Ontario’s nodal market is showing promise one month after its launch, with improved price certainty, increased day-ahead trading and LMPs reflecting expected congestion patterns, IESO officials say.

Ontario’s nodal market is showing promise one month after its launch, with improved price certainty, increased day-ahead trading and LMPs reflecting expected congestion patterns, IESO officials say.

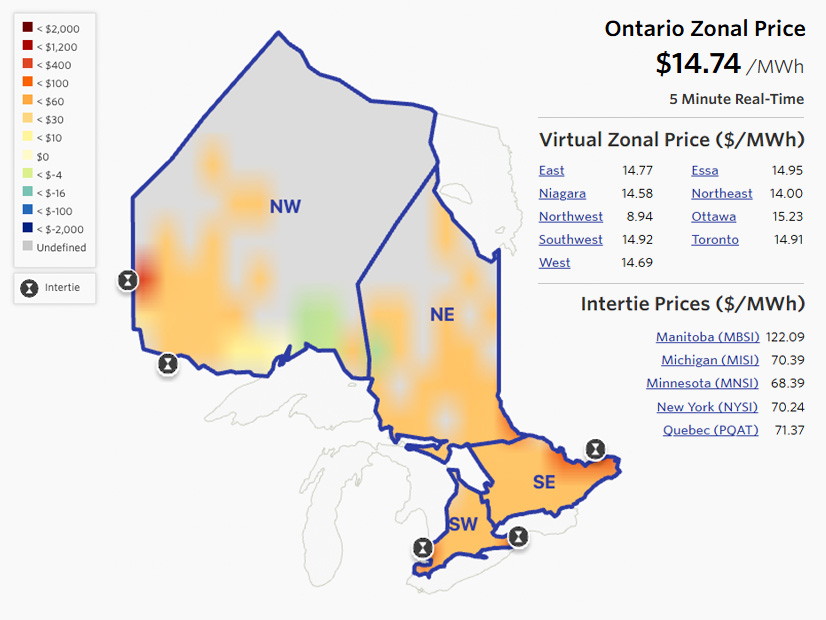

IESO’s Market Renewal Program (MRP) is designed to improve the way the grid operator supplies, schedules and prices power by creating a financially binding day-ahead market (DAM) and adding about 1,000 LMP nodes. The ISO says the nodal market, which launched May 1, should save Ontario $700 million over the next decade through reduced out-of-market payments and increased efficiency. (See IESO Nodal Market Launch Successful.)

In a briefing June 4, IESO said the initial month of operations were “consistent” with the MRP’s goals. The only glitches to date were a day-ahead market failure May 22 and a delayed opening to the new virtual market.

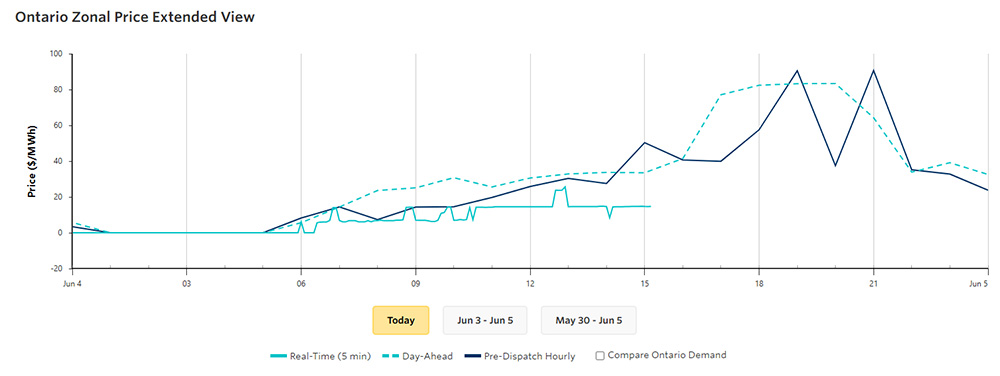

While day-ahead prices were not financially binding in the prior market — meaning all settlements were against real-time prices — about 95% of energy volume is now clearing in the DAM. Most non-quick-start generator commitments are being made in the day-ahead rather than in real time, and pre-dispatch reviews are selecting least-cost resources.

