Wood Mackenzie predicts that the U.S. low-carbon hydrogen sector will focus on blue rather than green in 2025 as federal leadership turns from blue to red.

Regulatory uncertainty, policy changes and competition for the renewable power used to generate green hydrogen will have a significant impact, the data and analytics firm said in its newly published forecast.

But Wood Mackenzie does expect 2025 to be a pivotal year for the hydrogen and ammonia sectors despite the challenges that persist.

“We anticipate increased levels of activity across both sectors and a shift towards greater commercialisation, with some surprises along the way,” principal analyst Bridget van Dorsten wrote Dec. 12 in announcing “Hydrogen: 5 things to look for in 2025.”

Wood Mackenzie’s analysts expect the U.S. to solidify its position as the world’s leading producer of blue hydrogen as the second Trump administration begins. Over 1.5 Mtpa of U.S. blue production capacity will reach final investment decision in 2025, the report predicts, over 10 times more than for green hydrogen.

The Biden administration’s push to develop the clean hydrogen sector has been slow to develop momentum, and the report envisions some significant headwinds for U.S. green hydrogen as President Trump returns to office.

“While there will still be some demand driven by corporate decarbonisation efforts, near-term opportunities for green hydrogen will shrink, and we anticipate a substantial uptick in cancellations, particularly for projects targeting mobility, steel and e-fuels,” the authors write.

A dozen or more colors and shades exist to designate the means by which hydrogen is produced. Truly green hydrogen is produced from water with renewable power and creates no carbon dioxide emissions, while blue hydrogen is generated from natural gas, with resulting CO2 captured and sequestered or repurposed.

The distinctions and details are of intense interest to industrial and environmental lobbyists, and neither side seems happy with the state of affairs. Over two years after Biden’s signature Inflation Reduction Act passed, there still is no final guidance for the 45V tax credit for clean hydrogen production.

Trump has railed against the Inflation Reduction Act and various aspects of the clean energy transition, placing the future of 45V and Biden’s Hydrogen Hub initiative in question.

But Wood Mackenzie expects that the 45Q tax credit — for investment in carbon capture and storage — will receive continued support, as it is strongly backed by the oil and gas industry.

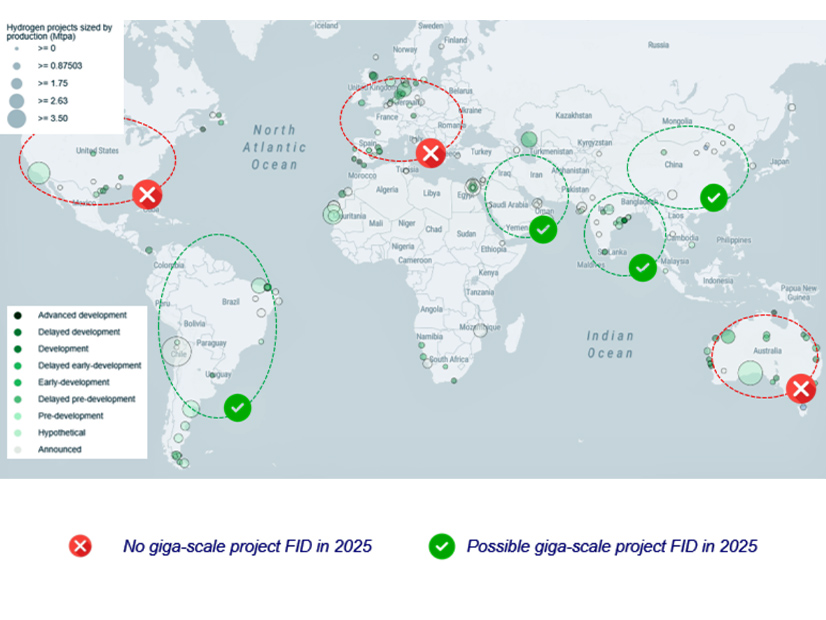

The report predicts some 2025 growth in green hydrogen outside the U.S., with at least one giga-scale project reaching final investment decision.

It sees strongest growth in China, India and the emerging economies of Latin America and the Middle East where there are low-cost renewable options, supportive government initiatives and availability of low-cost Chinese-made electrolyzers.

However, Wood Mackenzie also expects a continued mismatch between investments in production and contracts for output.

Of the 5.5 Mtpa of low-carbon hydrogen projects that have taken final investment decisions, the report notes, 2.5 million tons is uncontracted, most notably within U.S. blue hydrogen.

Even as some of these blue hydrogen projects start to unwind their uncontracted positions, overall uncontracted volumes are expected to rise.

The report also predicts growing momentum for the low-carbon ammonia space. It estimates an $8 billion investment across the value chain in 2025, double the amount seen in 2024.

“A key driver will be the strategic investments aimed at enabling offtake agreements, as projects push forward with greater certainty,” the authors write. “Many of these investors are targeting new energy markets for hydrogen (e.g. maritime, aviation, etc.), where demand for low-carbon ammonia is rising, positioning themselves to secure long-term offtake agreements as the market scales.”