Powerex intends to terminate a large portion of its rights on PacifiCorp’s transmission system in response to the utility’s plan to update its Open Access Transmission Tariff to align with CAISO’s Extended Day-Ahead Market (EDAM), the company said in a Nov. 14 paper that also warned the changes could cost the utility about $135 million in revenue.

Powerex argued in the paper that PacifiCorp’s expected tariff changes could lead to the utility using EDAM’s rules related to the distribution of transmission congestion rents to “effectively strip” its transmission customers of “the economic value of their transmission rights” — to the detriment of customers in both EDAM and SPP’s Markets+.

“Unfortunately, PacifiCorp has chosen to use its entry into EDAM to fundamentally redefine what it provides to its transmission customers in exchange for the transmission revenue it collects,” Powerex, the energy marketing arm of Vancouver, Canada-based BC Hydro, wrote.

The company’s contention potentially opens up yet another front in ongoing competition between EDAM and Markets+ and in the debates between each market’s supporters.

PacifiCorp’s plans already have led to Powerex providing a notice “to terminate the vast majority of Powerex’s long-term firm point-to-point transmission rights on PacifiCorp’s transmission system, for which Powerex currently pays over $42 million per year to PacifiCorp,” according to the paper.

However, despite the move to cancel the contracts, Powerex emphasized it will retain 200 MW of rights to ensure power flows in SPP’s Markets+ — a position it intends to fight for before FERC.

Jeff Spires, director of power at Powerex, told RTO Insider in an email that the company “continues to hold the long-term firm transmission rights it intends to use for Markets+ connectivity, and is committed to protecting these rights on the PacifiCorp system.”

Under PacifiCorp’s anticipated changes, transmission customers will face new congestion charges calculated in EDAM, collected in CAISO and delivered to PacifiCorp, according to Powerex. The congestion charges will not be returned to customers but rather spread across all of PacifiCorp’s load and exports, the paper stated.

“As a result, transmission customers that wish to use their rights to schedule physical deliveries outside of organized markets will not receive the economic value of the path they invested in, but will instead face volatile and potentially large EDAM congestion charges that they cannot manage or hedge,” Powerex argued. “Similarly, customers that wish to use their firm transmission rights in Markets+ will also not receive the economic value of the path they invested in, as they too will face these EDAM congestion charges (that are again allocated largely to PacifiCorp).”

Transmission customers will be forced to sell their transmission rights to CAISO for use in EDAM to continue receiving congestion value associated with their delivery path, Powerex contended.

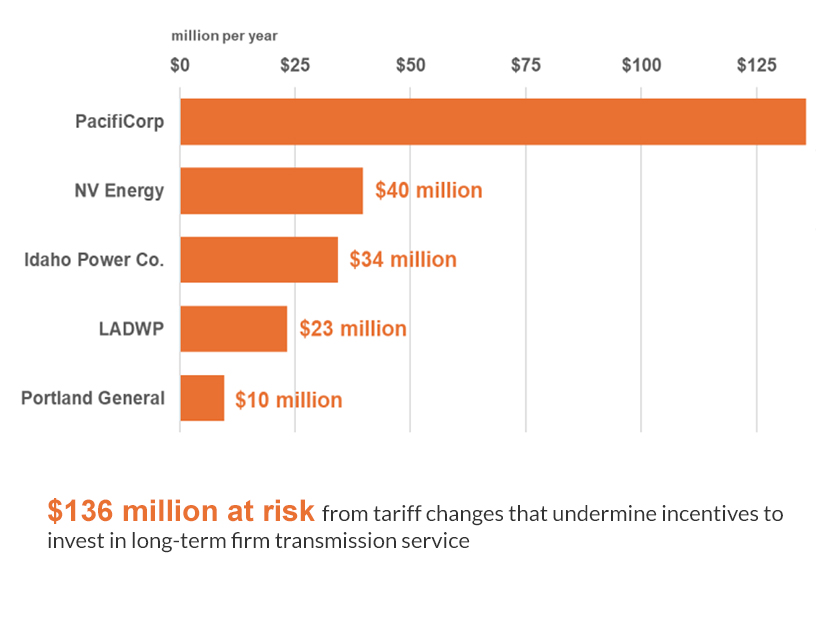

PacifiCorp could lose out on $135 million per year from its sale of point-to-point service to unaffiliated transmission customers, as the proposal will reduce the incentives to invest in the company’s firm transmission service, Powerex alleges.

“Any loss of third-party transmission revenue resulting from PacifiCorp’s proposal will directly increase the revenue that PacifiCorp must recover through higher retail rates,” the paper stated. This loss in revenue has not been considered in any EDAM benefit study, according to Powerex.

Clarity Needed at Market Seam

Additionally, Powerex urged Portland General, NV Energy, Idaho Power and LADWP, among others, to “consider whether to follow PacifiCorp’s lead and jeopardize their existing transmission revenue stream, or to instead seek ways to continue to provide the core benefits that are the foundation for transmission customers’ investments in long-term firm transmission service.”

The tariff changes highlight the absence of a governance structure in EDAM that protects transmission rights “in an equitable and consistent manner,” according to the paper.

When asked to comment on Powerex’s paper, a PacifiCorp spokesperson told RTO Insider that “[i]n developing its tariff for participation in EDAM, PacifiCorp has taken the view that addressing transmission usage for other markets is premature at this stage since market to market coordination requires larger discussions with stakeholders that can only occur in the context of developed and approved market designs. Once the issues at market seams become clearer, PacifiCorp will work with stakeholders and relevant parties to address those issues.”

Portland, Ore.-based PacifiCorp, whose sprawling territory includes portions of six states, was the first utility to join CAISO’s Western Energy Imbalance Market in 2014 and the first to publicly announce its intent to join EDAM in December 2022.

The company fully committed to joining EDAM in April. (See PacifiCorp Fully Commits to CAISO’s EDAM.)

Cindy Crane, CEO of PacifiCorp, recently touted the benefits of EDAM during CAISO’s Stakeholder Symposium in October, citing CAISO data showing $6 billion in member benefits from the WEIM since its inception and $1.4 billion in benefits in a fully implemented EDAM. (See Western Utility CEOs Reflect on Evolving Energy Markets.)

However, SPP’s plan to launch Markets+ has gathered momentum over the past two years and has garnered support from powerful backers such as the Bonneville Power Administration and Powerex.

In the competition for participants between the two markets, Markets+ supporters have consistently pointed to the market’s independent governance structure and market design established under that governance. (See BPA Execs Lay out Markets+ Benefits, Risks, Reasons.)

Powerex’s recent paper continued to push that argument while also claiming that EDAM benefits studies have failed to consider potential revenue losses if PacifiCorp’s transmission tariff proposal should pass.