‘Encouraging’ Results

“The results that we’re seeing from the first couple of weeks are actually really encouraging,” said Darren Matsugu, director of markets. “Our locational prices really have aligned with the expectations that we’ve seen historically based upon congestion across different parts of the province.

“With the introduction of the day-ahead market … we are seeing improved real-time certainty, both from participants and importantly for the ISO.”

Most export transactions now are being scheduled day-ahead, up from virtually none in the old market. The shift “really gives the ISO a much more complete picture about the next day’s operation than we used to see,” Matsugu said.

While the real-time market has shown more volatility than day-ahead prices because of unanticipated outages and supply/demand changes, those spikes are muted in consumer prices because only 5% of energy volume is settled in real time.

“We’re seeing really complete participation and competitive participation [in the day-ahead market], which has given us good confidence in those day-ahead market results,” Matsugu said. “And of course, if there’s any additional scheduling needed in between day-ahead and real-time, we are seeing that this vastly improved pre-dispatch sequence is doing a good job of selecting the least-cost resources.”

A Small Snapshot

Officials cautioned that their ability to draw conclusions is limited because of the short time the market has been operating. Participants still are learning about the market and developing their trading strategies, they said.

“A full year, covering all four seasons, will provide more complete information,” IESO said.

“Market performance really does need to be considered under a wide variety … of system conditions,” Matsugu said. “Every season, every month, presents itself with very material differences in terms of demand, supply conditions, transmission [and] outages. All those things are very different, and the market needs to perform very different optimization through the year. So, for example, performance during the summer and winter peak days, there’s quite significant differences in system peaks and that kind of transition from overnight periods. And those really are kind of our best test of the market’s ability to be able to efficiently maintain reliability.”

‘Defects’ Corrected

The transition to the new market “went very smoothly thanks in no small part [to] the efforts of many of you out there,” said Candice Trickey, director of MRP readiness.

She singled out the MRP Implementation Working Group, composed of representatives from different market sectors that helped the ISO design training and testing of the new market.

The first run of the DAM calculation engine was successful on May 2, and the first market settlement statements were issued May 15.

“Since the transition, the settlement statements have been issued on time, and there have only been a small number of disagreements that we’ve seen by a limited number of participants,” she added. “To date, anyway, we haven’t seen any widespread calculation or settlement errors.”

Although the ISO’s support teams saw a large jump in the number of contacts and tickets in the first week, “those have fairly quickly petered out to more normal volumes,” she said.

IESO identified some “defects” during and after the launch. “Not a surprise, once you put everything into production; new things pop up, and we did identify some defects,” Trickey said. “Those have all been quite quickly addressed through either workarounds or permanent fixes. Most of those things were fixed before any of you saw them.

“This was a very complex project [involving] more than 10 different systems that we had to integrate together,” she added. “They all ran 24/7, providing a continuous stream of results and instructions and reports. So, it’s no surprise that we experienced a few hiccups.”

Timothée Denis of Air Liquide said his company’s day-ahead trading limit — 50 MW before the transition — initially was limited to 25 MW at the new market’s launch. “So we had to bid on half of our capacity and liquidate the rest of that on the real-time market,” he said, adding that the problem was resolved May 22.

Virtual Market Delayed

Trickey also said there were some problems completing authorizations for virtual traders, which delayed the launch of the virtual market from May 8 to May 13.

The new system allows market participants to submit hourly bids and offers in any of nine virtual transaction zones.

A defect related to virtual trades caused IESO to declare a day-ahead market failure for the May 22 trade date, causing it to use real-time prices.

The ISO halted virtual trading to avoid further DAM failures until a fix was implemented, with virtual trading resuming May 24.

“Since then, we haven’t experienced any other issues, but it is early days, and we still remain on high alert, monitoring and watching to see if anything else should arise,” Trickey said.