New York state has issued the roadmap for its first-in-the-nation school bus electrification program and is preparing to draw the first tranche from a $500 million pot of money to start carrying it out.

The $100 million announced Thursday will be enough to replace only several hundred of the 45,000 fossil-powered school buses in the state. Electric buses are quite expensive, so the state is providing substantial vouchers to help fleet operators buy them.

These early efforts are not intended to fully electrify the nation’s largest school bus fleet. Rather, the goal is for every fleet operator to gain experience with a handful of electric buses before 2027, when the sale of internal-combustion school buses will be banned in New York.

The hope also is that electric vehicle technology and grid infrastructure will evolve over the next four years to the point the lifetime cost of owning and operating electric school buses (ESBs) decreases to parity with internal combustion engine (ICE) school buses.

Then the special incentives for conversion can be reduced.

New York state in 2022 mandated the gradual conversion of the school bus fleets operated by hundreds of school districts and private contractors. It’s a step toward meeting the goals of the state’s 2019 climate protection law, protecting the health of children who ride buses and improving the air quality in neighborhoods near bus depots.

Later in 2022, state voters approved a $4.2 billion bond act for environmental projects, $500 million of which was designated for ESBs.

Other states since have enacted phase-outs of their own, but New York was first. ICE school buses will be banned from roads in the Empire State in 2035.

Program Details

ESB adoption is in its early stages.

The World Resources Institute estimates only 69,000 of the 20 million-plus U.S. children who ride buses to school each day are riding emissions-free.

New York had just 310 ESBs by the most recent count, according to the New York State Energy Research and Development Authority, which issued the ESB Roadmap in mid-September.

The roadmap guides the ESB program through 2027. It focuses on helping fleet operators afford their first few ESBs so that they, utilities and the state itself can gain experience and plan the wider buildout.

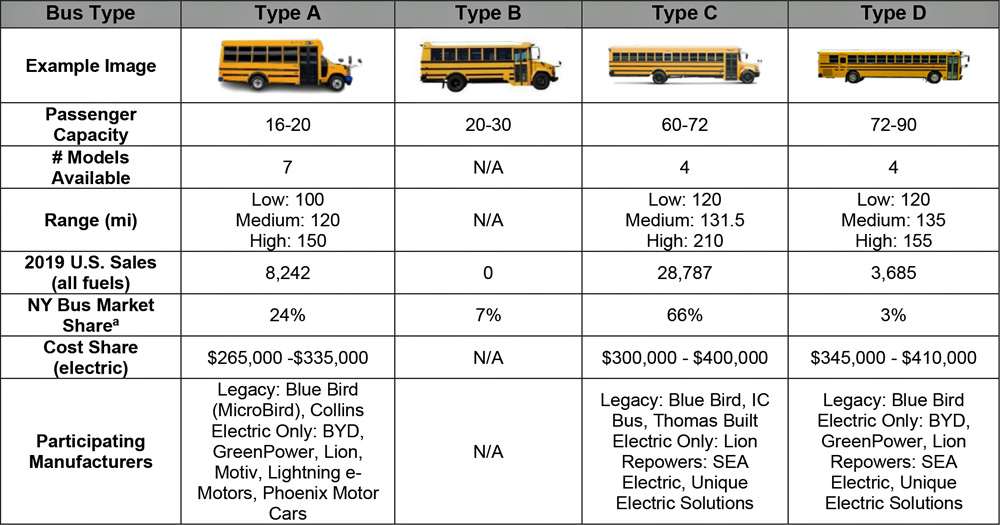

The most popular category of bus — the full-length Type C — runs in the $140,000 range with a diesel, gasoline or propane engine when purchased through one of New York’s school bus dealers. The cost jumps into the high $300s or low $400s with a battery electric drivetrain, depending on options chosen.

The base-level voucher offered by NYSERDA for purchase of an electric Type C bus in this first round of funding is $156,000. Up to $125,000 can be added through four bonuses for being a high-needs priority district, scrapping an ICE bus, adding vehicle-to-grid capacity and installing wheelchair capacity.

With the vouchers, an ESB might cost a fleet operator no more than an ICE bus.

