The West faces a “pivotal” opportunity to develop a fresh approach to managing its electricity markets, one that could update RTO governance to better accommodate the public policy and new technology driving changes in the sector.

That was the view shared by some stakeholders participating in a July 12 workshop hosted by the West-Wide Governance Pathways Initiative. It was the first in a series of four virtual meetings to explore how a proposed Western “regional organization” (RO) would structure its stakeholder processes after assuming oversight for CAISO’s Western Energy Imbalance Market and Extended Day-Ahead Market.

The workshops, which are being facilitated by nonprofit Gridworks, will provide a comparative examination of stakeholder processes for six RTOs and ISOs — including CAISO and SPP — and the Western Power Pool’s Western Resource Adequacy Program (WRAP) to identify the best practices to be adopted by the new Western RO.

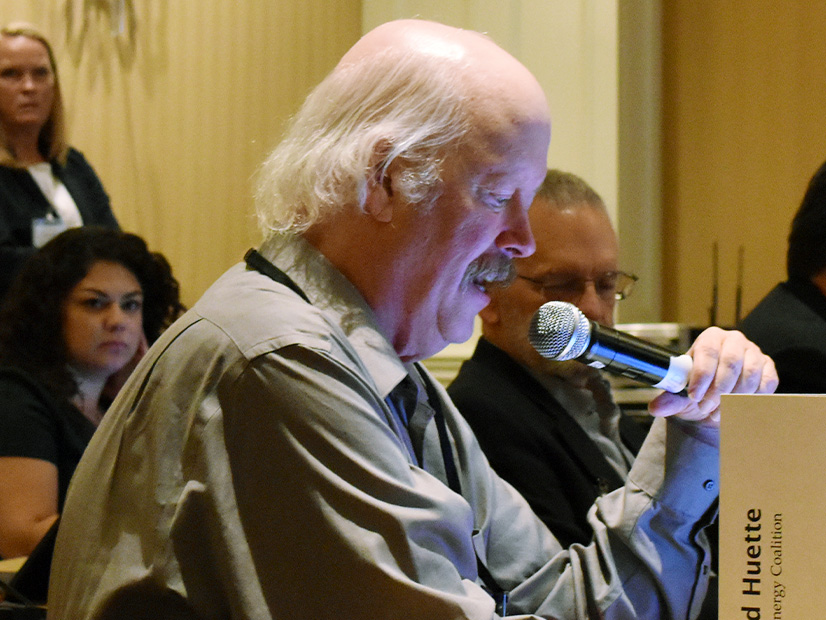

“I think we need a bit of a reset here, because in my mind, my perception of what we’re doing with the Pathways process is to change the RTO governance model,” Fred Heutte, senior policy analyst at the NW Energy Coalition (NWEC) said during the meeting.

The changes should go beyond procedural matters, Heutte said, “to reflect a new approach that combines market operations, grid dispatch and public policy, as represented primarily in state policy across all the diversity of all the different state policies across all the diverse states.”

Given that emphasis, Heutte cautioned against borrowing too heavily from processes in existing RTOs.

“The amount of friction and controversy in the East because public policy is not aligned with market design and operation — it’s been a problem for a long time, [and] it’s a growing increasingly more difficult problem,” he said.

Mona Tierney-Lloyd, head of regulatory and institutional affairs at Enel North America, “endorsed” Heutte’s comments and added that Pathways is in a “unique position relative to every other organized market” to take a “fresh view” on governance.

She said her experience participating in “several markets” across the U.S. indicates that interests representing distributed resources have been marginalized and “relegated to some sub working group that isn’t given the same kind of attention or weight … as other member classes.”

“We’re also at this really pivotal time of looking at new technologies coming online and really changing what is [recognized as] an electricity resource, looking at the distributed side of the resource equation more fully,” Tierney-Lloyd said, calling it “an opportunity to take a more modern look at the way the electricity system is changing and trying to incorporate that view into a stakeholder process.”

Brian Turner, Advanced Energy United’s director of regulatory engagement in the West, took up that theme.

“We have the opportunity to create something new that takes the best of what is and perhaps new ideas as well. Coming from a perspective of an organization that represents a lot of the new technologies that are increasingly important in the energy system, I think that that’s a perspective that is shared with nontraditional voices that have the opportunity to be represented here,” Turner said.

‘Fair Process’

Some workshop participants offered a more positive take on existing stakeholder processes in RTOs, particularly in the East.

Cathleen Colbert, senior director of Western markets policy at Vistra, said experience working in both CAISO and PJM helped her develop a “nuanced view” of the grid operators’ different approaches to stakeholder process. Colbert said she found CAISO’s staff-driven process suffers from an “asymmetry” of information and access, and while the ISO provides any stakeholder the opportunity to provide input, it has no obligation to consider that input.

“Because it doesn’t have any incentive to really engage stakeholders, because they don’t need stakeholder support to get anything through their processes and environments … there’s no incentive for them to truly be involved with their stakeholders unless you have a special relationship, unless you have figured out how to build a rapport and a relationship where you get offline access,” she said.

In contrast, Colbert finds the PJM stakeholder process, with its committee structure, to be “very open … in practice.”

“I don’t know if it’s the voting, but the PJM stakeholder process was incredibly collaborative and inclusive, versus the CAISO one, [which] is very, very hard for stakeholders to actually participate in meaningfully,” she said.

Heutte said CAISO’s stakeholder process is not perfect but has provided him “a relatively easy” way to submit his input on issues, while he thinks SPP’s “well structured” approach can be “very isolating.”

“If you’re not a formal member of a committee, then you’re really not treated as others are,” he said. “And it’s not just about the voting; it’s also about who gets recognized for speaking; it’s about the weight that your comments get, if you’re not a formal member of that group.”

Ryan Millard, senior director of West region regulatory and political affairs at NextEra Energy Resources, said “having a discussion at some point about the nuances of each process will be valuable, because maybe one process is more responsive in practice than another.”

“I think having some discussion with folks that are familiar with PJM, SPP and other RTOs can kind of marry up the practical realities of how this structure actually works, and how responsive it is,” Millard said.

Scott Miller, executive director of the Western Power Trading Forum, noted that some stakeholders see efficiencies in the “top-down” approach of CAISO’s stakeholder process, while others see benefit to the “bottom-up” approach they’ve experienced in SPP’s Markets+ and in some Eastern RTOs.

“The struggle, I think, is how we can get something that’s very efficient, but one in which people feel it’s transparent, they’ve got equal access, and it’s a fair process,” Miller said.

Huette expanded on that idea.

“It’s not just the challenge of do we pick a voting-oriented approach or a nonvoting-oriented approach, but rather, what is the key challenge is to make sure that we have synchronized the stakeholder engagement process to the overall direction that we’re trying to establish with this new approach to governance,” he said.