IEA said investment in clean technologies is projected to hit $2.2 trillion this year, or about two thirds of the total energy investment.

The International Energy Agency is forecasting record energy investment worldwide in 2025, despite the present uncertainties and headwinds.

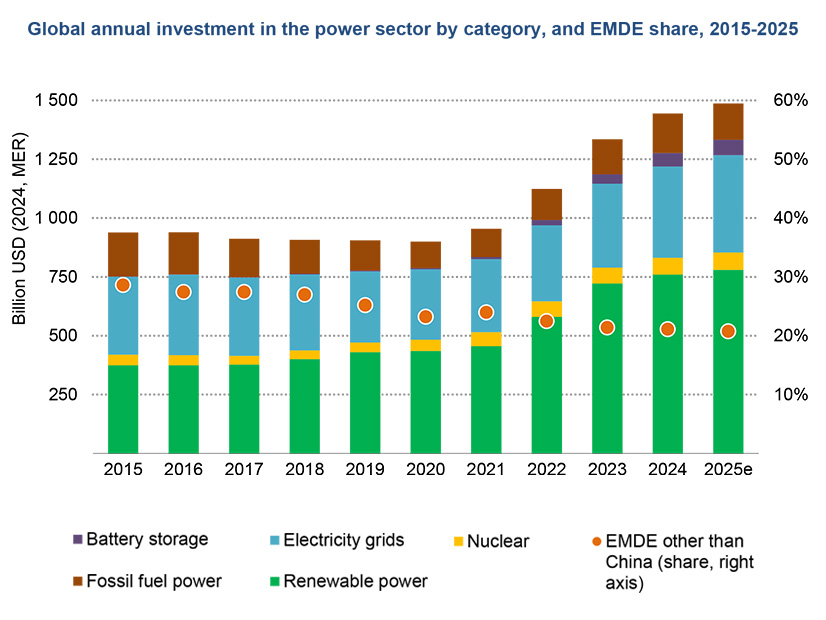

As it released the 10th edition of its annual report June 5, the IEA said investment in clean technologies is predicted to hit $2.2 trillion this year, or about two-thirds of the total energy investment. Both figures would be record highs — the $3.3 trillion total investment would be 2% more than in 2024.

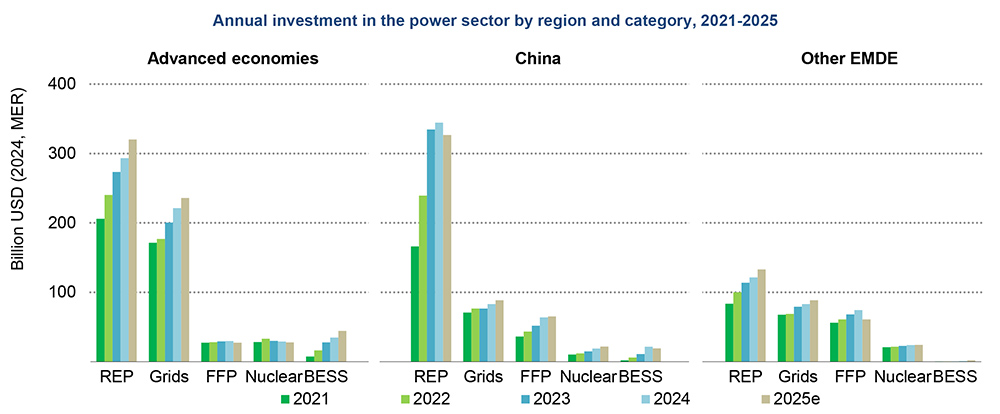

Photovoltaic solar is drawing more investment than any other technology, IEA said, and China is investing more than any other country or bloc of countries.

“When the IEA published the first ever edition of its ‘World Energy Investment’ report nearly 10 years ago, it showed energy investment in China in 2015 just edging ahead of that of the United States,” IEA Executive Director Fatih Birol said in the news release. “Today, China is by far the largest energy investor globally, spending twice as much on energy as the European Union — and almost as much as the EU and United States combined.”

The 10-year stretch was marked by another change: a de-emphasis on fossil fuel investments. In 2015, investment in the fossil sector was 30% higher than in electric generation and grids. In 2025, electricity investments are expected to be 50% greater than in fossils.

The volatility seen in the global economy and trade so far has not had a major effect, Birol said: “The fast-evolving economic and trade picture means that some investors are adopting a wait-and-see approach to new energy project approvals, but in most areas, we have yet to see significant implications for existing projects.”

IEA also flagged a disconnect that has been apparent in some regions for some time: The investment in grids to transmit all this new electricity is not keeping up with the investments to generate and use that electricity.

Transmission investment stands at $400 billion annually but is being held back by cumbersome permitting processes and limited supply of transformers and cables.

There also remains a significant geographic disparity in all types of investment. Many emerging markets and developing economies lag far behind the advanced economies, IEA said, particularly in Africa, which is home to 20% of the world’s people but attracts only 2% of global clean energy investment.

Looking specifically at the United States, the IEA report contrasts its increasing production and export of oil and natural gas over the past decade with its decreasing percentage of electricity generation investments going to fossil fuels.

IEA also notes the surging investment in data centers and the interest in powering them with clean energy, and the resulting enthusiasm for next-generation nuclear power to fulfill that need non-intermittently.

With its deep financial resources and its long history in nuclear power, the United States could emerge as a leader in next-generation nuclear, as well as in other technologies, such as geothermal, IEA said.

But here again, interconnection delays and transmission constraints are a potential hurdle. Power availability is the top concern for 90% of data center developers, IEA said, and nearly 50% consider upgrading grid infrastructure to be the best possible mitigation for this.

Compounding the problem, data center operators are competing with generation and transmission developers for the already-inadequate supply of key grid components such as transformers, IEA said. As a result, while a data center can take three to six years from concept to completion, new grid infrastructure can run five to 15 years.

FERC Order 2023 and other grid reforms may prove to be critical tools to enable growth, it added.