Additional aid will be available for charging infrastructure, but that portion of the program still is being developed.

(Hydrogen fuel cell buses also will be eligible for vouchers if any come to market.)

The early stages of the program are intended to focus on easy-to-electrify routes — those that will not test the range of present-day bus battery systems.

NYSERDA hopes to have up to 3,000 ESBs on the road by 2027, which with charging equipment would represent a roughly $780 million incremental cost over 3,000 similarly sized ICE buses. State and federal funding streams are expected to cover most of the added cost.

Challenges And Opportunities

NYSERDA expects to update the ESB roadmap in 2026, by which time it hopes to better understand best practices and costs from the early adopters’ experiences.

The 2023 edition of the roadmap outlines some of the challenges facing the ambitious goals and some of the early opportunities to overcome those hurdles:

New York school buses travel an average of 80 miles a day, which is within the 100- to 200-mile range of current ESB models.

The cold winters and hilly roads in the northern part of the state could reduce range. But range is expected to improve steadily: Federal data show improvements almost every year. From 2011 to 2022, the median range of electric vehicles offered for sale in the U.S. rose from 68 to 257 miles and maximum range from 94 to 520 miles.

The cost of ownership is something of a three-dimensional chess game. Upfront costs for ESBs are higher but maintenance costs are lower. To recoup the upfront cost, the service life must be maximized. ICE school buses average only 8.9 years on the road in New York — many are retired in good working order because of rust. So, it is best to use an ESB on longer routes to maximize return on investment — but not so long as to risk a dead battery.

Outside New York City, 96% of school buses are parked an average of 12 hours overnight every night — a long, predictable period ideal for a slower Level 2 recharge, when time-of-use rates are lower. More than half of New York’s school buses also are parked for four or more midday hours, presenting a window for a partial Level 2 recharge or more-complete Level 3 recharge.

Charger costs can range from $5,000 for a Level 2 unit to $100,000 for a Level 3 unit. Ideally, there is one plug per bus, but some fleet operators have found success with a combination of Level 2 and Level 3 chargers that add up to less than one plug per bus.

Recent problems for early adopters center on limited selection and availability — ESB manufacturers need clearer signals on market demand.

Future constraints as the 2027 and 2035 deadlines approach may include domestic content requirements, shortages of skilled labor for installation, permitting delays and extended timelines for transmission infrastructure upgrades.

Most school bus depots across the state lack the electrical capacity to charge more than a few buses, and many are in areas with limited grid capacity. There is no comprehensive database showing where these depots are and how many buses typically are parked there.

But the state Public Service Commission in April 2023 launched a planning process to address the charging needs of the medium- and heavy-duty vehicle sector.

Beyond the initial stages, electric infrastructure may range from 15% to 30% of the total cost of fleet electrification. This will be closely monitored.

Only 11% of fleet operators surveyed have assessed the electrification needs of their depots and their bus fleet.

With current technology limitations, fossil-fired cabin heaters may be needed for winter operation in the first generation of ESBs — battery-powered heaters would further limit mileage range already diminished by cold weather. This is counter to the whole point of bus electrification, but heaters can be turned on or off as needed while the bus is rolling, unlike the engine in an ICE bus.

Finally, the state has potentially put itself in a bind when it comes to paying for all of this.

NYSERDA expects the incremental costs of the first wave of ESBs — the 3,000 it hopes to see on the road by 2027 — will be covered by federal funds, utility incentives and the $500 million from the bond act.

That leaves 40,000 more electric buses to be purchased over the following eight years, and an untold number of megawatts of charging infrastructure to be installed. Whatever the eventual savings turn out to be, the up-front cost will be greater — high enough in some cases to cause sticker shock.

Public school budgets are subject to voter approval in New York state, as are supplemental capital spending proposals such as for a new building, roof replacements, a dozen electric school buses or rewiring a bus depot.

NYSERDA will help educate school district administrators and the public about the cost-benefit relationship in this conversion, and suggests districts conduct voter outreach of their own.

The state will focus its support of electrification in historically environmentally or economically burdened areas and those that are most at risk from transportation emissions.