The U.S. Energy Information Administration has revised its forecast upward for retail electrical sales — especially in ERCOT and PJM.

The U.S. Energy Information Administration has revised its forecast upward for retail electricity sales — especially in ERCOT and PJM and largely because of anticipated commercial demand.

In its Short-Term Energy Outlook released June 10, EIA projected that commercial consumption would increase 3% in 2025 and 5% in 2026. It previously predicted an average of 2% in the two years.

EIA expects total generation this summer to be 1% higher than last summer, also from commercial and industrial load growth, and it expects less generation from natural gas-fired plants because of higher natural gas prices.

The Henry Hub spot price forecast is about $4/MMBtu for 2025 and $4.90 in 2026, on average, compared with $2.20 in 2024, EIA said.

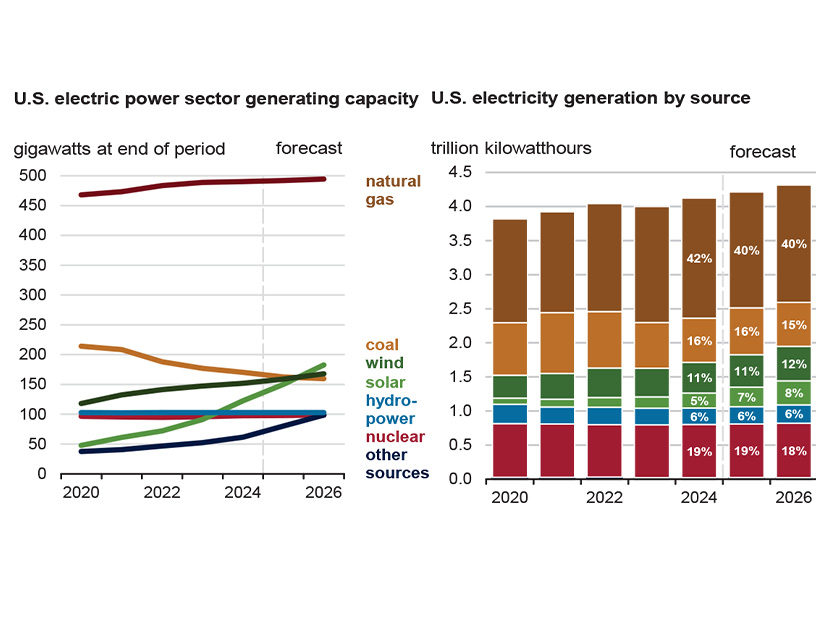

Solar generation is projected to increase from 5% of the U.S. total in 2024 to 8% in 2026 and wind from 11% to 12%.

Natural gas is projected to dip from 42% of the total in 2024 to 40% in 2026, coal from 16% to 15%, and nuclear from 19% to 18%. The outlook for hydro is a steady 6% of the total in all three years.

Breaking it down geographically:

-

- Electricity sales are expected to increase from 2024 to 2026 in every region except New England, with the largest increase in the West South Central region — from 716 TWh in 2024 to 810 TWh in 2026, a 13.1% jump.

- The same two regions had the lowest and highest all-sector electricity prices in 2024 and are projected to hold the same ranks in 2026: West South Central would rise from 9.73 cents/kWh to 10.16 while New England would rise from 23.06 to 25.79.

- Total power generation by grid region is expected to increase or decrease from 2024 to 2026 by small percentages with two exceptions: PJM is projected to jump 7.6% from 873 TWh to 939, and ERCOT is projected to jump 19.8% from 459 TWh to 550, both from increased renewable, natural gas and coal generation.

Factoring into the report are the economy and the weather. The forecast assumes real GDP growth at an annualized 1.4% in 2025 and 1.7% in 2026.

It also assumes an easing of the trade wars and a reduction in tariffs but notes that future trade policy is a source of uncertainty in the outlook, as is consumer spending, which is projected to grow much more slowly in 2025 and 2026 than in 2024.

EIA also assumes 2025 will be slightly cooler than 2024, which was warmer than average. This allows a 5% reduction in predicted 2025 cooling degree days and a resulting decrease in electricity demand.