As energy demand — and demand peaks — scale up, virtual power plants are turning the energy industry’s traditional models of supply and demand on their heads, said Chloe Holden, an industry analyst at Advanced Energy United, in her opening remarks at a Sept. 16 webinar on the vital role VPPs could play in the U.S. clean energy transition.

“Virtual power plants … are large groups of distributed energy resources in homes and businesses that can be controlled remotely, so that we don’t have to rely on coordinating supply to meet demand,” Holden said. “Instead, we can schedule demand to match supply.”

The technology and business models are well proven, she said. For example, EnergyHub, a provider of demand side services, now manages more than 1.3 million “connected devices” ― including smart thermostats, batteries, electric vehicles and water heaters ― for more than 60 utilities across the country, according to Nick Papanastassiou, the company’s director of market development and regulatory affairs.

“We work with a network of about 50-plus [original equipment manufacturers] across all sorts of devices,” he said.

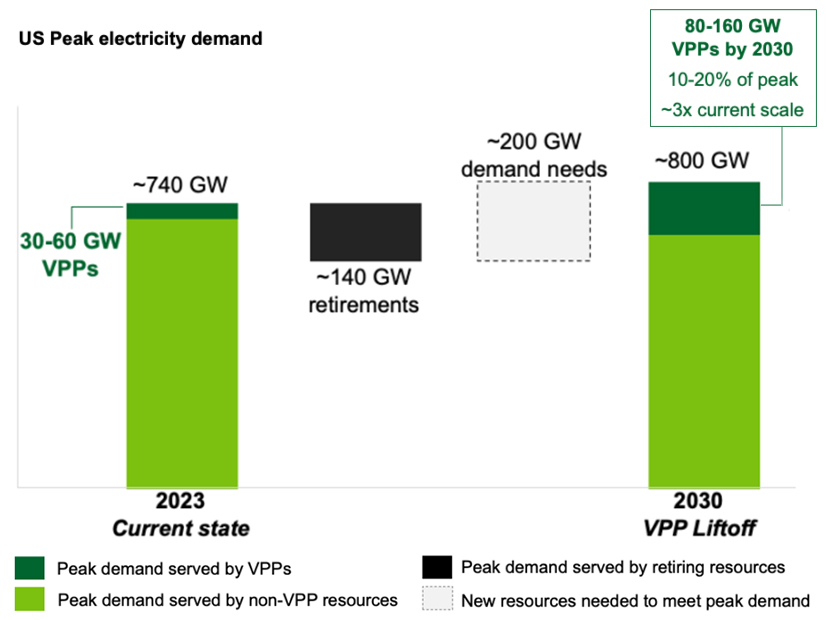

The U.S. has between 30 GW and 60 GW of VPPs online, Holden said. But the U.S. Department of Energy estimates that 80 to 160 GW more VPP capacity will be needed by 2030, and those millions of connected devices could provide 10% to 20% of the additional demand on the grid.

Holden, Papanastassiou and other speakers at the webinar explored the opportunities and obstacles facing VPP expansion, looking at residential and commercial and industrial programs as well as new electric vehicle-managed charging and vehicle-to-grid (V2G) programs.

An enthusiastic proselytizer for residential VPPs, Papanastassiou reeled off a list of benefits. Like traditional central power plants, they are dispatchable and reliable and can provide not only fast-response for peak demand, but also grid support services, he said.

“There are a lot of flavors of what a VPP could be,” Papanastassiou said. “But at its heart, it’s this notion that customers and devices are providing flexibility to the grid in a really valuable and harmonized way.”

He pointed to a demand management and energy conservation project EnergyHub worked on with Ontario’s grid operator, IESO. With upfront incentives and “a really robust, multichannel marketing effort,” EnergyHub helped enroll more than 100,000 smart thermostats in a VPP that delivered 134 MW of power during a peak demand event.

Carter Wood, who works on electric vehicle policy at Ford Motors, said the automaker continues to partner with utilities, such as DTE in Detroit, on managed charging and bidirectional, V2G programs. But he cautioned that VPPs based on EV batteries are a different value proposition from VPPs aggregating smart thermostats or other home appliances that cost considerably less. Scale will be linked to EV adoption rates.

Ford, like other automakers, has slowed its plans for rolling out new EV models. Carter said its F-150 Lightning electric pickup truck is its only model offering bidirectional charging that can be tapped for backup power or potential grid support. But as EV adoption scales, EV-based VPPs could supplant natural gas peaker plants, he said.

The 8½-by-11 Principle

Successful VPP programs need three basic elements to draw in customers, Papanastassiou said. “One, a compelling incentive to participate; two, a simple enrollment process supported by effective marketing, and three, a program that isn’t going to actively inconvenience them.”

Raghav Murali, head of policy and government affairs at PowerFlex, agreed VPP programs need to be “simple and streamlined. I like to sort of refer to it as an 8½-by-11 principle,” he said. “If it’s too complicated to fit in a single sheet of paper, then we probably can’t sell it to customers.”

A subsidiary of EDF Renewables, PowerFlex works primarily with commercial and industrial customers, many of which look to VPPs to cut their energy bills and help the grid, Murali said.

He sees “reasonable, common-sense virtual power plant policies that can help these programs scale” as another key component for successful VPPs.

Some utilities continue to offer more traditional demand response and energy conservation programs and have yet to embrace “a multi-technology stack,” Murali said. “There are certain programs that have onerous [air conditioning] cycling programs that have mandatory terms … [and] data privacy requirements that are completely out of step with what any company would agree to.”

He acknowledged concerns about “double-dipping” in measuring the performance of the different components or devices in a VPP but argued that submetering technology used with battery storage and electric vehicle chargers “is a more efficient and streamlined way to measure asset performance in a VPP paradigm.”

Both Murali and Wood called for tech-neutral regulations for VPPs. “Make sure they’re not ‘smart thermostat’ programs. Make sure they’re not ‘storage’ programs but are VPP or grid services programs that encompass the broad technology type,” Murali said.

“A lot of what we advocate for is, you know, treat [EVs] in same category as stationary storage,” Wood said. “We should be treated tech neutrally.”

Framing VPPs in a tech-neutral context could “become more and more pressing in communications to regulators and decision makers,” Holden said. “There are all these devices on the grid, and either they are tapped to their full potential or they’re not. So as demand rises, there’s a need to enable them to do what they’re technically capable of doing.”