Dominion brought in $599 million in net income during the second quarter, despite mild weather and some unexpected outages at the Millstone Nuclear Plant in Connecticut, the firm reported Friday.

While Dominion reported on some of the recent issues its business faced, it also said it is wrapping up a business review, with plans to host an investor day by the end of September laying out a new long-term plan.

“I’m pleased with the progress we’re making toward delivering a compelling repositioning of our company to create maximum long-term value for shareholders, employees, customers and other stakeholders,” CEO Robert Blue said. “As I’ve said before, I’m as excited as ever for the future of our company.”

The second quarter had some of the mildest weather Dominion has seen in half a century, enough to cut into its earnings by 8 cents/share, said CFO Steven Ridge.

“With regard to Millstone, we experienced both an increase to the duration of a planned outage at Unit 2 and an extended, unplanned outage at Unit 3, which taken together amounted to an additional 8-cent headwind during the quarter,” Ridge said. “These outages are uncharacteristic for Millstone, which has a strong history as the largest zero-carbon electricity resource in New England, exemplary safety and reliable performance.”

Dominion recently hired Eric Carr from PSEG Nuclear as its new chief nuclear officer, and senior leadership are working on a review of the plant’s operating procedures to ensure it is reliable in the years to come, Ridge added.

Dominion Virginia Power last month implemented a rate cut for customers — with the average monthly bill dropping $14 — that was authorized as part of legislation passed earlier this year in Virginia that changed how the utility is regulated. (See Virginia Legislature Passes Utility Regulation Bills Backed by Dominion.)

The firm is seeking to spread out recent unrecovered fuel costs to avoid swamping that recent rate cut with a $15/month bill increase, Blue said.

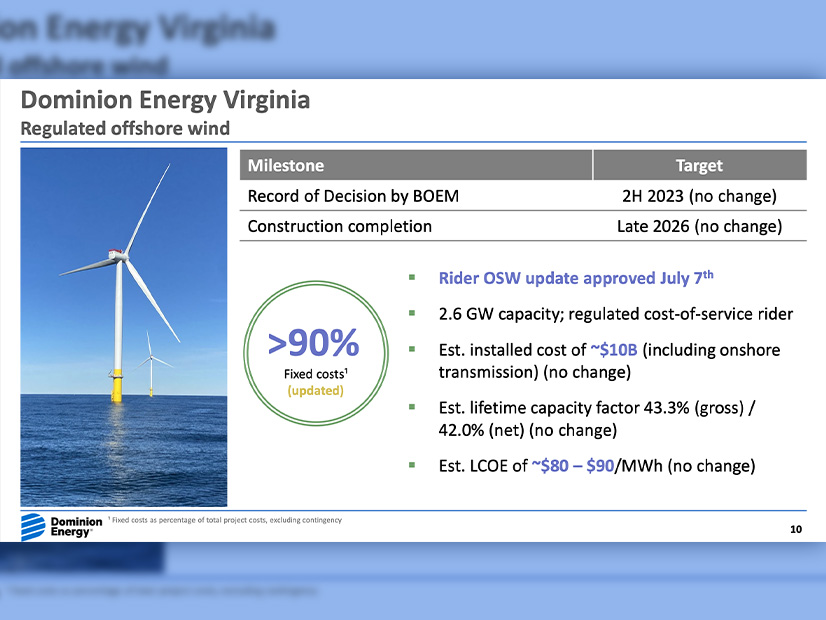

The 2.6-GW Coastal Virginia Offshore Wind project remains on track and on budget, despite some of the issues other major offshore wind developments are running into.

“We continue to work closely with the Bureau of Ocean Energy Management and other stakeholders to support the project’s timeline,” Blue said. “BOEM received comments from all agencies on the draft of the final EIS [environmental impact statement] and is on schedule to deliver the final EIS by the end of September and the record of decision by the end of October. We continue to be encouraged by the administration’s timely processing of offshore wind projects.”

The Virginia State Corporation Commission recently approved an updated rider for the project, which will pay the utility $271 million for its efforts for a year. The project’s costs, excluding contingencies, are now 90% fixed, said Blue. Procurement processes are well underway, and the first monopoles should be delivered to the Port of Virginia by the end of the year.

“Despite trends we see elsewhere in the offshore wind market, we do not see anything that changes our confidence in delivering the project on time and on budget,” Blue said.