Federal regulators have completed their first-ever regional environmental analysis of future offshore wind farms that have not yet been proposed.

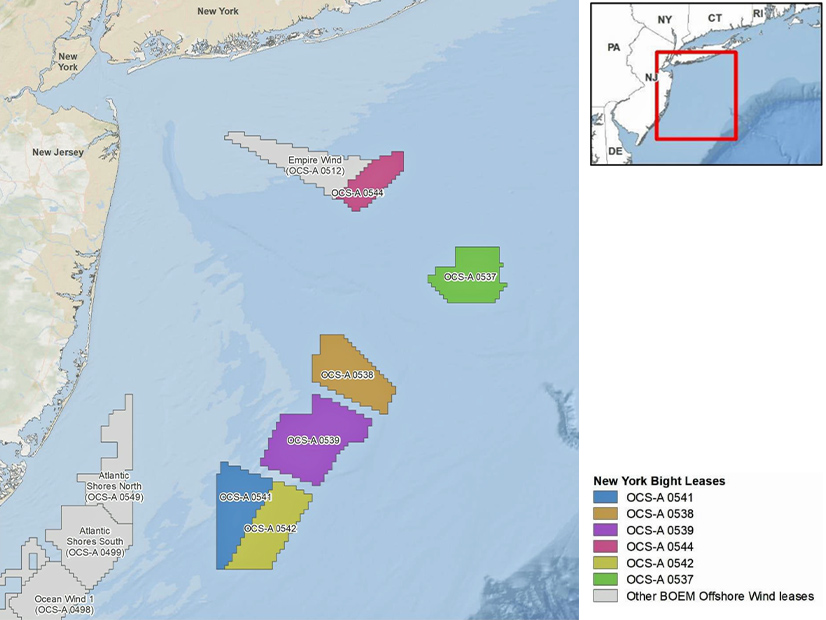

The Bureau of Ocean Energy Management’s programmatic environmental impact statement (PEIS) looks at six wind lease areas covering nearly a half-million acres in the New York Bight.

Because all six areas were leased in the same 2022 auction, BOEM concluded that the leaseholders would be likely to submit their construction and operation plans on a similar time frame. Because all six are in close proximity off the New York-New Jersey coast, BOEM concluded the environmental considerations are likely to be very similar.

Each construction and operation plan submitted for an individual wind farm still would require individual review and approval by BOEM, but the PEIS is intended to speed up those reviews by reducing redundancies.

BOEM said this will help developers meet the offshore wind goals set by the Biden administration (30 GW by 2030), New York (9 GW by 2035) and New Jersey (11 GW by 2040).

The six lease areas hold the potential for 5.6 GW to 7 GW of generation, BOEM said, using a conservative ratio of 3 MW per square kilometer.

The PEIS assumes placement of 1,103 wind turbine generators with rotor tips stretching up to 1,312 feet above the ocean, 22 offshore substations, 44 export cables totaling 1,772 miles and 1,582 miles of inter-array cables across the six lease areas.

The PEIS lists a series of predicted effects from these potential future offshore wind farms. Most are similar to the effects predicted in individual environmental impact statements BOEM has prepared for wind farms proposed off the Northeast coast, except that in this case, the impact could vary depending on whether it was one project or six being measured.

And as with the other statements, the PEIS is imprecise in some of its predictions — a specific metric could be better, worse or unchanged after a forest of thousand-foot turbines is installed nearby.

The impact on benthic resources, invertebrates and fish habitat could range from moderate beneficial to major detrimental, for example. The negative effects on commercial fisheries and the critically endangered North Atlantic right whale could be negligible, moderate or major. Major negative impact is expected on cultural resources, navigation and vessel traffic. The view from the shore might be minimally affected, and it might suffer a major negative impact.

As with other projects, there is projected to be a major negative impact on scientific research and surveys, which of course would complicate efforts to quantify some of the other impacts as the wind farm is built and begins operating.

BOEM released a draft of the PEIS in January. It said input received in the subsequent comment period was considered for inclusion in the final PEIS released Oct. 21.

In a news release, BOEM Director Elizabeth Klein said: “We appreciate the feedback we have received, and we believe our regional approach will provide a solid baseline for future environmental reviews for any proposed offshore wind projects in the New York Bight.”

There are other wind lease areas in the New York Bight, but these six were sold at the same auction in February 2022, at an early high point for the burgeoning U.S. offshore wind sector.

The industry was racing forward with support from the federal government and multiple states and had not yet been slammed by the financial and logistic challenges that would, over the next two years, result in the cancellation of most of the offtake contracts for the early Northeast projects and a timeout for some.

As such, the 2022 New York Bight auction drew $4.37 billion in bids — the nation’s highest-grossing offshore energy lease ever, including for fossil fuels.

The winners were:

-

- Atlantic Shores Offshore Wind Bight, OCS-A 0541;

-

- Attentive Energy, OCS-A 0538;

-

- Bluepoint Wind, OCS-A 0537;

-

- Community Offshore Wind, OCS-A 0539;

-

- Invenergy Wind Offshore, OCS-A 0542; and

-

- Vineyard Mid-Atlantic, OCS-A 0544.