A more than 40% decline in New Jersey solar installation capacity from 2023 to 2024 has added to the debate over how to retool the state’s net-metering system to help advance the solar sector.

The state reached a milestone of 5 GW of installed capacity late last year but installed only 241.4 MW of projects in 2024, according to figures released this month by the New Jersey Board of Public Utilities (BPU). That was a drop from 453.2 MW in 2023 and was the lowest level of new installations since 2015.

The decline became a focal point in a four-hour public hearing the BPU held Feb. 10 as part of its yearlong effort to determine whether the state’s net-metering system should be modified, left as is, or dramatically restructured.

The sector has enjoyed solid growth for 15 years, driven by an initial incentive program of solar renewable energy certificates — which some critics said was too generous — in addition to net-metering benefits. The state’s 206,000 net-metered projects account for more than 95% of solar projects in the state, which ranks it among the biggest in the nation. Questions as to whether the system is sustainable or equitable and fair to non-solar utility customers emerged repeatedly at the hearing.

State law allows energy suppliers to stop offering net metering when the total capacity generated by net-metering customers reaches 5.8% of the total annual kilowatt-hours sold in the state. New Jersey reached that threshold in May 2024, triggering the board’s initiative to solicit stakeholder input on what comes next. (See NJ Scrutinizes Solar Net Metering Strategy.)

Solar developers ― who made up about half of the more than 80 attendees at the online hearing ― say any change to the current net-metering system should consider the challenges already facing the sector.

“Right now, we are in a very fragile market,” said Fred DeSanti, executive director of the New Jersey Solar Energy Coalition. He cited as an example the state’s offshore wind sector, which has yet to build a turbine and largely has ground to a halt. “We’re seeing what’s going on with the offshore wind, and that makes this almost paramount to make sure that this [solar] renewable energy resource is something that still continues to be in play in New Jersey.”

The sector’s difficulties include the extensive backlog of interconnections at PJM and the difficulty of connecting solar projects to the grid controlled by some utilities because the infrastructure is aging or insufficient, DeSanti said. Also challenging are high interest rates, material shortages, a 10% tariff levied by President Trump on Chinese goods, which developers fear will raise solar panel prices, and the possible disappearance of the federal 30% income tax credit for solar projects, DeSanti said.

Residential installations were 33% lower in 2024 than 2023, DeSanti said. But most worrying was the “abysmal” performance in the commercial solar sector ― largely due to interconnection problems ― with installations of 71 MW, about 37% of the state’s approved capacity in 2024, he said.

DeSanti said that to thrive, the solar sector needs a bill enacted, S2816, that would require each utility in the state to submit an infrastructure improvement plan. If the federal tax credit “goes away,” he added, the solar program “probably will as well.”

Net-metering Adjustments

Net metering allows solar homeowners or business project operators to draw electricity from the grid when the weather or sundown curtails generation, and to send power to the grid when their solar systems generate more electricity than they need. The incoming and outgoing electricity volumes are balanced out, or “netted,” at the end of the month and the utility pays the solar project for the net volume of electricity they generate.

But because solar owners are paying only utility delivery charges on their net consumption and not the full amount of electricity they use from the grid, critics argue they typically don’t pay enough to cover their share of the fixed or overhead costs of the utility. That includes maintaining and improving the grid, funding electric vehicle charging programs, providing subsidies for low-income customers and energy efficiency programs. Critics say that by not paying the overhead, solar project owners leave those costs to be spread among the rest of the customers, pushing up their bills.

Adjustments to net meter billing that other states have used or studied include changing the time over which the net-metering balance is calculated, for example, to daily rather than monthly. Under another proposal, known as “buy all, sell all,” the customer buys all the electricity they use as though they don’t generate any, and sells all the energy they generate. Some states have considered a per-kilowatt fee to pay for overheads. Another factor to be addressed once a plan is adopted is whether it affects new customers or existing customers only.

Lyle Rawlings, a solar developer and president of Mid-Atlantic Solar and Storage Industries Association, said the future of net metering is central to the sector’s future.

The system “works especially well for residential system owners,” he said, urging the BPU to “keep net metering.” But the state can “benefit greatly from alternatives” tried by other states, he said.

His organization favors the Massachusetts SMART program, under which the state calculates the revenue needed to support a solar project and the size of incentive is calculated by subtracting the energy compensation generated by the project from the revenue figure, he said. The system can work for behind-the-meter projects, which are net-metered, or those in front of the meter that are tied directly to the grid.

