Requests that two developers submitted this year have prompted the U.S. Bureau of Ocean Energy Management to start planning a 2026 offshore wind auction in the Gulf of Mexico.

The new development is a change from recent history: The first Gulf of Mexico wind lease auction, in August 2023, attracted only two bidders, lasted only two rounds and resulted in a winning bid of just $5.6 million for only one of the three areas offered.

The second auction, originally scheduled for September, was canceled two months ahead of time because of a lack of interest. (See BOEM Cancels Gulf of Mexico Wind Lease Auction.)

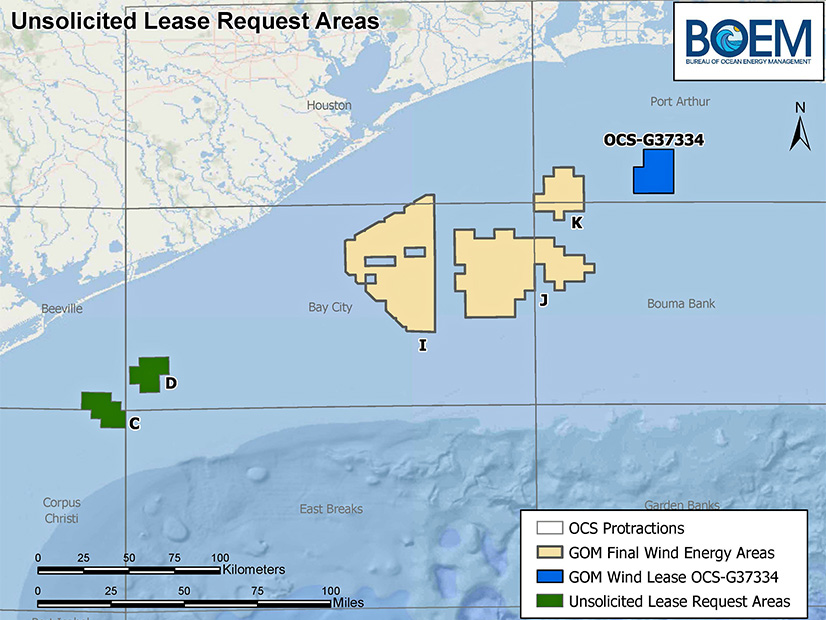

But Hecate Energy Gulf Wind submitted an unsolicited request to lease two areas that had not been on the auction block, named Option C and Option D, totaling 142,000 acres southwest of Houston. BOEM then published a request for competitive interest to see if any other developers might want to lease C and D. Invenergy GOM Offshore Wind responded.

BOEM determined that both companies were legally, technically and financially qualified to hold a renewable energy lease in the Gulf of Mexico, setting the process in motion.

In April the bureau issued a timeline for a dozen offshore wind auctions from mid-2024 through mid-2028, three of them in the Gulf of Mexico.

President Joe Biden, a staunch offshore wind supporter, was running for reelection at the time and potentially could have seen all of the auctions carried out in his second term. Instead, all eight auctions remaining on the timeline would fall during the second term of President-elect Donald Trump, a staunch offshore wind critic.

Along with the politics that impact U.S. offshore wind power development, the Gulf of Mexico itself poses some significant challenges to power generation. The wind there is typically weaker than in the West and East coasts targeted for wind power development — except during the gulf’s frequent hurricanes. New equipment must be designed to maximize energy output in light wind and minimize physical damage in heavy wind.

Also, electricity is relatively cheap in the region, increasing the competitive disadvantage of offshore wind, and state leaders have not been clamoring for offshore wind the way Northeast and California officials have.

Still, BOEM pushes on in the gulf. Its regional director, Jim Kendall, said in a news release Dec. 12, “The Gulf of Mexico remains an attractive option for offshore wind energy development. We are excited about the future of this emerging sector in the region.”

One selling point for offshore wind in the gulf has been its potential as a source of power to generate green hydrogen, which is projected to grow as an industry in the region.

Hecate touched on this in its proposal for up to 133 turbines totaling up to 3 GW of capacity. It listed a range of potential uses beyond straightforward interconnection to the grid, including power purchase agreements with private off-takers and direct production of other energy resources.

The plan drew support and criticism during BOEM’s comment period.

The Southern Shrimp Alliance called on BOEM to reject the request for Option C and adjust Option D because of expected conflicts with shrimping.

The Nature Conservancy endorsed renewable energy development but listed a set of environmental protections that must accompany it and noted that wind-to-hydrogen production would require further analysis under the National Environmental Policy Act.

The Texas General Land Office noted that Hecate has no experience with offshore wind development and said there are multiple, significant concerns that must be addressed before it would allow a wind power lessee to run a transmission line across submerged state lands.