While natural gas has taken a huge bite out of coal’s share of the electric generation market in the U.S., LNG will not have the same impact globally, according to a new report from the Institute for Energy Economics and Financial Analysis (IEEFA).

That is because China, the world’s largest coal consumer, will not be replacing that domestic resource with imported natural gas, IEEFA said in its report, “LNG is not displacing coal in China’s power mix.”

“Policymakers in both LNG exporting and importing countries should approach claims about the necessity of LNG as a ‘bridge fuel’ with a high degree of skepticism,” report co-author Sam Reynolds said in a statement. “The case of China clearly shows that LNG has played a minimal role in displacing coal in the country’s largest coal-consuming sectors.”

China is the world’s largest energy consumer, with coal accounting for 55% of its primary energy demand, while natural gas, hydropower and renewables each provided 8% of primary energy consumption in 2022.

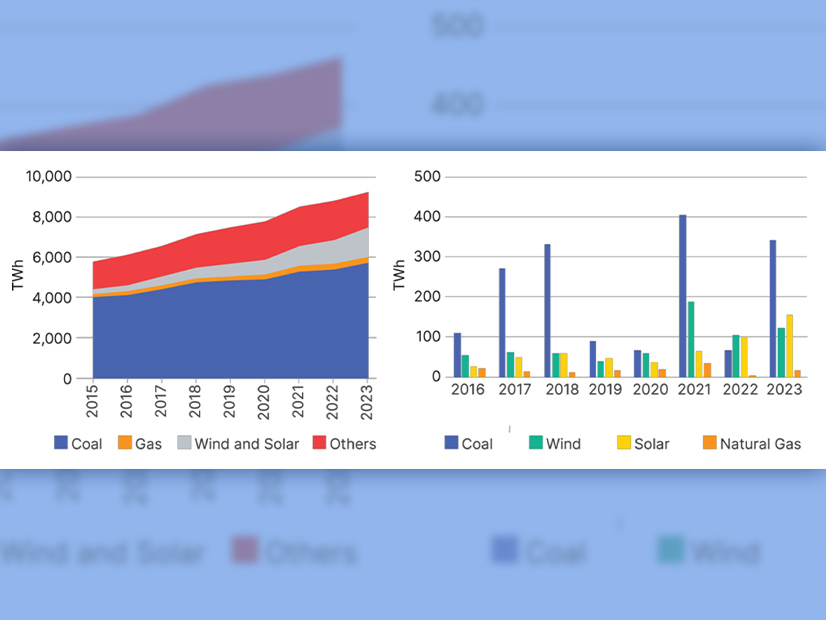

Over the past decade, natural gas’ share of generation has stayed around 3%, while renewables have grown to 16% and contributed more to coal’s falling share of generation from 70% to 61%.

“Although China is the world’s largest LNG importer, the country’s coal demand has increased more than LNG imports every year since 2017,” the report said. “Claims about the role of LNG in displacing coal usage appear to be based on hypothetical arguments that coal generation would be even higher without gas-fired power.”

While coal’s share of total generation has fallen over the last decade, its generation output has grown by 1,700 TWh, which suggests coal is not being displaced in absolute terms, while wind and solar have contributed to its decline in share of overall generation.

Recently, China even passed policies to “strictly control” coal-to-gas switching and promote domestic production of coal and natural gas.

“As a result, coal capacity additions have far outpaced additions of gas-fired power plants, and both are dwarfed by wind and solar installations,” the report said. “National energy sector development plans have called for coal plants to provide flexible operations to integrate variable renewables sources.”

LNG also costs three times as much as coal in China, so even if prices for imported gas drop as new supply comes online in the near future, those declines likely will not be enough to close the gap. China has replaced coal heating with gas heaters in urban areas, but the paper suggested that would be hard to replicate in the countryside.

China is the fourth-largest producer of natural gas, which has been growing in recent years, but it is the largest coal producer, last year hitting record production of 4.7 billion tons, 14% above 2021 levels.

China is also the largest importer of coal, with imports accounting for about 10% of supply needs.

“The country’s coal, natural gas and LNG demand have all increased since 2016,” the report said. “China consumes nearly seven times more coal than natural gas, though consumption of both fuels increased by roughly the same amount (8 exajoules) between 2012 and 2022.”

Electricity generation has grown 6.3% a year since 2013, with coal, natural gas, wind, solar and nuclear increasing every year over that time frame.

“Looking ahead, generation from coal and renewables will continue to exceed gas-fired generation, and capacity investments suggest that LNG and gas will continue to play a limited role in coal displacement,” the paper said. “In recent years, gas plant capacity additions have paled in comparison to coal and renewables additions.”

China had 1,051 GW of installed wind and solar at the end of 2023 and could hit 1,300 GW this year, beating its target of installing 1,200 GW of wind and solar by 2030. That trend has the International Energy Agency predicting the country could get 50% of its generation from renewables by 2028, while IEA’s projections for gas power are flat through 2030.