Ørsted last week provided an outlook and an update on its place in the U.S. offshore wind power market, where great business opportunities are balanced by significant near-term challenges.

The briefing came after the world’s largest offshore wind developer reported its second-quarter/first-half financials Thursday and published its investor presentation.

In the follow-up earnings call, CEO Mads Nipper was pressed by financial analysts on the situation off the Northeast coast, focus of the first phase of what is expected to be a massive U.S. buildout in decades to come.

Ørsted has achieved some significant positive milestones there in recent months:

Federal regulators gave Ørsted final approval for Ocean Wind 1 off the New Jersey coast. And the state allowed Ørsted to benefit from tax incentives previously reserved for ratepayers when it said it needed more money to proceed with the 1.1-GW project. Nipper said this will help the company progress to a final investment decision.

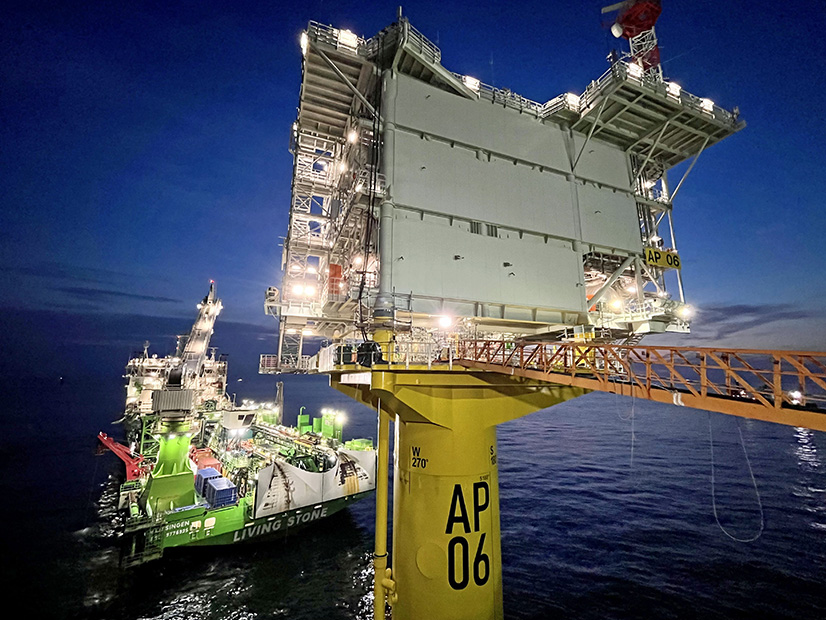

And off the Rhode Island coast, the turbine foundations and substation have been installed for South Fork Wind, which Nipper expects will be commissioned by the end of this year as the nation’s first utility-scale offshore wind farm.

But also in recent months, Ørsted has told New York it may not be able to go forward with Sunrise Wind 1 without more money.

Rhode Island shot down Ørsted’s proposal for Revolution Wind 2 as too expensive.

And New York invited Ørsted to resubmit lower bids for Sunrise Wind 2. (Other bidders in the state’s third solicitation were given the same option.)

Other developers and other states are having the same problems:

Avangrid has reached a deal to back out of power purchase agreements for Commonwealth Wind and is seeking a higher rate for Park City Wind.

Shell and Ocean Winds are trying to back out of their SouthCoast Wind PPAs.

Equinor and BP told New York they need more money to build Beacon Wind, Empire Wind 1 and Empire Wind 2.

Atlantic Shores wants the same help from New Jersey that Ocean Wind 1 received.

Developers cite surging material costs and rising interest rates. With the eventual income from these wind farms locked in place before costs started rising, the developers say they cannot obtain financing to build them.

Given this, and given that these projects each carry a price tag in the billions, the details are of particular interest to financial analysts.

Q & A

The following is a summary of some of the questions posed Thursday and Nipper’s responses.

Q: Do policymakers understand that they need to pay more to reach their offshore wind goals?

A: Generally, we are confident they will. But the challenges are not small, and it is good that the industry is showing financial discipline by pulling projects to make the point that prices need to increase and auction frameworks need to change.

Q: Is it time to rethink some of Ørsted’s final investment decisions on U.S. projects, given the stubbornness of regulators, and focus on new bids instead?

A: We are having good dialogues and see progress. So, we are still pursuing plans. We see no value in walking away from existing projects and pursuing new ones.

Q: What is your assessment of the U.S. offshore sector?

A: States’ ambitions are continually growing, and they are realistically considering what needs to happen to achieve those goals. President Biden’s target of 30 GW installed by 2030 is still within reach.

Q: What is your timeline for a final investment decision on the Northeast U.S. projects?

A: We are aiming for fourth quarter 2023 or very early 2024. We need clarity on investment tax credits for individual projects — final guidance has not been issued on domestic content. So, there is not a clear number on Revolution 1 or Sunrise 1. And we are still in discussion with New York on increasing offshore renewable energy credits for Sunrise 1, which is very important to that project moving forward.

Q: Why did New York invite developers to resubmit lower bids in the third solicitation?

A: The auction framework was quite complex, and we believe some of the other companies’ bids may not have been fully compliant. Ours was.

Q: So Ørsted is not going to rebid at a lower price?

A: We submitted a realistic bid the first time.