The New Jersey Board of Public Utilities’ (BPU) effort to limit the ratepayer costs of its incentive plan to stimulate the development of storage has run into concerns that its early stages are too slow and modest.

The limited size of the project capacity eligible for incentives in the first two years of the program will crimp storage development progress and push up expenses, developers told a stakeholder meeting held Friday into the grid-scale elements of the Storage Incentive Program (SIP).

The proposal uses a “declining block system” in which the first applicants are allocated incentives and capacity from the initial blocks, which pay the incentive at a rate that would cover about 30% of the project cost. Once that initial block is subscribed, the incentives for the next block then decline by a predetermined amount set by the BPU as more blocks are allocated. If a block is unsubscribed, the BPU can adjust the incentive to make it more attractive.

The system is designed to give the BPU the flexibility to adapt to market conditions and “ensure that the total cost to ratepayers decreases as the quantity of resources increases,” while also giving potential investors a “clear trajectory” of incentives, the straw proposal says.

But Scott Elias, director of Mid-Atlantic state affairs for the Solar Energy Industries Association, said the BPU’s proposed award of 30 MW of storage in the program’s first year is too small, and the agency should be planning for about 100 MW.

“It’s entirely conceivable that a single project would eat up the full capacity for the entire year,” he said. “And we think that would undermine the philosophy behind a block structure.”

Dennis Duffy, vice president at Energy Management Inc., an energy facility operator and developer, said the benefits of rapidly developing larger capacities of storage than is anticipated by the BPU are “known and measurable” and would create economies of scale.

“There’s no question, if you want to lower the costs, you’ve got to do these projects in scale,” he said. “And the way you do that is by larger volumes in the initial years of the program.”

Judy McElroy, CEO of Fractal Energy Storage Consultants, also urged the BPU to consider offering larger blocks of capacity.

“A 5-MW battery or storage system can be on the order of 20 to 25% higher on a per-unit basis than, say, a 50-MW or 100-MW storage system,” she said.

Block Size vs. Cost Tradeoff

BPU officials said the block sizes were set in an effort to balance the size of incentives needed to get the storage sector up and running with the cost to ratepayers.

Abe Silverman, the BPU’s general counsel, said the fixed incentives in the grid-scale part of the storage proposal would cost ratepayers $2.08 million in the first year. He displayed a slide that showed the program would cost another $2.39 million for the blocks allocated in the second year, for a total of $4.472 million paid out in the second year. The program would award $1.8 million in the third year, for a total cost of $6.272 million.

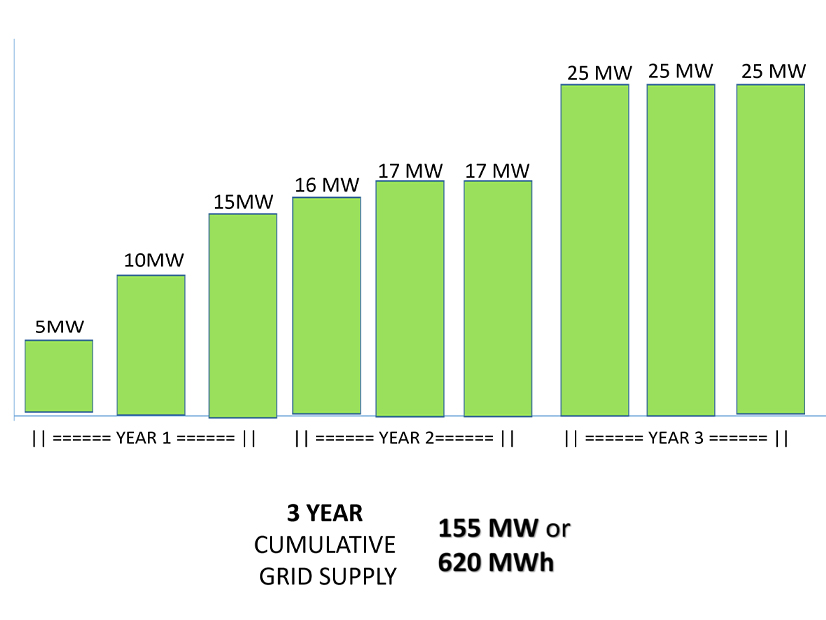

The program over that period would allocate three capacity blocks each year for three years: 5, 10 and 15 MW in the first year; one 16-MW block and two 17-MW blocks in the second; and three 25-MW blocks in the third. The incentives would start at $20/kWh per year for the first block, declining to $4/kWh in the last block of the third year.

