Dominion Energy Virginia’s (NYSE:D) new integrated resource plan anticipates continued development of solar, wind and storage and — much to the dismay of environmental groups — 970 MW of new natural gas capacity.

The company on Monday submitted its integrated resource plan to the State Corporation Commission, along with a planned rate cut.

“These plans demonstrate that solar, wind and storage will be the majority of the company’s generation development over the next fifteen years,” the IRP said. “Until new zero-carbon dispatchable generation options are developed or reach commercial viability, gas units are among the most affordable and reliable options for new generation that can quickly adjust output with changes in intermittent output.”

Reactions to the IRP

Gov. Glenn Youngkin (R) said the IRP shows the value of the kind of “all of the above” energy plan he supports.

“Virginia’s economy is growing, and the accelerated electricity demands of Virginia’s industrial users demonstrate the need for a more realistic and judicious approach to power planning,” Youngkin said in a statement. “We support an all-of-the-above approach that embraces the use of innovative generation technologies to bring more capacity online, while also thoughtfully managing the retirement of existing generation capacity to satisfy the growing needs of the commonwealth.”

Demand is projected to grow at 5% per year, which exceeds the expectations from when the 2020 Virginia Clean Economy Act (VCEA) passed. With PJM expecting retirements will outstrip new supplies in the coming years, Youngkin said “it would be a huge mistake” to retire baseload generation without a plan to replace it.

Advanced Energy United criticized the utility and its IRP for going against the intent of the VCEA, which is supported by the trade group’s members.

“We have seen this play from Dominion before. Its latest resource plan is yet another example of this utility picking a forecast that suits its business interests,” AEU Policy Director Kim Jemaine said in a statement. “Dominion chooses a questionable energy load forecast as justification for cherry-picking preferred technologies, preserving existing fossil-fuel facilities and calling for new investment in gas fired resources. In our view, Dominion has not developed a good faith decarbonization plan that fully aligns with the Virginia Clean Economy Act.”

VCEA was already designed to maintain reliability by relying on proven technologies and not requiring the retirement of natural gas until 2045, giving Virginia plenty of time to make the transition to 100% clean energy, Jemaine said. AEU wants Dominion to find ways to maximize the role of efficiency, demand response, smart rate design, rooftop solar and more technologies to rein in increasing demand.

“There are so many reliable and low-cost technology solutions to meet growing electricity demand, but they are largely absent from this new plan,” Jemaine said. “Instead, the utility is planning to preserve — even expand — natural gas-fired generation as a benefit to its shareholders, at unnecessary cost to Virginia consumers. This is a risky bet given volatile gas prices.”

The Integrated Resource Plan

Dominion’s IRP details ways the firm can meet its customers’ growing needs over the next 15 years — not an application to build specific projects, but a long-term planning document based on current technology and market information and projections.

Demand is expected to grow significantly faster over the next 15 years compared to the last as Dominion’s territory in Northern Virginia is home to a rapidly growing data center industry, and its customers are expected to electrify new sources of demand.

The firm’s plan is to continue developing renewable energy as required by the VCEA, while keeping most of its current power stations until the late 2030s.

“This ‘all-of-the-above’ approach ensures we can reliably serve our customers ‘around the clock,’ especially on the hottest and coldest days of the year,” Dominion Energy Virginia President Ed Baine said. “Our plan balances the benefits of renewables with the reliability of ‘on-demand’ power so we can meet the growing needs of our customers.”

