The multiple tax credits provided by the Inflation Reduction Act are key to the development of major clean hydrogen projects, as well as seasonal hydrogen storage, says one company that is already building the largest green hydrogen storage and generation facility in the U.S.

John Young, Mitsubishi Power | Reuters Events

John Young, Mitsubishi Power | Reuters Events

“Mitsubishi Heavy Industries has officially recognized that the energy transition is going to happen here in the United States first,” John Young, head of government relations at Mitsubishi Power Americas, said in a webinar Thursday organized by Reuters.

“The center of excellence in the energy transition is going to move from Japan to the U.S,” Young continued. “That’s a big deal for our company here in the U.S. because we now get the full weight of our parent company’s resources.”

The IRA’s multiple and expanded tax credits will provide significant benefits to the company’s energy storage projects as well as its solar development business, and the credits can be stacked, he said.

Among them is a 30% solar investment tax credit for projects through 2025. And projects that can certify that steel and manufactured components were made in the U.S. can qualify for an additional 10% credit. Another tax credit is available for projects located in a community that previously relied on fossil fuel generation, Young noted. The IRA also has expanded the production tax credit, he added, providing additional support for solar projects alone.

Storage, whether battery for short term or hydrogen for longer term, such as seasonal use, are also provided new tax credits under the IRA.

“Under the IRA, this investment tax credit was increased 30% over 10 years. And importantly, standalone storage now qualifies as eligible. Like the other credits, this ITC also includes that 10% bonus credit for energy communities and domestic content.”

The bottom line, he said, is that the credits are “technology neutral,” making it easier for companies like Mitsubishi to innovate and bring new technologies to market quickly.

“That we can choose between the investment tax credit and the production tax credit for both the long-duration energy storage and the production of hydrogen really blows the doors off this whole tax regime and allows hydrogen the flexibility it deserves.

“The IRA represent a clear recognition by Congress that if the U.S. is going to lead the world in the energy transition, it needs carrots and sticks and foundational change in the way our federal tax code works.

“We see this change as leveling the playing field for all technologies to have the same shot, same goal — net-zero greenhouse gas emissions — and it doesn’t matter whether [it’s] from wind, solar, geothermal, hydrogen or space lasers, as long as you are generating energy with net-zero emissions.”

Michael Ducker, Mitsubishi Power | Mitsubishi Power

Michael Ducker, Mitsubishi Power | Mitsubishi Power

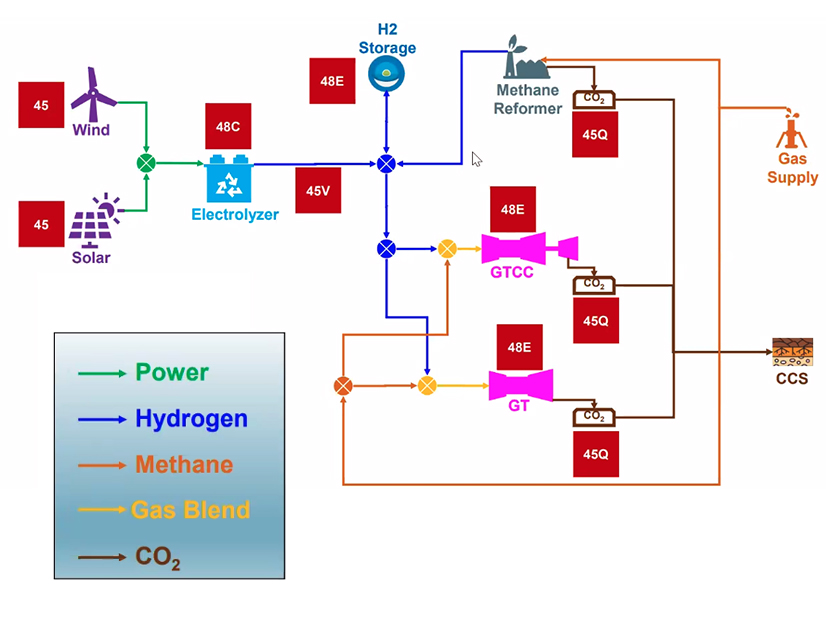

The company began a massive project in Utah that will power an electrolyzer with renewable power to produce green hydrogen that will be stored in massive salt caverns as a fuel for combined cycle gas turbines when demand outstrips available renewable power. (See The Growing Inevitability of Hydrogen.)

The ACES Delta Project will produce 100 metric tons of hydrogen per day with 220 MW in Delta, Utah, said Michael Ducker, vice president of hydrogen production for Mitsubishi Americas.

In 2019 when the company began the project, there was no discussion of hydrogen hubs, Ducker said. “We actually had folks tell us when we were investing in the project that it was a science project; that we were throwing money away,” he said.