NERC released its State of Reliability report, which found the bulk power system remains highly reliable and underlying performance metrics such as frequency response and misoperation rates are improving or remain stable.

NERC on June 12 released its State of Reliability report, which found the bulk power system remains highly reliable and underlying performance metrics such as frequency response and misoperation rates are improving or remain stable.

“Severe weather remained responsible for the most severe outages in 2024, with two significant winter storms and five major hurricanes that made landfall,” the report says. “NERC saw an improvement in performance during the winter events, with no operator-initiated load shed, in part due to industry’s efforts to improve generator performance during extreme cold weather following NERC and Federal Energy Regulatory Commission recommendations and regulatory updates.”

Hurricane Helene caused a record 431 transmission outages, but more than 95% of the outages caused by the storm were resolved within eight days, which is well below the average of 15 days seen for Category 4 hurricanes, NERC’s Jack Norris said on a press call.

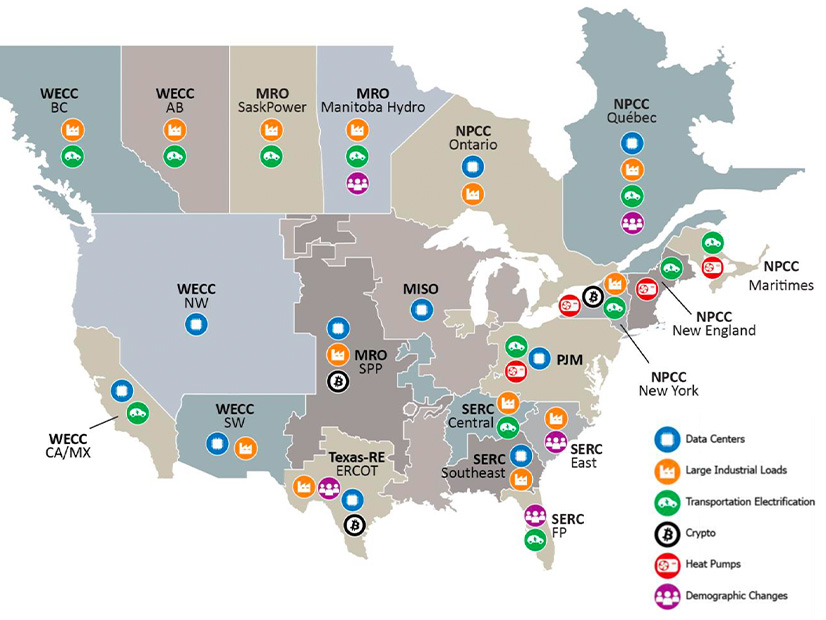

An issue that continues to dominate the industry’s attention this year is the growth in data centers.

“Data centers can be developed faster than the generation and transmission infrastructure needed in the area to support them, resulting in lower system stability,” the report says. “Additionally, the voltage sensitivity and rapidly changing, often unpredictable, power usage of these facilities creates new operating challenges. As such, more accurate models of the operational characteristics of these impactful loads are essential to reliability to prevent instability caused by these large changes in electricity demand.”

Developers are not going to plan a major data center for a site that lacks enough capacity on the system to meet its needs, NERC Director of Reliability Assessments John Moura said.

“The issue is that this confidence often rests on assumptions of capacity that may not fully materialize, especially during system stress events,” Moura said. “So, the scenario we’re really warning about involves rapid demand growth outpacing the timing of new generation and transmission infrastructure. Even with a good plan, there are things that can challenge getting the infrastructure in place.”

Needed generation could get caught up in an interconnection queue or run into supply chain issues, while transmission projects could be delayed.

The report addresses several recent reliability incidents caused by data centers tripping offline, notably 1,500 MW in Virginia. (See Data Centers’ Reliability Impacts Examined at FERC Meeting.)

“Fortunately, due to the location of this 2024 event, there was no major negative impact to reliability, but as more of these types of load interconnect, the need to address this risk will continue to grow,” Norris said. Northern Virginia is home to the largest concentration of data centers in the world, so 1,500 MW of load dropping off did not impact frequency on the grid as much as it could have if the facilities were in a more isolated location on the grid, he said.

The growth in data centers caught the industry by surprise, with a sudden focus on meeting rising demand after decades of stagnant growth in most markets. FERC recently held a two-day conference on resource adequacy where that was a key issue, and the Department of Energy has been ordering power plants to keep running based on NERC’s reports of narrow reserve margins. (See Wright Addresses Recent Orders Keeping Power Plants Open at Hearing.)

Another part of the issue is that markets have incentivized narrower reserve margins as part of their design to ensure reliability at the cheapest possible price, which means avoiding the overbuilding that preceded them, Moura said. But with the new demand growth and rising prices, power plants have seen retirements pushed back.

Some retirements that were planned have been deferred, but the changing market dynamics have also improved the economics for generators that were on the edge. Now higher prices are keeping them open to help meet the rising demand, Moura said.