Large corporations trying to green their operations continue to expand their solar generation capacity, with Meta, Amazon and Target among the leaders.

In its latest “Solar Means Business” report, the Solar Energy Industries Association reports nearly 40 GW of on-site and off-site corporate capacity installed by March 2024.

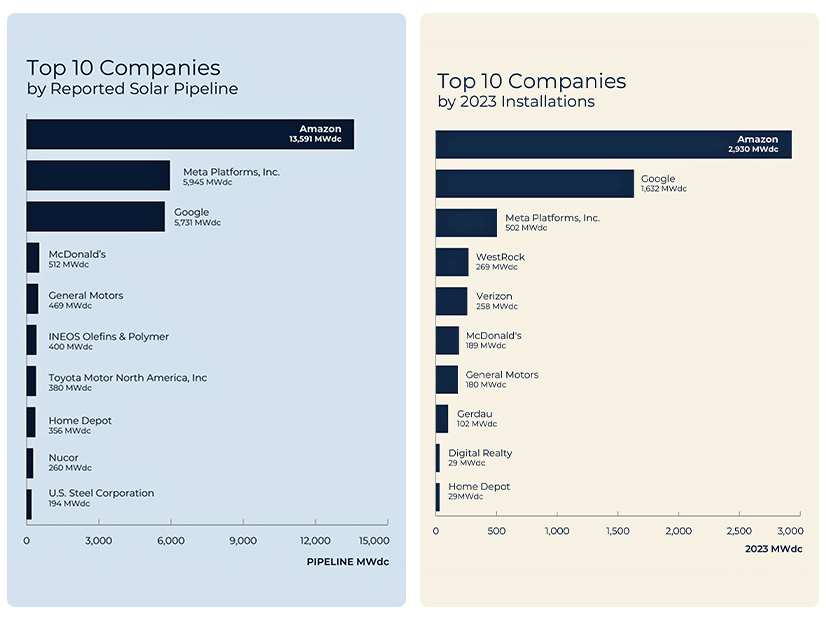

It finds that Meta Platforms leads on overall capacity (5,177 MWDC); Amazon led on capacity addition in calendar year 2023 (2,930 MWDC) and has the largest self-reported pipeline (13,591 MWDC); and Target has the largest on-site capacity (319 MWDC).

Additionally, the 2024 edition of the report is the first to tally corporate installed battery storage. Google tops the rankings by a wide margin, with 312 MWAC.

Solar and storage are a reliable and low-cost way to power operations, SEIA President Abigail Ross Hooper said in a Nov. 20 news release announcing the report.

It is not a one-size solution, she said: “These industry giants are investing in solar through a diverse range of applications, including on-site and off-site installations, on carports, paired with storage, or even as an anchor tenant for a community solar project.”

Most of the companies surveyed for the report cited Inflation Reduction Act incentives as a driver of their expanded procurement of renewables. Most said they had no problem finding partners or institutional support for their plans.

About half said high or volatile prices, expensive capital and internal financial constraints have limited procurements.

About half said interconnection reforms, new community solar legislation and simpler tax credit monetization would help drive further investments.

The report also indicates:

-

- Corporate procurement represents more than 18% of U.S. solar capacity.

-

- In 2023, 20% of solar installations had a corporate offtaker.

-

- Corporate involvement has become increasingly diversified, with growing interest in community solar, tax equity investment and microgrids.

-

- Expectations of increased demand and rising cost for electricity — and a desire to lock in supply and price — drive solar investment decisions.

-

- Big-box retailers and the largest tech firms dominate the rankings, but a range of other sectors are making inroads, including automaker General Motors, fast food icon McDonald’s and packaging manufacturer Smurfit Westrock.

-

- Rooftop commercial solar capacity has grown at a 12% compound annual growth rate for the past five years. It is an obvious choice for Target, Walmart, Amazon and other companies with large, flat-roofed facilities, and growth has continued despite rising costs, supply chain disruptions and other headwinds.

-

- Battery storage will be a key trend for corporate buyers, as states and utilities seek to add storage capacity to their grids. It is a versatile solution — No. 2 Kaiser Permanente, for example, is using its 115.6 MWAC of installed storage to form microgrids to make its medical facilities more resilient to outages, while No. 5 Starbucks is using its 10.5 MWAC for customer EV charging.

-

- Procurement plans are huge: The top 10 corporate buyers alone report a pipeline of 27.8 GWDC of solar, and the actual total is likely higher, as some pending projects are not disclosed.