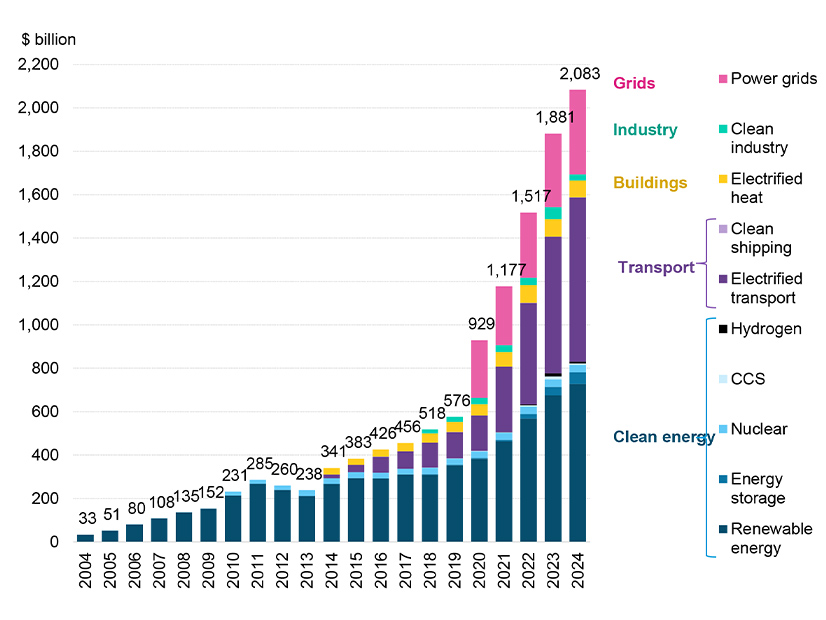

Worldwide investments in the energy transition totaled $2.1 trillion in 2024, BloombergNEF reports.

While it is the first time BNEF calculated the investments at greater than $2 trillion in its annual report, the 11% year-over-year growth was less than in the preceding three years, which saw annual increases of 24% to 29%.

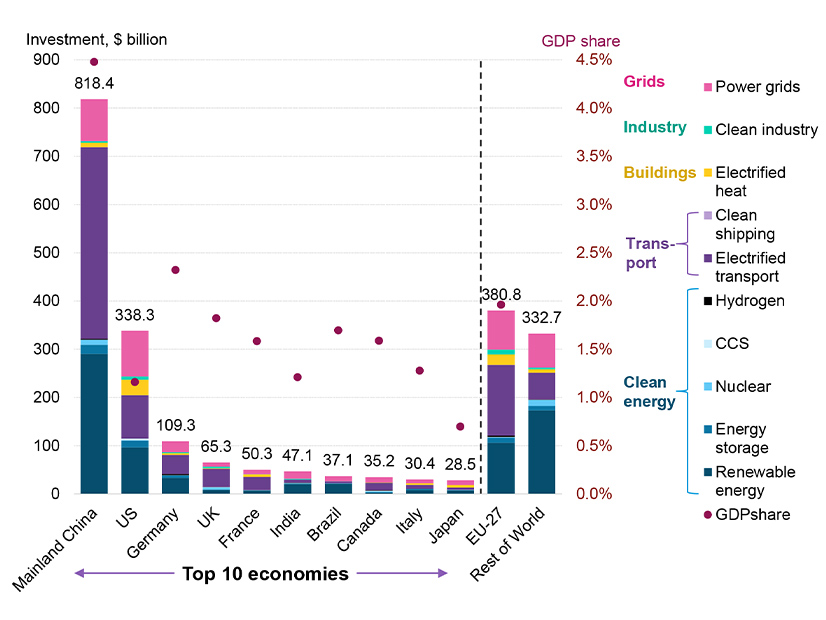

China dominated the global tally with $818 billion. The United States was a distant second at $338 billion, and the other eight nations in the Top 10 list of economies ranged from $109 billion (Germany) to $29 billion (Japan). The 27 EU nations totaled $381 billion, and all other nations combined for $333 billion.

The bulk of the spending was in three sectors: electrified transport ($757 billion), renewable energy ($728 billion) and power grids ($390 billion).

Investment in the remaining sectors (carbon capture and storage, clean industry, clean shipping, electrified heat, hydrogen, nuclear) accounted for just 7.4% of total investments and collectively was 23% lower than in 2023.

This demonstrates the challenge of scaling up “emerging” clean technologies, the authors wrote. The exception was energy storage, which jumped 36% to a record $54 billion investment despite the headwinds facing it.

BNEF also notes the record level of investment still is far short of what is needed to reach net zero by 2050.

Albert Cheung, deputy CEO of BNEF and lead author of “Energy Transition Investment Trends 2025,” said in a Jan. 30 news release:

“Our report shows just how much growth we’ve seen in the energy transition over the past few years, despite political uncertainty and high interest rates. There is still much more that needs to be done, especially in emerging areas like industrial decarbonization, hydrogen and carbon capture, in order to reach global net-zero goals. True partnership between the private and public sectors is the only solution to unlock the potential of these technologies.”

Along with energy transition investment, the report examines three other types of funding: clean energy supply chain investment, climate-tech equity finance and energy transition debt issuance.

-

- Supply chain investment — new factories commissioned in 2024, mines and battery metal processing facilities — totaled $140 billion, down from $145 billion in 2023. Despite efforts to move supply chains away from mainland China, it still accounted for 81% of the total.

- Climate-tech companies raised $51 billion in private and public equity in 2024, a 40% drop from 2023 that BNEF attributes in part to artificial intelligence startups competing for funding. Clean power and transport companies accounted for the majority of equity, $32 billion.

- Debt issuance rose 3% to $1 trillion in 2024. The United States ($206 billion) and China ($169 billion) were the largest markets by a wide margin and were 5% and 13% higher respectively than in 2023. European issuances dropped 7% year over year while volume in the Middle East/Africa was down 35%.