California regulators are considering a package of changes to the state’s low-carbon fuel standard, including measures to shore up prices of LCFS credits as fuel producers continue to generate excess credits.

The California Air Resources Board (CARB) is weighing the possibility of a one-time “stepdown” of the carbon intensity (CI) target, a move that could increase the demand for credits.

In addition, the agency is looking at a so-called auto-acceleration mechanism that would further decrease the CI target when certain market conditions are met.

CARB has been presenting the proposed changes to stakeholders during a series of recent workshops, and the CARB board received an update on the proposals last week.

The idea behind the proposed changes is to create a “steady price signal” for LCFS credits to spur ongoing investment in low-carbon fuels.

The LCFS is based on the carbon intensity score of transportation fuels used in the state, which reflects the greenhouse gas emissions of a fuel throughout its lifecycle.

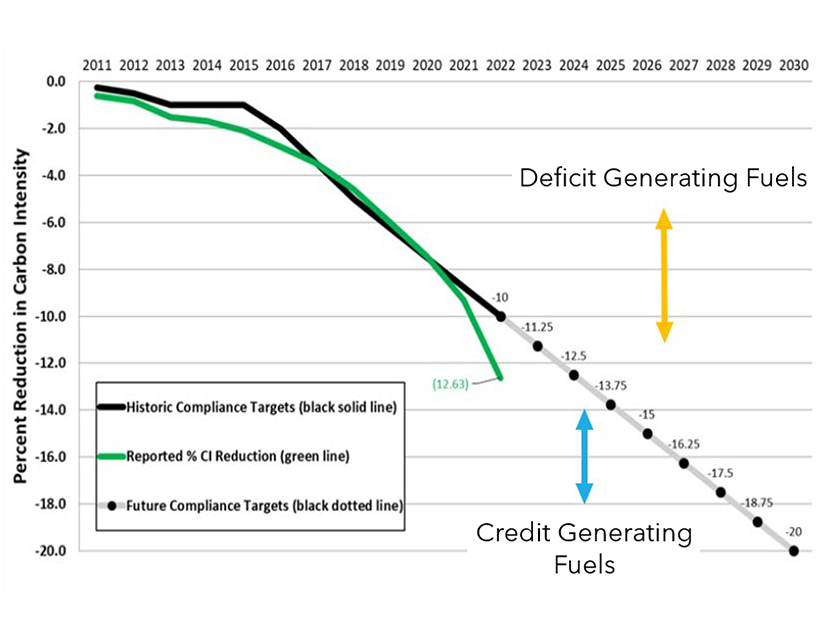

The LCFS sets a CI target that decreases each year. Fuels that exceed the CI target generate a deficit, which fuel producers must offset by acquiring credits. The credits come from fuels whose CI is below the target.

In 2021 and 2022, the LCFS program “overperformed,” as the carbon intensity of transportation fuels, on a composite level, dropped below annual LCFS targets.

That has led to suggestions that CARB set more aggressive CI targets, which would help the state meet its carbon reduction goals.

3Degrees, a climate consulting firm, has urged CARB to roll out a lower CI target starting Jan. 1, 2024.

“We are concerned that multiple millions of credits are projected to be added to the credit bank in 2023, and a significant CI reduction is needed for 2024 in order to absorb these credits and maintain a robust market that incentivizes deep transportation sector decarbonization in line with midcentury targets,” Maya Kelty, 3Degrees’ senior director of regulatory affairs, said in a letter to CARB.

Working out Details

CARB hasn’t yet released a formal rulemaking package for the proposed LCFS changes, and many details still must be worked out regarding how CI targets would be adjusted.

The magnitude of a one-time stepdown in the CI target hasn’t been decided. The stepdown, planned for 2025, would be an additional decrease in the CI target on top of the annual decreases already scheduled in the LCFS program.

CARB also is working out what would trigger an auto-acceleration mechanism to reduce CI targets. One idea is to trigger the mechanism when the ratio of credit price to credit bank size hits a certain number; another concept would rely on the ratio of total credits to total deficits.

CARB wants an auto-acceleration mechanism to be based on “well-defined, publicly available market metrics.”

Stakeholders who support an auto-acceleration mechanism include Neste US, a producer of renewable diesel.

“The record high credit bank and unexpected rapid increases in the credit bank have been key reasons for increasing unpredictability of the market and the price,” wrote Oscar Garcia, West Coast regulatory affairs manager for Neste US.

The Union of Concerned Scientists, however, said an auto-acceleration mechanism isn’t the proper solution. Jeremy Martin, a senior scientist in UCS’ clean transportation program, said the main cause of recently falling LCFS credit prices has been the surge in the use of lipid-based renewable diesel in California. Renewable diesel is made from fats and oils, such as canola oil or soybean oil.

“With [Renewable Fuel Standard and federal] tax credits, renewable diesel became an inexpensive source of LCFS compliance and flooded the market,” undermining credit prices, Martin said in written comments. He called for capping LCFS compliance from lipid-based fuels.

Other commenters raised concerns that higher credit prices resulting from a stringent CI target would be passed along to consumers of gasoline, who over time are more likely to be low-income drivers who can’t afford an EV.

Other Changes Proposed

The current LCFS regulation reduces CI targets each year through 2030, with a 20% statewide reduction by 2030 from a 2010 baseline. Proposed changes would implement further reductions from 2030 to 2045.

Another proposed change would add aviation fuel to the fuels covered by the LCFS. Jet fuel currently is exempted from generating CI deficits.

Other changes under consideration would offer LCFS credits for refueling infrastructure for medium- and heavy-duty zero-emission trucks. LCFS has supported light-duty ZEV refueling infrastructure since 2019.

CARB staff expect to release a formal LCFS rulemaking package this year, which would be followed by a 45-day comment period. The regulations would go to the CARB board for a vote early next year and potentially take effect in 2024.