Signed into law Aug. 16, 2022, the IRA is the largest federal investment in climate and clean energy action in history, and leading up to the IRA’s second anniversary, the Department of Energy and other agencies have heralded the law’s impact and benefits.

Money from President Biden’s two signature climate laws isn’t just being used for big clean energy projects to produce zero-carbon hydrogen and suck carbon dioxide out of the air, according to a Department of Energy official.

The Infrastructure Investment and Jobs Act and Inflation Reduction Act are “delivering clean energy upgrades to school children in Selma, Alabama,” for example, and “decarbonizing food production in America’s heartland, one mac and cheese at a time,” said Doug Schultz, chief operating officer at the DOE’s Office of Clean Energy Demonstrations (OCED).

During DOE’s Aug. 14 webinar marking the second anniversary of the IRA, Schultz described how the OCED awarded the Kraft Heinz Co. up to $170.9 million earlier this year to “upgrade, electrify and decarbonize food production” at 10 of its plants, including a Michigan factory producing Kraft’s signature comfort food, Schultz said.

“It takes a whole lot of heat to dry all that macaroni, which produces a whole lot of emissions,” he said. “This project will employ clean tech like heat pumps, electric heaters and electric boilers to slash those emissions 99%.”

Biden signed the IRA into law Aug. 16, 2022. It is the largest federal investment in climate and clean energy action in U.S. history, and in the weeks leading up to the IRA’s second anniversary, DOE and other agencies have been heralding the law’s impact and benefits for Americans across the country.

In opening remarks at the webinar, Kathleen Hogan, principal deputy under secretary for infrastructure, reeled off numbers from DOE’s recent Progress Update, tracking the department’s implementation of IRA and IIJA programs. All of the new programs established in the two laws have been launched, and $48.7 billion has been awarded to thousands of projects, Hogan said.

A DOE video highlighted a new factory in Weirton, W.Va. ― a former steel town ― where startup Form Energy is using IRA tax credits to help it build long-duration iron-air batteries, while paying workers average wages of more than $63,000, according to Ted Wiley, president and chief operating officer.

Figures released by the Treasury Department on Aug. 7 showed that “more than 3.4 million American families had already claimed more than $8 billion in residential clean energy and home energy efficiency tax credits against their 2023 federal income taxes.” The lion’s share ― $6 billion ― went to the 1.2 million households that installed solar panels and batteries and received tax credits averaging $5,000 per family.

A General Services Administration press release announced the agency so far has spent $480 million out of its $3.4 billion in IRA funds for “sustainable improvements to federal buildings across the country” and also has promoted the use of low-carbon building materials on those projects.

But the achievements come after an occasionally rocky two years in which IRA implementation has progressed in fits and starts.

Pain points include the Treasury Department’s still-incomplete efforts to provide guidelines for all of the law’s tax credits, with some companies and their investors waiting on the sidelines because of uncertainty about whether their projects will be able to benefit.

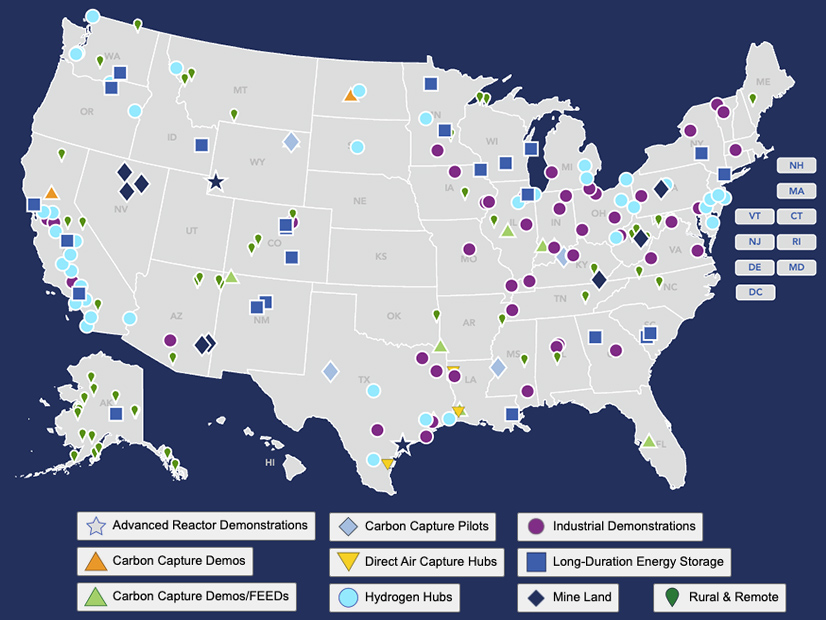

The tax credit for clean hydrogen is a prime example. Treasury released proposed guidelines in December 2023 but has yet to finalize the rules, which will be critical for the development of the seven hydrogen hubs OCED announced last October. They’re intended to build out a clean hydrogen industry. But only three of the hubs have signed contracts with DOE, allowing them to begin planning the projects.

