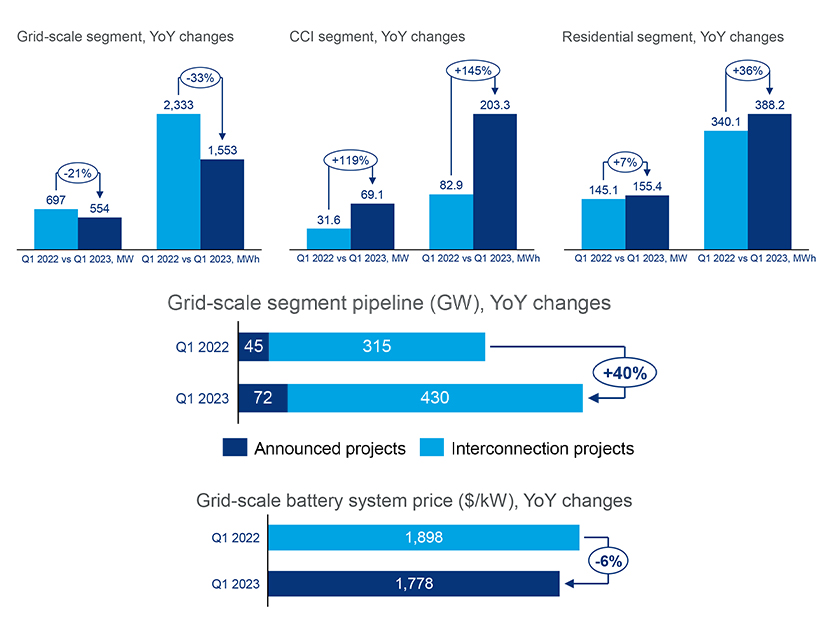

After a strong showing last year, the U.S. energy storage market shrank in the first quarter of 2023, with grid-scale installations dropping 21% year over year, according to a new report from industry analysts Wood Mackenzie and the American Clean Power Association (ACP).

Installations fell from 697 MW in the first quarter of 2022 to 554 MW this year, primarily due to a backlog of more than 1.8 GW of storage projects that were scheduled to come online in the first quarter but have been delayed by supply chain and interconnection bottlenecks, the report says.

“Late-stage projects are facing rolling delays, with 80% of delayed projects from Q4 2022 scheduled to come online in Q1 once again pushed to later quarters of the year,” the report says.

Wood Mackenzie expects about 1.4 GW of the backlog to go online in the second quarter but cautions that “volatility quarter to quarter is still strong, and additional delays should be expected.”

On the upside, the residential storage sector hit a record high of 155.4 MW deployed in the quarter, while community, commercial and industrial (CCI) installed 69.1 MW, the sector’s second highest quarter on record. Wood Mackenzie defines grid-scale as storage interconnected to the transmission system, while CCI and residential are classified as on the distribution system. All sectors have experienced supply chain and interconnection delays. (See Report: Storage Projects Stymied at Distribution System Interconnection.)

Despite the grid-scale slowdown, which Wood Mackenzie says could continue through 2024, the report still expects the U.S. to add 75 GW of storage between now and 2027, with grid-scale accounting for 81% of the total.

But will that be enough to get to President Joe Biden’s 2035 goal of a completely decarbonized grid? Probably not, said Vanessa Witte, Wood Mackenzie’s senior analyst for energy storage. Using conservative estimates, “our base case analysis projects about 65% zero-carbon electricity by 2035, not 100%,” Witte said in an email to NetZero Insider.

An August 2022 study from the National Renewable Energy Laboratory sets a much higher target for energy storage by 2035, calling for 120 GW to 350 GW of “diurnal storage” — that is, with a duration of 2 hours to 12 hours.

However, the U.S. market is also lagging on duration, a critical need for grid reliability, according to Wood Mackenzie. For example, the 554 GW of grid-scale storage installed in the first quarter can deliver about 1,553 MWh of energy, which averages out to less than 3 hours of duration. The figures for residential and CCI are similarly low.

Witte sees duration as a reflection of how storage is currently being used on the grid, which varies by geography. California and Texas dominate the U.S. market, with about 84% of grid-scale deployments, the report says.

“In California, storage is predominantly being used across the hours that are required to gain resource adequacy, which are the ramping hours between around 5 p.m. to 9 p.m. … which has driven the 4-hour durations,” Witte said. “In other markets though, such as Texas, lower durations are more typical because there is no capacity [or resource adequacy] market, so storage is predominantly used to capture price spikes. It is a purely economic play, and this does not require or incentivize more than 1-2 hours of duration.”

“Outside of California and Texas is a bit of a mixed bag,” she said. “Storage isn’t always being used for firming or resiliency purposes, which would incentivize a 4-hour or longer duration,” although storage with 4-hour duration is becoming more common, she said.

Solar + Storage

The report sees several markers for storage market growth.

The pipeline of new projects is growing, the report says. Project announcements jumped year over year, from 42 GW in the first quarter of 2022 to 75 GW this year. Similarly, storage capacity sitting in interconnection queues rose from 315 GW to 430 GW.

Costs are also coming down, the report says, from $1,896/kW in the first quarter of 2022 to $1,778/kW this year, a 6% drop. Witte said those figures represent a median, “turnkey” price that includes not only the battery packs, but the balance of system and other installation costs, minus developer and interconnection fees.

The growth of the solar market is still another driver, as more solar systems are paired with storage, Witte said.

“Solar-paired systems made up 64% and 42% of installs in 2021 and 2022, respectively, and [are] projected to be about 54% of the 2023 installs,” she said. “Each year has some amount of variation, though we do expect solar-paired systems to take up a large chunk of the installs moving forward.”

One highly uncertain variable is the energy storage supply chain — specifically, how quickly the U.S. industry can wean itself off its dependence on China for the processing of critical minerals such as lithium, cobalt and nickel — and manufacturing of storage cells and battery packs.

The tax credits and other incentives in the Inflation Reduction Act will have a “tremendous impact” on the storage supply chain, Witte said. A recent report from ACP found that 10 utility-scale battery storage manufacturing plants had been announced since the IRA passed in August.