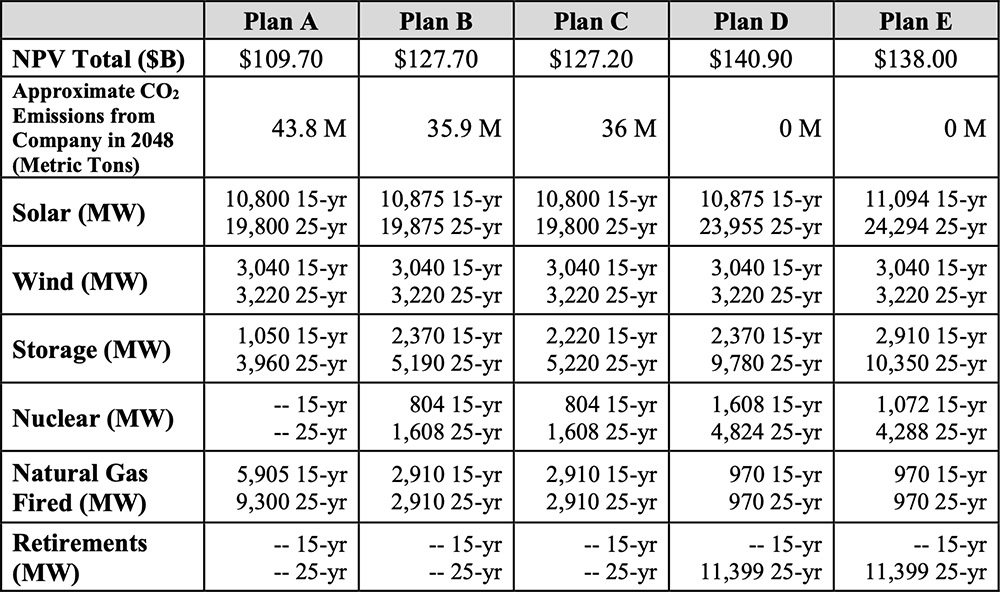

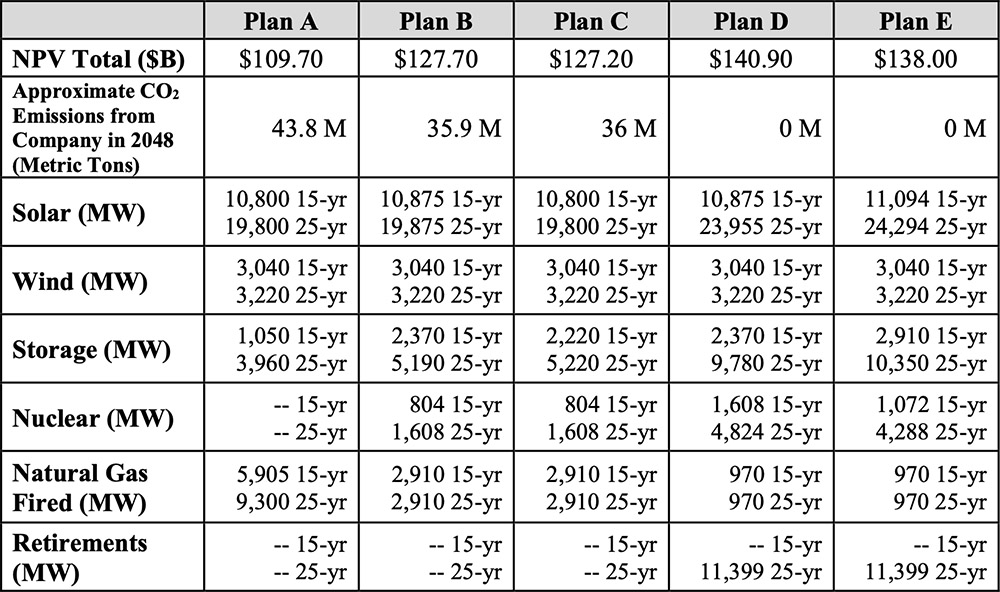

The firm offered five long-term “alternative plans” that it said were developed using constraint-based, least-cost planning techniques and proven technologies:

Plan A is a low-cost alternative that will meet applicable carbon regulations and the mandatory Virginia Renewable Portfolio Standard (RPS), but does not meet the VCEA’s targets for solar, wind and energy storage. Dominion does not view it as a true path forward as it fails to meet state policies, but it noted that even without retiring most of its existing units, it still needed to construct significant new resources to meet demand. The utility forecast a net present value (NPV) of $109.7 billion for Plan A.