“We want to make sure we’re doing something that’s realistic from a budgets standpoint … but also get things moving,” said Paul Heitmann, program manager for the clean energy division of the BPU, who presented the proposal at the hearing. He said there was a clear tradeoff between block size and the cost; creating larger blocks would result in smaller incentives because of the BPU’s cost constraints.

But Ted Ko, a consultant to clean energy companies who said he had extensive experience putting together storage projects, told the hearing that the BPU needed to take a broader view of the program. The agency should consider the goal of reducing ratepayer costs in conjunction with a more expansive vision of reducing the “the overall cost of deploying the energy storage to meet the target.”

“The way to do that with incentive programs … is to get the market learning curve accelerated quickly enough to reduce the soft costs of energy storage deployment in your state, in your market … thereby reducing the overall cost of deploying to your targeted goal,” he said.

Long-duration Storage

The discussion came in the second of three online hearings into the SIP proposal, for which more than 300 people signed up to listen in and more than 20 people spoke.

The state is trying to remedy slow progress toward its ambitious goals for storage development. The state Energy Master Plan recognized storage as a key element and predicted that the state would eventually need 9 GW of capacity. The state’s Clean Energy Act of 2018 set a goal of having 2,000 MW in place by 2030. Yet the state at present has only about 500 MW of storage.

The SIP sets a target of building 1,000 MW of four-hour-plus storage by 2030. It anticipates a steady increase in the annual capacity of storage installed each year, with 40 MW of four-hour storage installed in 2023, rising to 330 MW in 2029.

The full incentives would be paid to a storage facility that is available for 95% of the hours in the day, the SIP suggests. And the proposal suggests that units should be available for at least 50% of the year.

Hong Zhang Durandal, senior manager for EDP Renewables, a global clean energy development company, said the BPU could attract more participants into the storage market and increase the sector’s flexibility by setting the availability percentage before 50%. That would increase the market and prevent storage users from having to rely on just a few players, he said.

“Say some unexpected event happened to battery X operator for some X reason,” he said. “Then you have another three battery providers that can actually fulfill” whatever the need is, he said.

The proposal also suggested that there could be incentives for long-duration storage, which provide power for more than 20 hours, rather than the four-hour duration that the BPU adopted as a standard in the proposal. The agency is soliciting input from stakeholders to flesh out the details of what it should look like and how to stimulate the development of long-duration storage.

Such a program could be expected to offer lower incentives because long-duration technologies can have lower costs and sometimes don’t cut carbon emissions as much as short-duration storage, the proposal says.

The proposal cites the example of Form Energy, which has agreements with both a Minnesota electric cooperative and a Georgia utility to deploy pilot versions of “a novel iron-air-exchange flow battery” that it claims “can offer up to 100 hours of electricity storage at a price of less than $20/kWh.” However, the battery “likely” has lower efficiency and loses more power in providing charge than does a lithium-ion battery, the straw proposal says.

Michael D’Ambrose, consulting engineer at TRC, a Connecticut-based consulting firm, said the BPU should be open to storage with durations even longer than 20 hours, such as “seasonal energy storage,” as well as alternative sources such as hydrogen.

Heitmann said the agency wants to be “technology agnostic” but also has to evaluate what mix of storage duration models is best for the state goals and what targets to prioritize. There are models for both thermal storage and mechanical storage emerging, and flywheel systems are a “proven technology,” he said.

“Long-duration storage tends to not have that high megawatts” generating capacity, which smaller-duration projects do, he said. “But it’s got the ability to do it for a long time. … Long-duration storage has a place, and it’s kind of one of those missing pieces of making this all work and helping us balance everything on our grid.”