NV Energy will commit to joining CAISO’s Extended Day-Ahead Market (EDAM), sources have told RTO Insider, a move that will end months of speculation among Western electricity sector stakeholders about whether the Nevada utility would choose EDAM over SPP’s Markets+.

The utility plans to make its intent public May 31 when it files an integrated resource plan with the Public Utilities Commission of Nevada, multiple sources closely involved with market developments in the West said.

NV Energy did not respond to a request for comment on the matter, a topic of increasing interest in the region, with multiple sources recently telling RTO Insider that the utility has been revealing its decision in favor of EDAM in private meetings. An NV Energy executive offered the clearest public signal yet on the utility’s leaning during a May 22 joint session of the CAISO Board of Governors and Western Energy Imbalance Market (WEIM) Governing Body. (See Is NV Energy Leaning to CAISO’s EDAM?)

The selection still must be approved by the PUCN. A 2021 Nevada law requires the utility to join an RTO by 2030, with the decision subject to approval by the commission, which has been hosting workshops exploring the two day-ahead market options in the West as part of its RTO proceeding. (See Nevada RTO Proceeding Examines EDAM, Markets+ Design.)

At one of those workshops, the Brattle Group presented data showing NV Energy stood to gain $62 million to $149 million in annual economic benefits from joining the EDAM, while it stood to lose as much as $100 million from withdrawing from CAISO’s Western Energy Imbalance Market (WEIM). The results of joining Markets+ ranged from a loss of $17 million compared with the status quo to a benefit of $16 million. (See Nev. RTO Effort Turns Focus to NV Energy Day-ahead Studies.)

Big Win for EDAM

NV Energy’s decision spells a major victory for the EDAM in its ongoing competition for members with SPP’s Markets+ day-ahead offering.

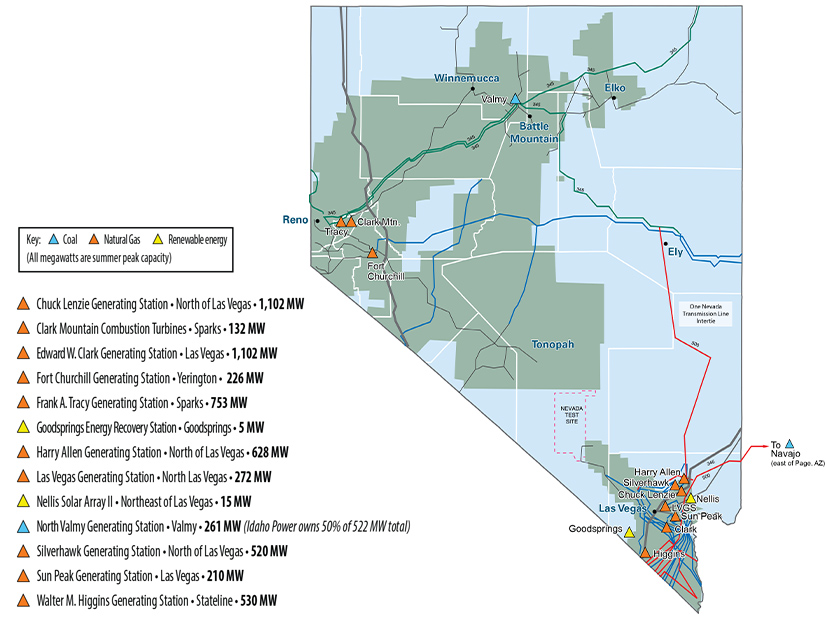

The utility serves the majority of Nevada’s electricity users and is the balancing authority for the state. Its control area occupies a central position in the WEIM, functioning as the primary wheel-through point for energy transfers between the WEIM’s California participants — including the ISO — and PacifiCorp’s sprawling balancing authority area in the inland West.

PacifiCorp in April became the first entity to agree to sign an implementation agreement for the EDAM, sealing its participation in the market. (See PacifiCorp Fully Commits to CAISO’s EDAM.)

NV Energy’s membership in EDAM also would be consequential for Markets+ because the utility’s BAA sits between the territories of the entities that have shown the most interest in joining the SPP-run market, including the Bonneville Power Administration and Puget Sound Energy in the Northwest, and Arizona Public Service, Salt River Project and Tucson Electric Power in the Desert Southwest. The inclusion of Nevada’s transmission network in EDAM would limit the ability of those entities to transfer energy among each other in a geographically divided Markets+.

The decision also is significant for the West-Wide Governance Pathways Initiative. Backers of that effort in April issued a proposal to make stepwise changes to the governance of the WEIM/EDAM, with the objective of eventually putting the market under the authority of an independent “regional organization” after seeking changes to California law related to CAISO. (See Pathways Initiative to Act Fast on ‘Stepwise’ Governance Plan.)

But step 1 in that proposal entails elevating the “joint” authority the WEIM’s Governing Body currently shares with CAISO’s Board of Governors over WEIM matters to “primary” authority. Under the plan, the ISO would pursue that change with FERC only after the EDAM secures implementation agreements with a “set of geographically diverse” WEIM participants representing load equal to or greater than 70% of CAISO BAA annual load in 2022. With commitments from PacifiCorp, Balancing Authority of Northern California, Idaho Power, Los Angeles Department of Water and Power, and Portland General Electric, NV Energy has been cited by Pathways supporters as the entity needed to trigger that move.

NV Energy’s filing with the PUCN on May 31 will coincide with a monthly meeting of the Pathways Initiative’s Launch Committee, at which the committee is expected to vote on adopting step 1 of the governance proposal.