The U.S. Energy Information Administration reports that fossil fuel generation retirements will slow in 2024 and that solar and storage will dominate capacity additions.

The two forecasts represent a pause and an acceleration, respectively, of recent trends.

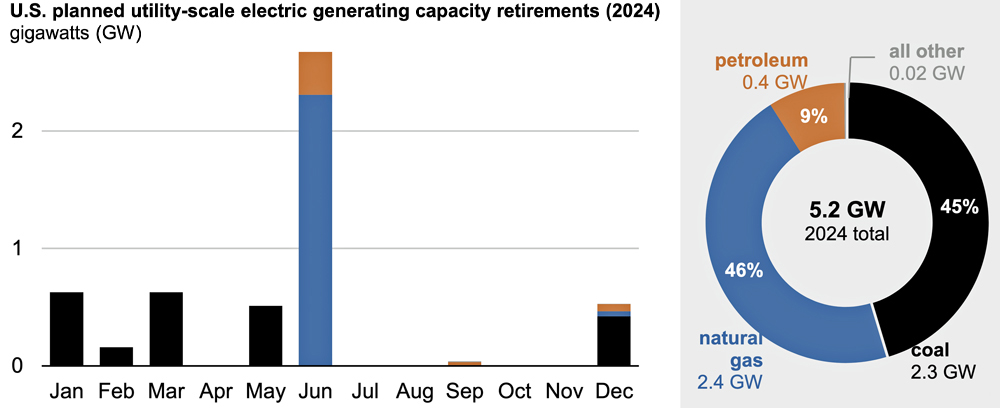

EIA said Feb. 20 that operators plan to retire 5.2 GW of capacity this year, most of it coal- or natural gas-burning plants. Coal retirements alone totaled 22.3 GW in the past two years and are expected to total 10.9 GW in 2025.

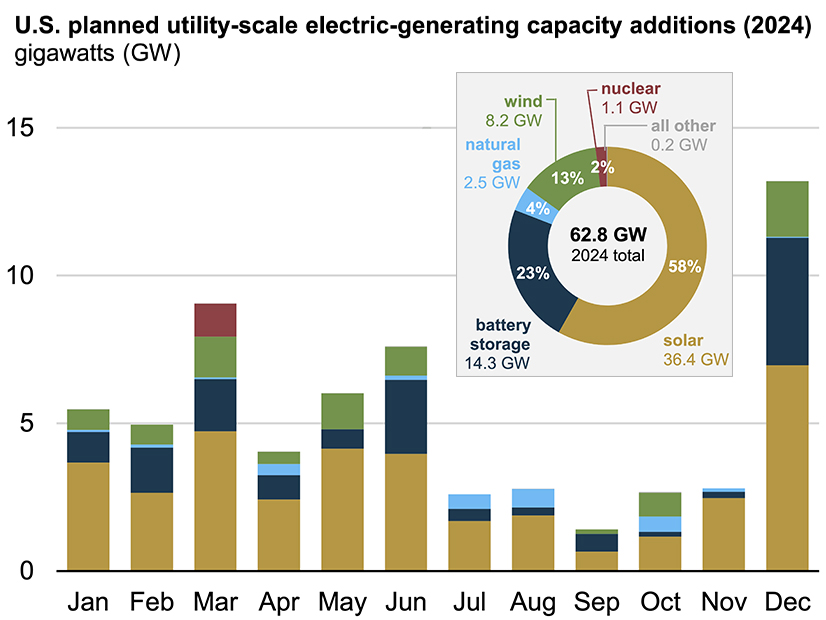

EIA said Feb. 15 that developers and power plant owners plan to add 62.8 GW of new utility-scale capacity in 2024. Almost all scheduled additions are emissions-free power sources, including a record 36.4 GW of solar. That would nearly double the 2023 total of 18.4 of new solar, which itself was a record.

Retirements

Fossil fuel generation has been retiring rapidly, so much so that some grid operators have begun issuing warnings about potential capacity shortfalls. (See NYISO to Keep Gas Peakers Online to Solve NYC Reliability Need and PJM Requests 2nd Talen Generator Delay Retirement.)

The 5.2 GW scheduled for retirement in 2024 would be the least since 2008 and would be down 62% from 2023, when 13.5 GW was retired. Forecast for retirement in 2024 are plants totaling 2.4 GW of natural gas, 2.3 GW of coal, 450 MW of petroleum and 20 MW of other power sources.

The largest gas retirement will be the last six units (1,413 MW) at the Mystic Generating Station outside Boston, one of the nation’s oldest power plants. The other large gas retirement scheduled is TVA’s Johnsonville station (754 MW).

The largest coal retirements will be Seminole Electric Cooperative’s Unit 1 in Florida and Homer City Generating Station’s Unit 1 in Pennsylvania, both 626 MW.

Almost all of the petroleum-fired capacity retirement will be at TVA’s Allen plant, which has 20 old combustion turbine units totaling 427 MW.

Construction

EIA forecasts heavy growth in renewable energy development in 2024 — particularly in photovoltaics, which is outstripping other generating resources as supply chain challenges and trade restrictions ease.

The planned additions break down to 36.4 GW of solar, 14.3 GW of battery storage, 8.2 GW of wind, 2.5 GW of natural gas and 1.1 GW of nuclear, plus about 200 MW from other sources.

Slightly more than half the nation’s 2024 utility-scale solar construction is planned in three states: Texas (35%), California (10%) and Florida (6%). Elsewhere, the nation’s largest single solar project — the Gemini facility in Nevada, with 690 MW of solar capacity and 380 MW of battery storage — will start to come online this year.

Battery construction also could set a record: 14.3 GW of grid-scale storage capacity added in 2024 would nearly double the installed capacity nationwide, which stood at 15.5 GW at the start of this year. The heaviest battery development is expected to be in the states with the heaviest solar development: Texas (6.4 GW) and California (5.2 GW).

Wind energy is the outlier in the report. Wind capacity addition has slowed after record construction of 14 GW-plus in both 2020 and 2021. The big news in U.S. wind energy in 2024 is likely to be the Vineyard Wind (800 MW) and South Fork Wind (130 MW) projects, the nation’s first utility-scale offshore wind farms. Both are nearing completion off the Northeast coast.

The 2.5 GW of natural gas additions planned in 2024 is the lowest total in a quarter-century. Also notable: 79% of the gas capacity added in 2024 will be simple-cycle turbines, which can start up and ramp up or down relatively quickly to support the grid at times of fluctuating demand or faltering supply from wind and solar generation. This will be the first year since 2001 the slower but more efficient combined-cycle turbine technology did not account for most capacity additions.

Finally, start-up of the fourth reactor at the Vogtle nuclear plant in Georgia, originally scheduled for 2023, now is slated for 2024.