MISO’s second, mostly 765-kV long-range transmission plan could tip past $25 billion with the addition of more projects, stakeholders have learned.

RTO staff said its “near-final” second long-range transmission plan (LRTP) stands between $23 billion and $27 billion, up from the original range of $17 billion to $23 billion. The grid operator plans to submit the portfolio to its Board of Directors for approval in early December.

“That is currently where we’ll think we will land, including underbuilds,” Director of Economic and Policy Planning Christina Drake said of the cost during a teleconference June 21. The proposed portfolio will require “underbuilding,” or secondary, lower-voltage transmission upgrades to support a 765-kV network in the Midwest region. MISO is still finalizing its list of underbuild projects. It also has yet to translate its reliability and economic analyses into a business case for the second LRTP portfolio.

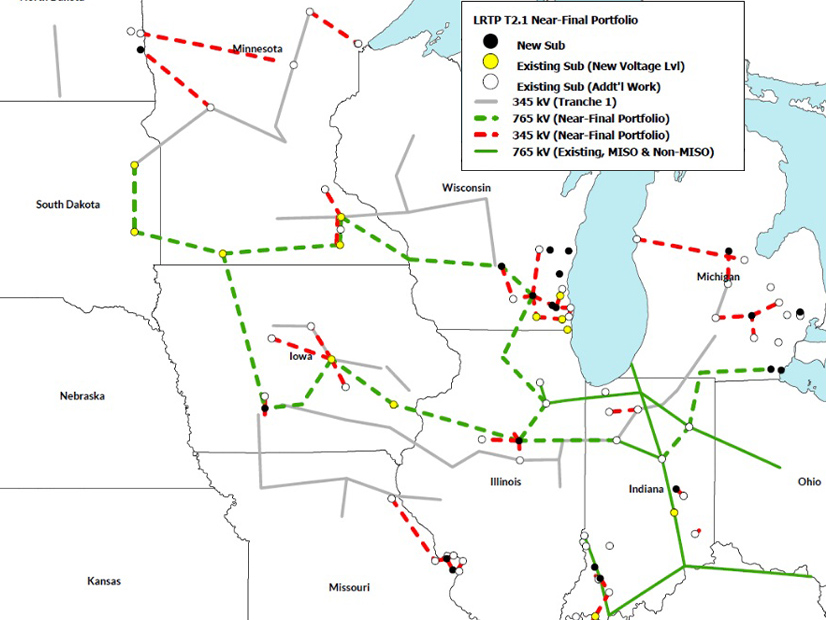

MISO last month said it would add seven 765- or 345-kV projects in the Dakotas, Minnesota, Michigan, Indiana and Iowa and replace an original 765-kV project in Missouri and Iowa with segments of 345-kV line in the St. Louis metropolitan area. (See “MISO Undeterred, Plans More LRTP Projects,” MISO IMM Knocks LRTP Benefit Calculations; RTO Poised to Add More Projects.)

“We’re in some of the final stages here of economic and reliability robustness testing,” Drake said.

MISO’s analyses so far indicate that with the second, expanded portfolio, its Midwest region reduces curtailments by 8.5% annually — or by 20.4 million MWh — by 2042. Reductions in curtailments should assist fleet evolution, the RTO said. They should also reduce adjusted production costs by allowing the dispatch of the most economical units.

RTO staff said the portfolio would allow more generation dispatch from its West region to flow east to population centers. MISO’s analyses showed the portfolio “enables and incentivizes” energy deliveries from renewable sources in Minnesota, the Dakotas and Wisconsin, which will cut down on price separation in the Midwest region.

MISO said it expects LRTP II to overall reduce the cost to serve load in the Midwest by the early 2040s. While the Central region could save $2.20/MWh and the East region $.70/MWh, costs could rise at times in the West region, which will export more often.

The RTO also said the portfolio would reduce congestion to improve existing transmission limits, especially in its Central and East planning regions.

Some stakeholders said the savings seemed underwhelming for the scale of the proposed 765-kV network.

MISO Senior Expansion Planning Engineer James Slegers cautioned stakeholders that when more generators can deliver output, the greater volumes will likely aggravate congestion on other flowgates. The RTO said it plans to address congestion shifts through the underbuild process or through its next LRTP portfolio.

The RTO is planning to debut a second part of the portfolio that proposes more projects for MISO Midwest.

Drake said MISO is aware that the $25 billion portfolio would not enable all new deliveries of generation the RTO expects in the next 20 years.

“That’s why we’re taking this in two slices,” Drake said. She said the second part will be considered a separate portfolio and able to stand on its own merits.

WEC Energy Group’s Chris Plante challenged MISO’s characterization of the second LRTP being a standalone portfolio. He likened the system to a car that needs major repairs in addition to several secondary issues.

“We need to look at all the problems of the vehicle. I appreciate MISO saying that it’s standalone, but that’s a red herring. Just say what it is: It doesn’t address all of the constraints. Let’s be honest,” Plante said.

MISO Executive Director of Transmission Planning Laura Rauch said that despite not proposing to solve all system issues with this portfolio, MISO is nonetheless demonstrating that it provides value and sustains reliability.

Drake said that without the second LRTP, curtailments, overloads and price separation will proliferate, and new resources will be prevented from connecting to an already strapped system.

The LRTP portfolio would resolve most impending thermal violations on 200-kV and above facilities in the Midwest, MISO said. But for facilities under 200 kV, it said, the second LRTP appears to solve thermal violations less consistently. Staff said some of the remaining violations are better addressed through MISO’s routine annual transmission planning or through network upgrades assigned to generators trying to complete the interconnection queue.

MISO will host another LRTP workshop July 17.