An autonomous underwater vehicle will soon slip out of sight off the north California coast, mapping thousands of acres of seabed as a first step toward construction of the floating wind farm envisioned there.

The data gathered in the coming months will give a better picture of the ecosystem in the lease area and any obstacles, hazards or sensitive sites that lurk a half mile or more below the surface. And it will inform RWE when it puts together a construction and operation plan for the 1.6-GW project it has named Canopy Offshore Wind Farm.

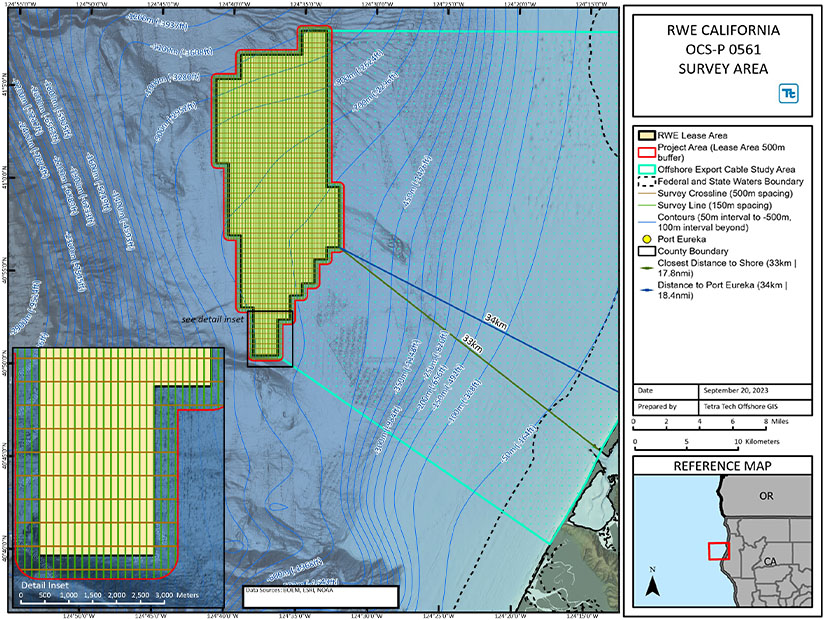

The site characterization surveys are similar to the early-stage work the German company has done for its 19 existing offshore wind facilities with one key exception: Lease Area OCS-P 0561 is 1,760 to 3,400 feet deep.

RWE has contracted with Norwegian firm Argeo to survey the depths with one of the fluorescent-painted uncrewed micro-submarines that it also uses for offshore oil, gas and mineral applications. It will arrive on site this month.

A third of a century after the first commercial offshore wind farm came online, more than 70 GW of capacity is installed worldwide, almost all of it firmly affixed to the seabed with a rigid foundation in shallow water.

RWE is one of many companies and governments trying to extend the success of fixed-bottom wind to floating wind in deeper water — it launched a 3.6-GW tubular steel demonstrator off Norway in 2021 and a 2-GW twin-hull concrete demonstrator off Spain in 2023.

RWE is preparing proposals in France, Norway and the United Kingdom, but it expects Canopy Wind to become its first operational floating farm sometime in the mid-2030s.

Project Director Rob Mastria spoke to NetZero Insider on June 13 with a look at what is ahead.

The underwater work starts this month with the geophysical survey.

The autonomous underwater vessel glides about 130 feet above the seabed, using sonar to avoid obstacles and using a digital camera to make a photographic mosaic of the environment where the turbines would be moored and where the export cables would run.

The geotechnical survey gets right down to the bottom, using equipment that collects sediment samples and biological information.

Subsequent research and design work will build on the results of these two surveys.

Back on land, different work is being done.

“We need to really have two major focus areas,” Mastria said. “The first is building relationships and collaborating with the local community in the Humboldt area and tribal nations, trying to make sure we develop those points of connections and relationships so that we can share information back and forth. The second pillar is really working on the market development in California.”

As elsewhere, there has been pushback against offshore wind on the West Coast because of feared impacts on the scenery and fishing industry, and developers are working to overcome this. They also need to help create a supporting industrial and infrastructure ecosystem that does not now exist. (See West Coast OSW Will Require Robust Supply Chain.)

RWE, which bid $158 million for its 63,338-acre California lease in a 2022 auction, looks internally and externally to build the confidence to make these investments, Mastria said.

“It’s a combination of believing in floating, knowing that there’s vast opportunity in the future for it because there’s only so much area in shallow water depths that can be used, but it also comes down to what I’ll call market signals,” he said.

“We have a federal policy of wanting to have 30 GW of offshore wind by 2030. California has its own state targets for offshore wind, 25 GW by 2045.”

He added: “California has always been a leader in the climate change space and wanting to really incorporate renewable energy into the grid there. This is a technology that can play a major role in helping California meet its clean energy goals.”

The long development timelines for Canopy and wind farms in the four other lease areas along the California coast give some room to prepare the transmission, manufacturing, workforce and port facilities needed for the new industry, Mastria said.

The company has already taken steps in that direction: The protected species observer training program it put together graduated a class of 19 area residents in April. These people or others certified in the task will be on duty on vessels around the clock while underwater survey work is in progress, watching for marine mammals in the vicinity.

RWE is the only wind power developer to hold leases off all three mainland U.S. coasts: Atlantic, Pacific and Gulf of Mexico. The underwater, political and market conditions are different in each, just as fixed-bottom and floating wind are different from one another, creating three distinct sets of hurdles to clear.

But RWE frames the question as how to build a wind farm, Mastria said, not whether it is possible.

“We have a ton of experience, and we know that this works,” he said. “We have, in addition to our projects, a global floating team. So that’s a team that focuses on advancing floating technology, doing assessments to monitor the state of the market and how the technology solutions are developing.”

Mastria has worked 16 years in the renewable energy industry, the past four of them in offshore wind. Notably, he was project development director for New York’s South Fork Wind, which this year became the first utility-scale offshore wind farm completed in U.S. waters.

South Fork is a bright spot in the Northeast offshore wind industry, where most projects have canceled contracts or been canceled altogether since early 2023 due to rising costs and supply chain constraints.

Most of the affected Northeast proposals remain in active development, but advancing to construction will take longer and cost more, in most cases.

Among the casualties has been Community Offshore Wind, RWE’s two-phase joint venture with National Grid Ventures.

In the past 12 months:

Community’s 1.3-GW Phase 1 contract with New York had to be spiked when General Electric halted development of an 18-MW turbine. (See NY Offshore Wind Plans Implode Again.)

New York “waitlisted” the 1.3-GW Phase 2 proposal so the state could concentrate on getting two mature projects back into the pipeline after they balked. (See Sunrise Wind, Empire Wind Tapped for New OSW Contracts.)

The partners withdrew a 1.3-GW proposal in New Jersey when the financials did not pencil out. (See NJ Awards Contracts for 3.7 GW of OSW Projects.)

A recurring theme in the early stages of West Coast offshore wind development has been the need to avoid the setbacks seen on the East Coast. (See Strategy Offered for Success of Future West Coast OSW Sector.)

Mastria offers the same message.

“One of the things that I try to do is bring the experience from what has been done on the East Coast to try to make sure that the way we set up how offshore wind will work on the West Coast learns from those experiences on the East Coast and smooths the way based on the experiences that the industry has had,” he said.