Similarly frustrating, the IRA’s programs providing rebates to help low-income families install energy-efficient appliances — like heat pumps — have rolled out at a glacial pace. Wisconsin and New York are the only states so far that have launched programs.

According to Ward Lenz, deputy director at DOE’s Office of State and Community Energy Programs, 22 states have submitted applications, and he expects more to come in. However, some states are very early in the process. For example, the Maryland Energy Administration (MEA) announced in July that DOE had approved its application to receive “early administrative funds” provided by the law, so it could start planning its program.

The money will be used to hire staff to design and implement the program, MEA said. While acknowledging the high level of public interest in the rebates, the agency has yet to announce any target dates for when the federal dollars might be available.

‘Overly Rosy’ Expectations

The IRA’s impact on clean energy manufacturing has been one of the law’s most widely hailed achievements, with a recent report from the American Clean Power Association noting the law has stimulated $500 billion in private investment in new plants and projects. Of the more than 160 projects announced in the past two years, 42 are online or under construction, the report says.

DOE’s Grid Deployment Office also has been active in awarding IRA funds to expand grid capacity across the country, with its Grid Resilience and Innovation Partnership (GRIP) awards. Most recently, $2.2 billion in GRIP awards were announced for eight projects, including two interregional lines and six that will increase capacity on existing lines with grid-enhancing technologies. (See DOE Announces $2.2B in Grid Resilience, Innovation Awards.)

Such encouraging numbers don’t always align with public perceptions. A poll conducted by the University of Chicago’s National Opinion Research Center in April asked a series of questions about the IRA, and in almost all cases more than a third of participants said they didn’t know enough about the law to answer.

Further, only 15% to 26% of participants saw the IRA as providing benefits to people like themselves, depending on particular provisions of the law, such as tax credits for electric vehicles or rooftop solar or grants for clean energy projects in low-income communities.

Amy Turner, director of the Cities Climate Law Initiative at Columbia University’s Sabin Center for Climate Change Law, said such polls may not capture a longer view of the law.

“The IRA has programs that are meant to last as long as a decade,” Turner said in a phone interview with NetZero Insider. “Just because we have an anniversary of the law doesn’t necessarily mean that this is the anniversary when everything is meant to be happening all at once, at the same time.”

The billions of dollars in the law have posed a heavy lift for DOE and other agencies, which “have been standing up really massive new programs that are now operational and getting money out the door,” she said. “They weren’t necessarily experienced in the things that they were being asked to do.”

In some cases, like the home energy rebates, expectations of how quickly the money would be available were “overly rosy,” Turner said. “[The] dates that we can expect to see the rebates active in different states across the country have been continually kind of pushed back,” as individual states develop plans that must be approved by DOE.

Turner said she believes the IRA’s provisions that allow for direct pay of its tax credits may have the longest lasting and transformative impacts. “This is a 10-year program,” she said. “It really stands to change the way that states, tribes, local, nonprofits and a range of other non-taxpayers pay for things like renewable energy development and clean vehicles.”

Those entities previously had been unable to take advantage of clean energy tax credits because they don’t file taxes and therefore had no way to use the credits. With limited options, they often had to work with third-party developers who could use the credits.

The direct pay provisions allow them to get the credits as a cash payment but do require them to file complicated paperwork with the Internal Revenue Service, which is slowing uptake, Turner said. Officials in small towns and nonprofit staff members have to learn in real time, she said.

“So, the hope is that by a handful of non-taxpayers going first and figuring out some of these early hurdles, the broader public can learn how to proceed, and the IRS can smooth out some of its processes,” Turner said.

Turner also said the IRA’s direct pay provisions should be unaffected by election results. “Even after all [the law’s] grant money is allocated and goes out the door, this is a program that remains in the tax code until 2032. A president cannot change it on his or her own. It would require Congress to act,” she said.