Alternative B is similar to A, but it meets the VCEA’s procurement goals and adds another 2.9 GW of combustion turbine generation, 19 GW of additional solar, 2.6 GW of additional offshore wind, 600 MW of onshore wind, 5.1 GW of storage, and 1.6 GW of small modular reactors (SMR). Even with the additional generation, Dominion would have to increasingly rely on imports, with plans to buy 4 GW from the market starting 2041 and beyond, requiring additional transmission. (NPV: $127 billion.)

Plan C is similar, but Dominion ignored VCEA requirements for in-state renewables. (NPV: $127 billion.)

Plan D leads to zero emissions as Dominion retires all carbon-emitting generation by the end of 2045. Plan D includes additional procurements to make up that gap with 3.4 GW of incremental solar, 4.6 GW of storage and 3.2 GW of SMRs. (NPV: $140.9 billion.)

Plan E is similar, but like Plan C it ignores the locational requirements of the VCEA. (NPV: $138 billion.)

“Plan D results in the company purchasing over 10.8 GW of capacity and 13 GW of energy in 2045 and beyond, raising concerns about system reliability and energy independence, including reliance on out-of-state capacity to meet customer needs,” the IRP said. “In addition, there is no guarantee that other states will maintain dispatchable generation that will be available for purchase when the company needs incremental power.”

All the plans show that a growing capacity and energy need will require a diverse mix of resources and an increased reliance on market purchases, even under normal weather conditions and with few retirements.

Short-term Plan

Because the longer-term plan is full of uncertainties around technology and other issues, the IRP also included a short-term action plan for the next five years. Dominion said it plans to continue developing solar, onshore wind and storage while completing the Coastal Virginia Offshore Wind project on schedule by 2026.

The firm also plans to continue its efforts to get a license extension for the North Anna Nuclear Plant, developing 970 MW of new gas-fired combustion turbines; start development of a “backup” LNG facility to support reliable operations of its natural gas plants, and continue compliance with both North Carolina’s and Virginia’s environmental laws.

The Chesapeake Climate Action Network (CCAN) also panned the IRP. “Included in the IRP is a push for small modular reactors, a new nuclear reactor prototype that costs up to $10 billion each at a nameplate capacity of 300 MW of electricity and is currently operational only on one floating barge in Russia. A solar facility costs 3% as much per megawatt of nameplate capacity,” the group said.

CCAN also criticized Dominion for considering scenarios in which it would abandon the VCEA’s goals. “All iterations of the IRP assume that Virginia will exit the Regional Greenhouse Gas Initiative by 2024, despite a lack of legal authority for Virginia to do so without the approval of the legislature,” it said.

“We should recognize this unholy union between billionaire Governor Youngkin and Dominion for what it is: a corporate profit grab that would bankrupt Virginians and exacerbate climate change,” CCAN’s Virginia Director Victoria Higgins said. “The state can meet demand without compromising our clean energy goals or forcing Virginians to choose between energy and food. Suggesting new fracked gas infrastructure in 2023 is patently absurd.”

Rate Cut

The firm’s rate decrease would save the typical residential customer between $7 and $14/month because of bipartisan legislation that eliminated $350 million in riders while giving the SCC more flexibility to set its rates going forward. (See Virginia Legislature Passes Utility Regulation Bills Backed by Dominion.)

“Earlier this year we promised substantial rate relief for our customers,” Baine said in a statement. “Thanks to bipartisan legislation and broad support from consumer advocates, we are delivering on that promise.”

Dominion also asked to securitize some fuel costs so they will be recovered from customers over a longer term, which will lower monthly bills by another $7 starting July 1. The savings are partially offset by a $2.67 increase to the stand-alone transmission charge that would go into effect September 1 if approved, meaning the typical residential customer would save between $4 and $11 a month.