we know the methane emission intensity of those cargoes?”

“It’s real simple,” Rice responded. “It’s bullet-proofing our operations and then [providing] radical transparency.

“We know where these emissions are coming from. As a natural gas producer, that biggest source of emissions is a piece of equipment called the pneumatic device. At EQT, we had over 10,000 of these, and we’re replacing every single one of them over 36 months, at a cost of $25 million. That’s going to have the impact of lowering emissions almost over 700,000 tons.”

Majkut noted that reducing emissions at EQT was only part of the solution. “There are emissions associated with liquefaction and shipping,” he said, before Rice asserted, “That’s going to be net zero too.”

Majkut said he believed about 60% of emissions now occur “on the cargo [ship] side.”

Rice agreed. “We’re talking about rebuilding. Probably one of the more challenging things we need to do is rebuild these cargo ships. This is an opportunity for us,” he said in an apparent reference to the industry.

One of the most critical questions put to Rice during the interview came from a member of the audience, Amy Myers Jaffe, a Tufts University professor who had appeared in an earlier, unrelated panel discussion.

“You’re elaborating a plan that’s big buildout, spending billions of dollars. But you’re going to be competing against Saudi Aramco, which already has a plan in place to export [green] hydrogen as ammonia. You’ve got Australia doing a big buildout to export [green] hydrogen as ammonia. And we know that Europe is committed to transitioning [to green hydrogen],” she said.

Noting that U.S. LNG-exporting companies would likely need a 20-year contract with European customers who might baulk at such a long-term commitment in order to pay for the enormous expense of Rice’s plan, she asked why U.S. companies shouldn’t skip exporting LNG and prepare to ship hydrogen or ammonia.

Rice countered that Europe needs gas rather than hydrogen at this point, that LNG in the future will not be a fuel but a hydrogen feedstock, and that focusing on future zero-carbon hydrogen has been an impediment to developing blue hydrogen today.