In both, “the solar developer or investor or the homeowner knows what their total revenue is going to be, and that’s a really good kind of security to have,” he said.

Balance of Benefits

New Jersey faces an issue that California has wrestled with on a much larger scale. With 31% of its electricity generated by solar, California has sought to cut the credits paid to new net-metering users and focus more on promoting investment in solar systems paired with storage. That has angered owners of existing solar panels who fear they will see their credits cut. (See California PUC Adopts Contested Net Metering Plan.)

The Solar Energy Industries Association last year ranked New Jersey 10th among states by total solar installed. The state’s maturing solar market ― its nearly 211,000 solar projects together generate 7% of the electricity generated in state ― in part triggered this scrutiny of net metering.

“There’s a lot of benefits associated with this, and I think that’s what makes the net-metering debate so difficult,” said Abe Silverman, a former BPU executive who now is a researcher at the Ralph O’Connor Sustainable Energy Institute at Johns Hopkins University.

“We know very clearly about what the [net-metering] rate we are paying for that electricity production is, and it’s relatively high,” he said in an interview with Net Zero Insider. But it becomes a “lot harder to tally up all the benefits” that the system reaps from net-metered solar projects, which include enabling the utility to buy less power from the grid, reducing the investment necessary in the distribution grid and cutting pollution, he said.

“So, the question becomes, where’s that trade-off? Where’s the right place to draw the line between the benefits and the costs?” he said. “At what point do you start saying: ‘OK, this was an incentive that needed to be there in the sort of dawn of the rooftop solar age. Maybe now that incentive needs to start getting shrunk!’”

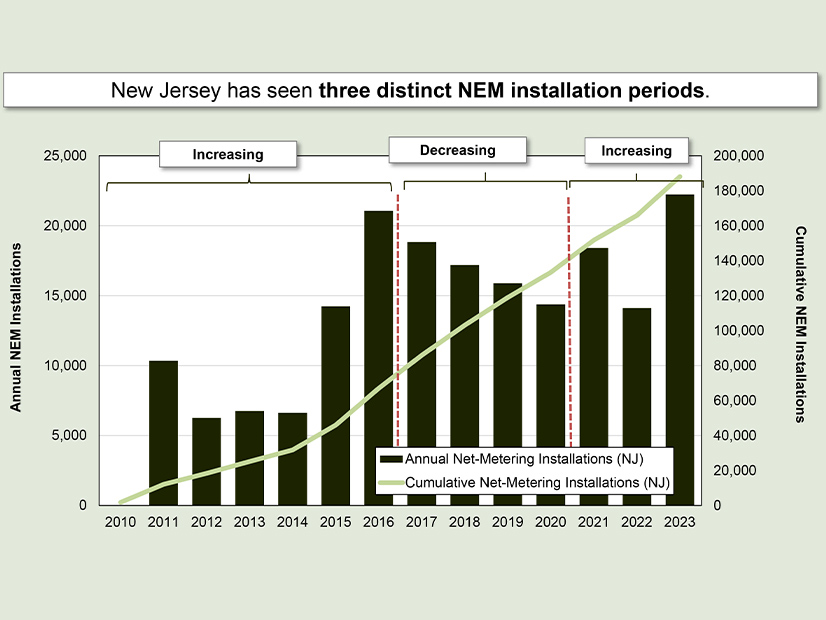

David E. Dismukes, a consultant for the New Jersey Division of Rate Counsel, said at the hearing that New Jersey ranks among the top five states for net-metering capacity. The 22,500 net-metering projects added in 2023 were the state’s highest annual figure ever, according to slides shown by Dismukes.

“But that continued growth that we’ve seen has put a lot of pressure” on New Jersey, as it has elsewhere, he said.

“A lot of other states are questioning some of the continued policies,” he said. That includes “whether they need to be updated and whether they need to be reformed in light of these large levels of participation that is increasing the cost associated with the buyback rates and some of the costs associated with maintaining the distribution system through a cost-service perspective,” he said.

Andy Wall, a board member of the Mid-Atlantic Solar and Storage Industries Association, said net metering should be continued in part because it is simple to understand.

“Net metering is the simplest model we know to get residential customers to take the decision to host solar,” he said, adding that the incentive helps drive up the volume of solar generated energy. “By keeping it simple, we will keep overall ratepayer costs at a minimum.”